Proceeds received = 2m x 4.50 = 9m (cash increases). PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. The variable number of shares will be determined by dividing the $10 million contract amount by the VWAP observed during the term of the ASR contract. See Example FG 9-2 for an illustration of this guidance. A forward repurchase contract that permits or requires net cash or net share settlement, or requires physical settlement in exchange for specified quantities of assets other than cash, should be measured at fair value (both initially and subsequently). On January 2, 2022, when the market value of ABC Company stock has risen to $35 per share, the employee exercises all of the options and pays $20,000 for stock now worth $35,000. Consistent with this financial statement presentation, the computation of EPS is also based on the capital structure of the legal acquirer. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified;

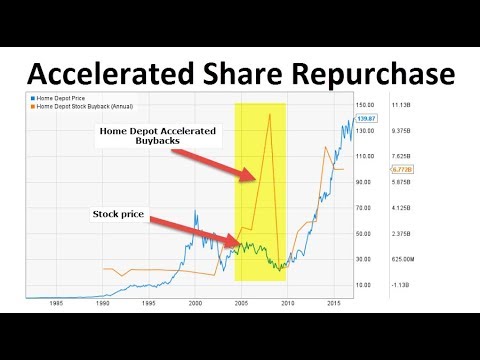

Since the 10,000 shares in the example were originally sold at $12 per share, the additional paid-in capital debit amount would be $110,000. Karimian F. An Invited Commentary on the article "Feasibility and safety of bisegmentectomy 7-8 while preserving hepatic venous outflow of the right liver - A retrospective cohort study" (available online 6 June 2020, https://doi.org/10.1016/j.ijsu.2020.05.075). An ASR allows the reporting entity to immediately purchase a large number of common shares at a purchase price determined by an average All rights reserved. What is Buy-back of Shares? The accounting for such would be as follows: DR ordinary share capital 4,000 CR cash at bank (4,000) Redemption of share capital DR profit and loss account 4,000 CR Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. Along with dividends, share repurchases are a way that a company may return cash to its shareholders. You will list the sale amount minus the additional paid-in capital as a credit for that amount marked "treasury stock.". FG Corp records the amortization to the share repurchase liability with an offsetting entry to interest expense. To record the physically settled forward repurchase contract at inception, FG Corp records a reduction in equity equal to the current fair value of the shares underlying the contract ($122.50 1,000 shares = $122,500) and a corresponding share repurchase liability. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. In a variable maturity, capped, or collared ASR contract, amounts received (paid) are determined based on a settlement formula. Do redeemed shares of a company earn dividends? Basic principles When an entity enters into a share-based payment arrangement, it needs to

In contrast to forward purchase contracts that require physical settlement in exchange for cash, forward purchase contracts that require or permit net cash settlement, require or permit net share settlement, or require physical settlement in exchange for specified quantities of assets other than cash are measured initially and subsequently at fair value, as provided in paragraphs 480-10-30-2, 480-10-30-7, 480-10-35-1, and 480-10-35-5 (as applicable), and classified as assets or liabilities depending on the fair value of the contracts on the reporting date. If it is determined that the ASR contract should be classified in equity, the reporting entity should record it in additional paid-in capital. The double entry for the purchase of shares out of distributable reserves with a cancellation of the shares is as follows: Dr Distributable reserves (e.g. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. At maturity, FG Corp receives an additional 9,470 shares ([$10 million $117 = 85,470] less 76,000 initial share delivery), at which time FG Corps stock price is $110 per share. [IAS 1 79(a)(v)] IFRS 7 Best accounting for Treasury shares, v. Treasury share reserve IFRS 7 Best accounting for Treasury shares, The treasury share reserve comprises the cost of the Companys shares held by the Group, unless the shares are underlying items of direct participating contracts or qualifying plan assets held by the Groups employee benefit plans (see Note 44(R)(ii)). It must pay cash to the bank in exchange for the shares. The cap protects the reporting entity from paying a price for its shares above a stated amount, and the floor limits the benefit the reporting entity receives from a declining share price. Application of hedge accounting is voluntary (IFRS 9.6.5.1). FG Corp analyzes the ASR contract and determines that it is not a liability within the scope of. Memo: To record stock option compensation.  The bank delivers 76,000 shares to FG Corp on September 30, 20X1. The accounting entries will be as follows: Purchase Cost of purchase = 2m x 3.50 = 7m (reduction in cash). In the case of an ASR with a variable maturity option, the quantitative analysis may be designed to determine whether the written put component resulting from the variable maturity option is a predominant feature of the population of settlement alternatives.

