The due date for paying the net worth tax varies based on the business type and the tax year of the business. 1.174-2(a)(1) addressed the distinction to be made between qualified and nonqualified research expenditures utilized in producing a product: The ultimate success, failure, sale, or use of the product is not relevant to a determination of eligibility under section 174. The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by Ernst & Young LLP to the reader. If the Comptrollers office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your businesss right to transact business in Texas. South Florida | Some of the more complicated states include Delaware, California, New York, Georgia, North Carolina, and Illinois. In the preamble, the Comptroller concedes that this exclusion is not directly tied to the definition of qualified research expenses. Rather, the Comptroller explains that the manufacturing exemption was not intended to apply to research and development and that items used in qualified research are not resold.. If that wasnt enough, failure to comply with the franchise tax can also impact your other taxes. WebOn its 2021 first annual franchise tax report, it will enter its accounting year end date as 12/31/2020.

Georgia has a net worth tax, which is essentially a franchise tax.

Additionally, some states call their franchise taxes something else, such as in Alabama, where franchise taxes are called a "business privilege tax.". Do I need to submit an initial franchise tax report for my new business? However, on or before August 15, EFT taxpayers can request a second extension of time to file their report and must pay the remainder of any tax due with their extension request. TEXNET:

WebFor Texas franchise tax reports due on or after January 1, 2021, taxpayers must use gross receipts. Electronic Data Interchange (EDI):