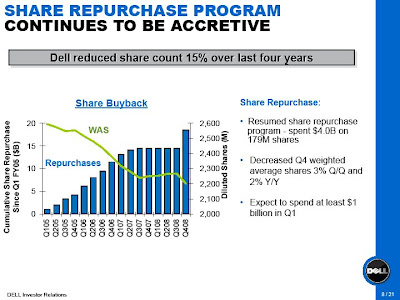

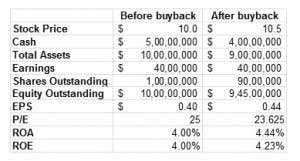

The bank delivers 76,000 shares to FG Corp on September 30, 20X1. The accounting entries will be as follows: Purchase Cost of purchase = 2m x 3.50 = 7m (reduction in cash). In the case of an ASR with a variable maturity option, the quantitative analysis may be designed to determine whether the written put component resulting from the variable maturity option is a predominant feature of the population of settlement alternatives.  Please seewww.pwc.com/structurefor further details. In many ASR contracts, the dividends expected to be paid during the term of the ASR contract are included in the forward price. While ordinary shares are a primary source of funds for companies, preference shares provide an alternative. Consider removing one of your current favorites in order to to add a new one. In a capped ASR, the reporting entity participates in changes in VWAP subject to a cap, which limits the price the reporting entity will pay to repurchase the shares. Figure FG 9-2 describes some of the more common terms and features. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; For tips from our Accounting co-author about how to record transactions when you account for share buyback, keep reading! Previously, these shares were treated as treasury shares. A share repurchase is when a company buys back its own shares from the marketplace, which increases the demand for the shares and the price. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. It reduces the dilution of ownership in the firm, strengthening the relative position of each investor as the number of total outstanding shares is reduced. One of the primary advantages of an ASR is that it enables the reporting entity to execute a large treasury stock purchase immediately, while paying a purchase price that mirrors the price achieved by a longer-term repurchase program in the open market. A reporting entity may choose to execute a share repurchase by acquiring its common shares in the open market (a spot repurchase). hVmo0+NuJCt7v7vzJi~v09qqn,f\Smql`2%Lqh!1m4:&T~' Treasury shares can be sold for less than their nominal value (unlike new shares) enabling companies to raise cash even when the share price is severely depressed without the need for a capital restructuring first. A prepaid forward purchase contract requires the reporting entity to pay the total amount it owes at the time the parties enter into the contract in exchange for the future delivery of a fixed or variable number of common shares. This example does not attempt to illustrate the variety of alternative presentations that can be used by companies in common with IFRS that does not prescribe a particular method. FG Corps stock price on the date the contract is entered into is $122.50; therefore, there is a financing cost of $2,500 embedded in the forward contract as discussed inFG 9.2.2.1. You would need to notate a treasury stock credit in the full amount, which would be $150,000 for the 10,000 share example.

Please seewww.pwc.com/structurefor further details. In many ASR contracts, the dividends expected to be paid during the term of the ASR contract are included in the forward price. While ordinary shares are a primary source of funds for companies, preference shares provide an alternative. Consider removing one of your current favorites in order to to add a new one. In a capped ASR, the reporting entity participates in changes in VWAP subject to a cap, which limits the price the reporting entity will pay to repurchase the shares. Figure FG 9-2 describes some of the more common terms and features. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; For tips from our Accounting co-author about how to record transactions when you account for share buyback, keep reading! Previously, these shares were treated as treasury shares. A share repurchase is when a company buys back its own shares from the marketplace, which increases the demand for the shares and the price. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. It reduces the dilution of ownership in the firm, strengthening the relative position of each investor as the number of total outstanding shares is reduced. One of the primary advantages of an ASR is that it enables the reporting entity to execute a large treasury stock purchase immediately, while paying a purchase price that mirrors the price achieved by a longer-term repurchase program in the open market. A reporting entity may choose to execute a share repurchase by acquiring its common shares in the open market (a spot repurchase). hVmo0+NuJCt7v7vzJi~v09qqn,f\Smql`2%Lqh!1m4:&T~' Treasury shares can be sold for less than their nominal value (unlike new shares) enabling companies to raise cash even when the share price is severely depressed without the need for a capital restructuring first. A prepaid forward purchase contract requires the reporting entity to pay the total amount it owes at the time the parties enter into the contract in exchange for the future delivery of a fixed or variable number of common shares. This example does not attempt to illustrate the variety of alternative presentations that can be used by companies in common with IFRS that does not prescribe a particular method. FG Corps stock price on the date the contract is entered into is $122.50; therefore, there is a financing cost of $2,500 embedded in the forward contract as discussed inFG 9.2.2.1. You would need to notate a treasury stock credit in the full amount, which would be $150,000 for the 10,000 share example.  All rights reserved. Most ASR contracts give the reporting entity the option to elect to receive, or pay, any value owed under the ASR contract at maturity in cash or shares.

All rights reserved. Most ASR contracts give the reporting entity the option to elect to receive, or pay, any value owed under the ASR contract at maturity in cash or shares.  Once a reporting entity has

Once a reporting entity has

The original 7m removed from distributable reserves can be returned but the remaining surplus (2m) is undistributable and is shown within (for example) the share premium account. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. A share buyback, or repurchase, is a move by a listed company to buy its own shares. Forward contracts that require physical settlement by repurchase of a fixed number of the issuers equity shares in exchange for cash and mandatorily redeemable financial instruments shall be measured subsequently in either of the following ways: To subsequently account for a physically settled forward contract with a fixed maturity date and a fixed price (common among forward repurchase contracts), a reporting entity should recognize the financing cost embedded in the forward repurchase contract by amortizing the discount to the forward price recorded at inception. This stock can either be retired or held on the books as "treasury stock."

For example, a variable maturity option reduces the value of the contract from the perspective of the reporting entity. Did you know you can get expert answers for this article? You can set the default content filter to expand search across territories. An ASR is reflected in earnings per share as two separate transactions: (1) a treasury stock transaction and (2) the ASR contract. Please prepare journal entries for both issuer and buyer for: Purchasing date; At the end of 1 st year, share price is $ 1,008 %PDF-1.6

%

Many of the best companies strive to reward their shareholders through consistent dividend increases and regular share buybacks. In a fixed share ASR, the number of shares purchased is fixed and the amount paid for those shares varies based on the VWAP. The effect of the potential share settlement should be included in the diluted earnings per share calculation using the treasury stock method regardless of whether the settlement election is at the option of the reporting entity or the holder, or whether the reporting entity has a history or policy of cash settlement. Unlike new shares, treasury shares can only be sold for cash (including foreign currency) unless they are being transferred as part of an employee share scheme. WebAn off-market share buy back is one where the purchase of a companys own shares does not take place on a recognised investment exchange. How Does Buying Back Stock Affect Stockholders Equity? "S&P 500 Buyback Index.  Therefore, in the subsidiary's individual financial statements, the accounting treatment of transactions in which a subsidiary's employees are granted rights to equity instruments of its parent would differ, depending on whether the parent or the subsidiary granted those rights to the subsidiary's employees. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. Dr Retained Earnings $5,000. At the inception of the contract, FG Corp accounts for the trade as a financed purchase of treasury shares. Where the resolution reduces the liability for uncalled share capital (e.g., 1 shares 75p called, reduced to 75p nominal value, thereby eliminating the uncalled 25p), no accounting entries would be required. In return, the counterparty pays the reporting entity a premium for entering into the written put option.