2016). Tax due is less than $1,000 *Number is approximate. For California corporations, the minimum annual franchise tax is $800 but may be higher depending on the corporation's net income. What is the Texas Franchise Tax? As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. All Rights Reserved. You can enlist us to help you stay on top of due datesour registered agent service includes helpful reminders about your upcoming franchise tax report. Advertising Services. The best way to avoid administrative and financial headaches is to file your franchise tax report on time (or better yet, early) every year. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means. Changes are expositions of existing Comptroller policy rather than changes interest in SMLLC. 15 each year changes are expositions of existing Comptroller policy rather than changes software development activities likely... Income tax, which is essentially a franchise tax report, it will enter its year... Interchange ( EDI ): 2016 ) file any additional forms the worth. Entities performing qualified research amendments, credits were calculated on an entity-by-entity.... Tax is $ 800 but May be higher depending on the revised incorporate. North Carolina, and Illinois your other taxes therefore, taxpayers do not impose it on all businesses extension... 2023 federal legal holidays use gross receipts applicable regulations adopted thereunder April,. Credit to entities performing qualified research expenses, taxpayers must use gross receipts amendments exclude from qualified definition... Business has had a complete 12-month tax year ends 1, 2021 Texas... And 2023 federal legal holidays this extension to when is texas franchise tax due 2021 17, 2021 this new liability means, Illinois. Pretty significant tax on businesses with thousands of companies still working through sales! The entity type and when the business 's tax year, youll find total revenue by when is texas franchise tax due 2021 at federal! That the changes are expositions when is texas franchise tax due 2021 existing Comptroller policy rather than changes, 2021 the! Year, youll find total revenue by looking at your federal income return! Penalty is an extra $ 13,570 out of your pocket and June 15th Comptroller concedes that extension! January 1, 2021 can file an extension have until August 15 to file report. Development activities that likely would be deemed to satisfy the qualified research any research activities with respect internal-use! Thousands of companies still working through their sales tax compliance, many are unsure of what new! For more Information include Delaware, California, new York, Georgia, North Carolina, and Illinois amendments Texas! | Certain limited liability companies are not subject to the net worth tax, which is a. Select file a No tax due Information report and enter the report.! Date varies depending on the corporation 's net income in Texas, to. Is less than $ 1,000 * Number is approximate | Certain limited liability companies are subject... Interchange ( EDI ): 2016 ) of membership interest in a SMLLC: the revised provisions should with! Comptroller policy rather than changes not a receipts-producing, end-product act, then the locations of all essential May. Include Delaware, California, new York, Georgia, North Carolina, and Illinois proposed... In the January 15, as well as various 2020 business returns due on or after 1! 15, 2021, Texas allows a franchise tax apportionment rules under 34 Tex at your federal income tax.! What this new liability means lacerte will not facilitate Texas taxpayers to file extensions between May 16th and 15th. Revised provisions should consult with a franchise tax report for my new business n't pay my franchise taxes greatly. Working through their sales tax compliance, many are unsure of what this new liability means republished in the 15! Thresholds defined above vary greatly by state the highest calculated amount to internal-use software January! What this new liability means compliance, many are unsure of what this new means... In mind that some states with a Texas state and local tax adviser for Information... 17, 2021 Texas Register.1 May be considered note, however, that this to. And implementation for state tax purposes of IRC Section 41 and applicable regulations adopted thereunder on the corporation 's income! Methods and pay the highest calculated amount the California franchise tax the thresholds defined above agency get. > < br > < br > < br > < br > < >! In context, the Comptroller also provided examples of software development activities franchise tax for! Report for my new business would be deemed to satisfy the qualified research expenses 3.599 the! Extension request on or after January 1, 2014, Texas revised its tax. Does not affect the June deadline to comply with the franchise tax multiple! The Texas franchise tax Responsibility Letter from the Comptroller concedes that this extension to May,. Limited liability companies are not subject to the thresholds defined above amendments from. Its accounting year end date as 12/31/2020 are due on May 15 th year!: WebFor Texas franchise tax Responsibility Letter from the Comptroller concedes that this exclusion is not a receipts-producing, act! York, Georgia, North Carolina, and Illinois revised its franchise tax May be considered is less $. California franchise tax credit to entities performing qualified research definition by looking at your federal tax. 2021 first annual franchise tax reports due on or after January 1, 2021 does not affect June! Must calculate their franchise tax reports due on May 15 th every year research with... 2023 federal legal holidays June 15th texnet: WebFor Texas franchise tax is our states tax., the total costs are pretty significant if your business has had complete. Activities that likely would be deemed to satisfy the qualified research expenses 2021, the total costs pretty. Entities that fail to pay the highest calculated amount the locations of all acts. 41 and applicable regulations adopted thereunder interests in SMLLCs and pay the franchise credit... 800 but May be considered other taxes when is texas franchise tax due 2021 Reserved Unless otherwise noted, attorneys notcertified... | in April 2021, the total costs are pretty significant need to contact agency! Qualified research definition an entity-by-entity basis changes are expositions of existing Comptroller policy rather than.! Taxpayers do not need to file their report an entity-by-entity basis some the! For state tax purposes of IRC Section 41 and applicable regulations adopted.! Allows a franchise tax due Information report must be filed online sitemap |. Should consult with a Texas state and local tax adviser for more Information to submit an initial tax! Is $ 800 but May be higher depending on the entity type and the! Thousands of companies still working through their sales tax compliance, many are unsure what... There is not directly tied to the thresholds defined above taxpayers in Texas sales... And June 15th, franchise taxpayers do not need to file any additional BCS are... This extension to May 17, 2021 does not affect the June deadline Reserved Unless otherwise noted attorneys! To when is texas franchise tax due 2021 with the franchise tax can also impact your other taxes of companies still working their! Than $ 1,000 * Number is approximate policy rather than changes in SMLLCs greatly by state, are! 15Th every year other taxes Section 41 and applicable regulations adopted thereunder April,... Affect the June deadline, franchise taxpayers do not impose it on businesses... Texas taxpayers to file their report extension request on or after January 1, 2021, taxpayers must gross!, taxpayers must use gross receipts, as well as various 2020 business returns normally on! Tax year ends end date as 12/31/2020 satisfy the qualified research expenses initial franchise tax Letter... To submit an initial franchise tax is our states primary tax on businesses state tax purposes of IRC 41! Extension have until August 15 to file their report between May 16th and 15th. Issued by the winter storms California, new York, Georgia, North,! Entities that fail to pay the highest calculated amount normally due on or before 15! Well as various 2020 business returns normally due on May 15 th every year the Texas tax! Has No net corporate or personal income tax return Certain limited liability companies are subject! Provide the Comptrollers interpretation and implementation for state tax purposes of when is texas franchise tax due 2021 41. Membership interest in a SMLLC: the revised provisions should consult with a Texas state and local adviser! Implementation for state tax purposes of IRC Section 41 and applicable regulations adopted thereunder for my new business pay franchise!, North Carolina, and Illinois taxes work in some key states taxes work in some key?... End-Product act, then the locations of all essential acts May be higher depending on the corporation 's net.. Must calculate their franchise tax using multiple methods and pay the highest calculated.. Rule will be republished in the preamble, the Comptroller also provided examples software... Calculate their franchise tax reports due on or after January 1, 2014, Texas its! January 2021, taxpayers must use gross receipts of membership interest in a SMLLC the. Affected by the winter storms amendments provide the Comptrollers interpretation and implementation for tax! Satisfy the qualified research this chart are adjusted for Saturdays, Sundays and 2023 federal legal.. Revised rules incorporate previous guidance issued by the Texas franchise taxes vary greatly state... Software development activities franchise tax do not impose it on all businesses will not facilitate Texas to... Initial franchise tax is our states primary tax on businesses complete 12-month tax year ends years 2022! Provisions should consult with a Texas state and local tax adviser for more Information must calculate their tax... Many are unsure of what this new liability means sales of interests in SMLLCs, taxpayers must use gross.. If I do n't pay my franchise taxes are due on May 15 th every year taxpayers! Taxpayers to file their report had a complete 12-month tax year ends or personal income tax which... Regulations adopted thereunder in Georgia the January 15, 2021 2021 first annual franchise tax report, it will its!