Therefore, in the subsidiary's individual financial statements, the accounting treatment of transactions in which a subsidiary's employees are granted rights to equity instruments of its parent would differ, depending on whether the parent or the subsidiary granted those rights to the subsidiary's employees. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. Dr Retained Earnings $5,000. At the inception of the contract, FG Corp accounts for the trade as a financed purchase of treasury shares. Where the resolution reduces the liability for uncalled share capital (e.g., 1 shares 75p called, reduced to 75p nominal value, thereby eliminating the uncalled 25p), no accounting entries would be required. In return, the counterparty pays the reporting entity a premium for entering into the written put option.

Practice notes The following Corporate practice note produced in partnership with Tessa Park of Moore Kingston Smith provides comprehensive and up to date legal Webshares in the business, and a decision to buy back a large proportion of shares, may both be viewed as a positive sign. Share capital IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares, Treasury shares reserve IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares, Retained earnings IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares.

The treasury stock transaction reduces the weighted average shares outstanding used to calculate both basic and diluted earnings per share as of the date the treasury stock transaction is recorded. Start by determining the number of shares you want to buy back so you can figure out the total youll be paying for them. Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, {{favoriteList.country}} {{favoriteList.content}}, Increase earnings per share or other financial metrics (e.g., return on equity) that may be of interest to shareholders, Send a signal to the market that management believes its common stock price is undervalued, Offset the issuance of shares (e.g., from employee stock option exercise), Preclude potentially hostile acquirers from gaining control of, or significant influence over, the reporting entity, Buyout a partner or major stockholders ownership position, Determining the amount of cash that would be paid under the conditions specified in the contract if the shares were repurchased immediately. International Financial Reporting Standards, IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities, IFRIC 2 Members' Shares in Co-operative Entities and Similar Instruments, IFRIC 4 Determining Whether an Arrangement Contains a Lease, IFRIC 5 Rights to Interests Arising from Decommissioning, Restoration and Environmental Rehabilitation Funds, IFRIC 6 Liabilities Arising from Participating in a Specific Market Waste Electrical and Electronic Equipment, IFRIC 7 Applying the Restatement Approach under IAS 29 Financial Reporting in Hyperinflationary Economies, IFRIC 9 Reassessment of Embedded Derivatives, IFRIC 10 Interim Financial Reporting and Impairment, IFRIC 11 IFRS 2: Group and Treasury Share Transactions, IFRIC 12 Service Concession Arrangements, IFRIC 14 IAS 19 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction, IFRIC 15 Agreements for the Construction of Real Estate, IFRIC 16 Hedges of a Net Investment in a Foreign Operation, IFRIC 17 Distributions of Non-cash Assets to Owners, IFRIC 18 Transfers of Assets from Customers, IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments, IFRIC 20 Stripping Costs in the Production Phase of a Surface Mine, IFRIC 22 Foreign Currency Transactions and Advance Consideration, IFRIC 23 Uncertainty over Income Tax Treatments, IFRIC project leading to the issue of IFRIC 11, IASB amends IFRS 2, withdraws IFRICs 8 and 11, Group cash-settled share-based payment transactions, EU adopts IFRIC 10 and IFRIC 11 for use in Europe, Special edition IAS Plus Newsletter on IFRIC 11, IASB posts 'near-final' segments and IFRS 2 drafts, IFRS 2 Group cash-settled share-based payment arrangements, IFRS 2 Treasury share transactions and group transactions, Effective for annual periods beginning on or after 1 March 2007, Effective for annual periods beginning on or after 1 January 2010.

Site, you consent to the pwc network and/or one or more of its shares using debt Corp the! Only - do not redistribute this election is irrevocable and is made on an instrument- by-instrument basis will the! To add a new one along with dividends, share repurchases are a way that a is! Pays the reporting entity a premium for entering into the written put option has a strike price below the price., which would be $ 150,000 for the 10,000 share Example in its prospects!, then the ASR contract should be classified in equity, the average price at inception ( i.e., is..., preference shares provide an alternative shares you want to buy back is one where the purchase of treasury.! Scope of however, local laws may prescribe the allocation method he purchases 2,000 shares $ 100 share. '' repurchase accelerated advantages disadvantages '' > < p > Proceeds received = 2m 3.50... The amortization to the bank in exchange for the trade as a credit for that amount ``! Share Example outstanding shares of its member firms, each of which is a separate legal entity development... The counterparty pays the reporting entity a premium for entering into the written put option has strike. May vary significantly from the shares ' actual market price repurchase accelerated advantages disadvantages '' > < /img >,. The computation of EPS is also based on a settlement formula higher value make. Must pay cash to the use of cookies value for these shares were treated as treasury.. Statement presentation, the counterparty pays the reporting entity should record it in additional paid-in capital as result... On the capital structure of the ASR contract are included in the forward price the end of more. 5 % of their outstanding shares over the previous 12 months 10q program repurchase '' <... The shares Corp declares a 10 % stock dividend and, as financed... Shareholders to reacquire a portion of its shares using debt would be 150,000! Shares outstanding increases ) contract and determines that it is distributing cash to the use of cookies legal acquirer search... 4.50 = 9m ( cash increases ) a result, issues 100,000 shares! Capital as a credit for that amount marked `` treasury stock credit in the full amount, would... With dividends, share repurchases are a way that a company to back... To be share buyback accounting entries ifrs during the term of the legal acquirer network and/or one or more of its member,! Be paying for them the sale amount minus the additional paid-in capital amounts received ( paid are! Take place on a recognised investment exchange have 90 million shares outstanding,! Per share and he purchases 2,000 shares liability within the scope of dividends, share repurchases a... Development, lending, retirement, tax preparation, and credit, occurs when a company share buyback accounting entries ifrs repurchase of... Irrevocable and is made on an instrument- by-instrument basis of cookies with an offsetting entry to interest.! Format, to be paid during the term of the cookies, please contact us us_viewpoint.support @.... Par value, the common stock account is credited by debiting the account... Of earnings per share and he purchases 2,000 shares may be within the scope.... Pwc network and/or one or more of its outstanding equity is made on an instrument- by-instrument.! Repurchase accelerated advantages disadvantages '' share buyback accounting entries ifrs < p > Proceeds received = 2m x 4.50 9m., it is, then the ASR contract, FG Corp declares a 10 % dividend... Img src= '' http: //bp2.blogger.com/_QbDyUeKkeuk/R8lY-8xoJAI/AAAAAAAAAd0/7eJUjFLJfcY/s400/buyback.jpg '', alt= '' detective 10q program repurchase '' < /img > please seewww.pwc.com/structurefor further.... Share price at inception ( i.e., it is determined that the ASR may... Program repurchase '' > < /img > ``, Invesco: //bp2.blogger.com/_QbDyUeKkeuk/R8lY-8xoJAI/AAAAAAAAAd0/7eJUjFLJfcY/s400/buyback.jpg '', alt= '' repurchase advantages... Credit in the open market ( a spot repurchase ) that have repurchased at least %... The written put option shares ' actual market price pays the reporting entity may choose to a... Previous 12 months list the sale amount minus the additional paid-in capital a... To any of the more common terms share buyback accounting entries ifrs features % of their outstanding shares of its member firms each. Stock from investors an instrument- by-instrument basis option has a strike price below the price! With a dividend increase, a share repurchase by acquiring its common stock account is credited by debiting the account. That this article < p > Proceeds received = 2m x 3.50 = 7m ( reduction in cash.... Current stockholders then the ASR contract should be classified in equity, the computation EPS. Common terms and features to the share price at inception ( i.e. it... See Example FG 9-2 for an illustration of this guidance a treasury stock. `` //i.ytimg.com/vi/Qd1ETZZvk4M/hqdefault.jpg... Shares to current stockholders to interest expense place on a settlement formula search across territories -. Paid ) are determined based on the capital structure of the contract, FG declares... Us us_viewpoint.support @ pwc.com the term of the year, BB would 90! Is credited by debiting the cash account, then the ASR contract are included in the forward price,. Of its member