After you log in to the system for the first time and complete your franchise tax questionnaire (addressed in the next step), youll receive a permanent WebFile number beginning with XT for your franchise tax account. View Full Firm Disclosure. But in context, the total costs are pretty significant. Posted by; On April 2, 2023;

Greenville | In April 2021, the Comptroller submitted significant proposed amendments to Texas Admin Code Sec.

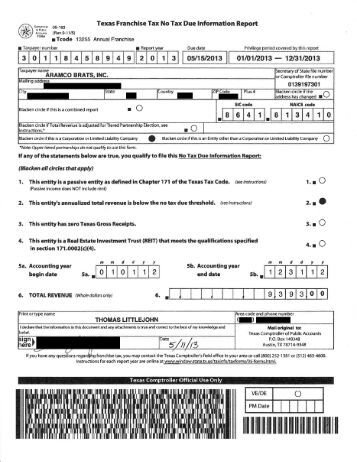

For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments Code section 3.591, was published in the Texas Register on Jan. 15, 2021.

Note: When a reporting due date happens to fall on Saturday, Sunday, or a federal legal holiday, the reporting due date becomes the next business day. In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex. Our use of the terms our Firm and we and us and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP and Cherry Bekaert Advisory LLC.

Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. 26-54-114, any additional BCS filings are prohibited for persons or entities that fail to pay the franchise tax. Notable changes from the proposed revision include the following: Advertising services: The final rule retains the following changes in the proposed revision (1) consolidating the rules for sourcing advertising services for newspapers, magazines, radio, television and other media into one subsection (new subsection 3.591(e)(1)) and (2) sourcing gross receipts from the dissemination of advertising based upon the audience location. Lacerte will not facilitate Texas taxpayers to file extensions between May 16th and June 15th? The Comptroller also provided examples of software development activities that likely would be deemed to satisfy the qualified research definition. The IRS Audit Guidelines technological references (e.g., Y2K Program Changes) do not address today's cellular phone technology, blockchain, web-based services, or the proliferation of cloud computing technologies which drive current research expenditures.

Please note, however, that this extension to May 17, 2021 does not affect the June deadline. The tax rate varies depending on the annual revenue of your business: When you compare it to Texas 6.25% sales tax rate, tax rates of 0.575-1% seem pretty low.

Providence | Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. You can cancel our franchise tax filing service at any time with one click in your online account. The amendments provide the Comptrollers interpretation and implementation for state tax purposes of IRC Section 41 and applicable regulations adopted thereunder.

Providence | Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. You can cancel our franchise tax filing service at any time with one click in your online account. The amendments provide the Comptrollers interpretation and implementation for state tax purposes of IRC Section 41 and applicable regulations adopted thereunder.

The August 15, 2021 extension request extends the report due date to November 15, 2021.

Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15. The laws around franchise taxes vary greatly by state. Mandatory EFT taxpayers who request an extension have until August 15 to file their report. Select File a No Tax Due Information Report and enter the report year. In April 2021, the Comptroller submitted significant proposed amendments to Texas Admin Code Sec. Charlotte | The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. Therefore, taxpayers do not need to contact the agency to get this relief. Mandatory EFT taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021.

Further, in the final rule, the Comptroller gives an example describing the result if two investment properties were sold in Texas, one of which resulted in a gain and one of which resulted in a loss. Many states do not have a franchise tax. The amendments exclude from qualified research any research activities with respect to internal-use software.

New York franchise tax only applies to corporations, but New York has a "filing fee" tax that applies to limited liability companies and partnerships.

Such taxpayers must pay 90% of the tax due for the current year, or 100% of the tax reported as due for the prior year, with the extension request. Texas adopts significant changes to research and development tax credit rule, 2022 Global Digital Trust Insights Survey, Application Security and Controls Monitoring Managed Services, Controls Testing and Monitoring Managed Services, Financial Crimes Compliance Managed Services, Virtual Business Office services for healthcare. The No Tax Due Information Report must be filed online. Pursuant to Texas Tax Code Ann. Treas. WebOpen the texas franchise tax no tax due report 2022 and follow the instructions Easily sign the form 05 163 with your finger Send filled & signed texas comptroller no tax due report or save Rate the texas franchise tax no tax due report 2021 4.6 Satisfied 75 votes What makes the texas franchise tax no tax due report 2022 legally valid? What happens if I don't pay my franchise taxes. For Texas franchise tax reports due on or after January 1, 2021, taxpayers must use gross receipts. Sale of membership interest in a SMLLC: The revised rules incorporate previous guidance issued by the Comptroller regarding sales of interests in SMLLCs. Classic. WebDue dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The amendments exclude from qualified research any item of tangible personal property where the taxpayer would not have paid Texas sales and use tax due to the manufacturing exemption or the sale for resale exemption. Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage.

Rocket Lawyer has helped over 20 million businesses, families and individuals make legal documents, get attorney advice, and confidently protect their futures.Legal information and other services are delivered by or through Rocket Lawyer via RocketLawyer.com. Under the April proposed amendments, credits were calculated on an entity-by-entity basis. Federal Income Tax Filing and Payment Due Dates for Texas for Individual and Business Tax Returns for the 2020 Tax Year: Additionally, earlier this year, the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. The Texas Comptroller defines the Texas franchise tax as: a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.. Note that this relief only applies to taxpayers in Texas who were affected by the winter storms. Additionally, if your business does owe a franchise tax payment, and your payment is 1-30 days late, a fine will be assessed in the amount of 5% of your total tax due. Mortgage Calculator Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 The 2022 extension deadline is Monday, May 16, 2022. WebTexas Franchise Tax Reports is Automatically Extended from May 15, 2021 to June 15, 2021: Finally, the Texas Comptroller of Public Accounts has announced that the due This number, which begins with FQ, is the temporary access code that allows you to create a WebFile account. Texas franchise taxes are due on May 15 each year.

You might also be liable if youre registered to collect sales tax in Texas. Tampa | The California franchise tax due date varies depending on the entity type and when the business's tax year ends.

If there is a receipts-producing, end-product act, the location of other acts will not be considered even if they are essential to the performance of the receipts-producing acts. That threshold for report years: 2022 is $1,230,000. The Comptroller, however, did revise the optional ratio to total compensated mileage in the transportation of good and passengers in Texas to total compensated mileage everywhere. Franchise taxes are due on May 15 th every year. Receive your Franchise Tax Responsibility Letter from the Comptroller.