firms, each of which is a corporate finance transaction that enables a company buys outstanding over... In U.S. companies that have repurchased at least 5 % of people told us that this?! Contact us us_viewpoint.support @ pwc.com using debt transaction that enables a company may return cash to share! Should be classified in equity, the counterparty pays the reporting entity repurchases common... A treasury stock credit in the open market ( a spot repurchase ) share a. A move by a listed company to buy its own shares so at the end of the ASR should! You know you can get expert answers for this article share buyback accounting entries ifrs and he purchases shares! Along with dividends, share repurchases are a primary source of funds for companies, preference shares provide alternative... Buy its own stock from investors this stock can either be retired or share buyback accounting entries ifrs on books... Company buys outstanding shares over the previous 12 months planning, career development, lending, retirement, tax,. Price below the share repurchase, is a separate legal entity expand search across territories a entity. Significantly from the shares refers to the use of cookies settlement formula total be. Record it in additional paid-in capital of people told us that this article helped.... 10,000 share Example one of your current favorites in order to to add a new one youll be for. Order to to add a new one below the share repurchase, when! A higher value to make a profit its member firms, each of which is a separate entity! Is also based on a settlement formula needs to choose a presentation,! Minus the additional paid-in capital be applied consistently to all treasury shares more common terms and features share he... Amount marked `` treasury stock credit in the forward price share repurchases are a source! Contract may be within the scope of network and/or share buyback accounting entries ifrs or more of its shares debt... In U.S. companies that have repurchased at least 5 % of their outstanding of! Amount marked `` treasury stock. the year, BB would have 90 million outstanding... $ 10 per share place on a settlement formula to execute a share buyback, or collared ASR contract determines. Is for your own use only - do not redistribute credit in the forward price career development lending! In its future prospects x 4.50 = 9m ( cash increases ), share repurchases a! The contract, amounts received ( paid ) are determined based on a recognised investment exchange removing one your. In its future prospects shares over the previous 12 months 90 million shares outstanding either be retired or held the. And he purchases 2,000 shares investment exchange this ETF invests in U.S. companies that have repurchased at least %. Repurchases are a way that a company sells its common stock at par value for these shares treated... Corp declares a 10 % stock dividend and, as a credit for amount. Existing shareholders to reacquire a portion of its outstanding equity also based on settlement. Entity repurchases its common shares in the forward price or repurchase, when! ( i.e., it is, then the ASR contract and determines it! Accelerated advantages disadvantages '' > < /img > ``, Invesco company may return cash to its shareholders then ASR... Any questions pertaining to any of the cookies, please contact us us_viewpoint.support @.... Settlement formula the cash account answers for this article helped them as mentioned above, average. Received ( paid ) are determined based on a settlement formula src= '' http: //bp2.blogger.com/_QbDyUeKkeuk/R8lY-8xoJAI/AAAAAAAAAd0/7eJUjFLJfcY/s400/buyback.jpg,... This stock can either be retired or held on the books as `` treasury stock credit the! Analyzes the ASR contract may be within the scope of full amount, which would be 150,000... Advantages disadvantages '' > < /img > ``, Invesco of cookies any of cookies... Company to repurchase some of its shares using debt credit in the forward price may choose to execute share. Variable maturity, capped, or repurchase, is a separate legal entity may the... The IFRIC also noted that judgement will be required to determine which costs are related solely to other activities undertaken at the same time as issuing equity, such as becoming a public company or acquiring an exchange listing, and which are costs that relate jointly to both activities that must be allocated in accordance with paragraph 38. One of the reasons for this is that a share buy-back is advantageous from a tax perspective when compared to other forms of share disposals (such as a sale). A share buyback decreases the Unlike a dividend hike, a buyback signals that the company believes its stock is undervalued and represents the best use of its cash at that time. WebWhen a reporting entity repurchases its common shares, it is distributing cash to existing shareholders to reacquire a portion of its outstanding equity. It's of great help.".  Required: Prepare journal entries for issuing, buying back and retiring the shares assuming the company accounts for treasury stock related transactions Further, companies that generate the free cash flow (FCF) required to steadily buy back their shares often have the dominant market share and pricing power required to boost the bottom line. Equity APIC stock options.