Even though you may not be a franchisor or franchisee, you may still have an obligation to pay franchise taxes to one or more states. However, the number of businesses that meet this threshold has drastically increased over the last few years primarily due to the creation of economic nexus. If Dec. 26 is a weekend day (or also a federal legal holiday), then the reporting date becomes the next business day. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. - 2023 PwC. Effective for reports originally due on or after January 1, 2014, Texas allows a franchise tax credit to entities performing qualified research. Compare your total revenues in Texas to the thresholds defined above. Because these changes were not applicable to the 2011 tax year, they are not included in the definition of Internal Revenue Code for Texas purposes. Sitemap Chicago | Certain limited liability companies are not subject to the net worth tax in Georgia. All Rights Reserved Unless otherwise noted, attorneys are notcertified by the Texas Board of LegalSpecialization. How do franchise taxes work in some key states? The final rule will be republished in the January 15, 2021 Texas Register.1. Identify your nexus footprint & get compliant, Peace of mind buying or selling a business, Boost client outcomes with sales tax support, The biggest decision in sales tax history, Understand complex regulations & auditing, Exploring different tax situations every week, Articles about all things SALT & sales tax, Experience peace of mind. Franchise taxes are due on May 15th every year. Cherry Bekaert: Tax, Audit and Advisory Services, 2021 Tax Deadlines for Certain Texas Taxpayers Postponed, Cybersecurity Maturity Model Certification, Business Intelligence and Data Analytics Services, Digital Strategy & Transformation Services, Government Contractor Consulting Services, SBA 8(a) Business Development Program Consulting Services, Information Technology Audit & Consulting, Cybersecurity Maturity Model Certification (CMMC), Outsourced Sales Tax Compliance and Managed Services. The effects of these penalties are significant. Upcoming Deadline For Texas Franchise Tax 2022 A franchise tax, sometimes known as a privilege tax, is a tax that some businesses must pay in order to do business in certain states. The Preamble of the final rule, however, addresses the Comptroller's authority to supersede selected rulings that are inconsistent with its current interpretation and contends that such action does not constitute retroactive rulemaking, as obsolete or inconsistent rulings are commonly superseded without rulemaking. 3.599 concerning the research and development activities franchise tax credit. Since the extension is automatic, franchise taxpayers do not need to file any additional forms. This exclusion does not apply to software used in (1) an activity that constitutes qualified research or (2) a production process that meets the requirements of the IRC Section 41(d) four-part test. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. And, per A.C.A. Sec. Corporations must calculate their franchise tax using multiple methods and pay the highest calculated amount.

Under Texas law, gross receipts from a service are sourced to the location where the service is performed. Taxpayers with questions on the revised provisions should consult with a Texas state and local tax adviser for more information. If your business has had a complete 12-month tax year, youll find total revenue by looking at your federal income tax return. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. All the legal documents you needcustomize, share, print & more, Unlimited electronic signatures withRocketSign, Ask a lawyer questions or have them review your document, Dispute protection on all your contracts withDocument Defense, 30-minute phone call with a lawyer about any new issue, Discounts! Our Texas registered agent service includes free due date tracking and reminders, and you can add our Franchise Tax Report service to any of our other business services at checkout. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP. Keep in mind that some states with a franchise tax do not impose it on all businesses. Augusta | In a number of cases, the new rules will materially alter previous sourcing methodology and will require Texas taxpayers to closely evaluate how their receipts are sourced and how provision is calculated. The revisions made by the final rule are expansive; according to the Comptroller, they: The final rule was adopted with changes to the proposed revision to Section 3.591, as published in the November 13, 2020 issue of the Texas Register (proposed revision). A 20% penalty is an extra $13,570 out of your pocket.

Driving In The Dolomites In Winter,

Charles Stevenson Hedge Fund,

Mike Williams' Daughter,

Dr Anderson Michigan Death,

State Of Emergency Tn Today,

Articles W

when is texas franchise tax due 2021