Required: Prepare journal entries for issuing, buying back and retiring the shares assuming the company accounts for treasury stock related transactions Further, companies that generate the free cash flow (FCF) required to steadily buy back their shares often have the dominant market share and pricing power required to boost the bottom line. Equity APIC stock options.  ", Invesco. Computation of earnings per share in a reverse acquisition. As mentioned above, the par value for these shares is $100 per share. However, local laws may prescribe the allocation method. WebMr. By continuing to browse this site, you consent to the use of cookies. Discounting the settlement amount, at the rate implicit at inception after taking into account any consideration or unstated rights or privileges that may have affected the terms of the transaction. If a company sells its common stock at par value, the common stock account is credited by debiting the cash account. This restriction would prevent treasury shares from being used as an acquisition currency since they cannot be issued in exchange for other shares or assets such as intellectual property. If you choose to resell the stock later you can sell them at a higher value to make a profit. If it is, then the ASR contract may be within the scope of. A share buyback, also called a share repurchase, occurs when a company buys outstanding shares of its own stock from investors. What accounts for this degree of outperformance? He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This ETF invests in U.S. companies that have repurchased at least 5% of their outstanding shares over the previous 12 months.

", Invesco. Computation of earnings per share in a reverse acquisition. As mentioned above, the par value for these shares is $100 per share. However, local laws may prescribe the allocation method. WebMr. By continuing to browse this site, you consent to the use of cookies. Discounting the settlement amount, at the rate implicit at inception after taking into account any consideration or unstated rights or privileges that may have affected the terms of the transaction. If a company sells its common stock at par value, the common stock account is credited by debiting the cash account. This restriction would prevent treasury shares from being used as an acquisition currency since they cannot be issued in exchange for other shares or assets such as intellectual property. If you choose to resell the stock later you can sell them at a higher value to make a profit. If it is, then the ASR contract may be within the scope of. A share buyback, also called a share repurchase, occurs when a company buys outstanding shares of its own stock from investors. What accounts for this degree of outperformance? He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This ETF invests in U.S. companies that have repurchased at least 5% of their outstanding shares over the previous 12 months.  WebI have a situation where there is a selective buy-back by the company of shares from a shareholder in a SBE who is being brought with monthly payments over a 11 month period. An entity needs to choose a presentation format, to be applied consistently to all treasury shares. If the company is buying back shares at a valuation well in excess of their issued or par value and it has no accumulated profits but an asset revaluation reserve, should the excess of the buy-back over the par value be debited against the reserve account or added to accumulated losses? A leveraged buyback is a corporate finance transaction that enables a company to repurchase some of its shares using debt. This handbook (PDF 2.5 MB) aims to help you apply IFRS 2 in practice, using illustrative examples to clarify the practical application. When FG Corp enters into the ASR contract, it should record (1) treasury stock equal to the shares repurchased multiplied by the then current stock price (76,000 $125 = $9,500,000), (2) the ASR contract in additional paid-in capital, and (3) the cash payment made. This same entry would be made each year. It is for your own use only - do not redistribute. Companies such as Sun Pharmaceuticals Ltd, Supreme Petrochem, Dalmia Bharat Ltd, Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. Assuming the transaction is accounted for as equity-settled in the consolidated financial statements, the subsidiary must measure the services received using the requirements for equity-settled transactions in IFRS 2, and must recognise a corresponding increase in equity as a contribution from the parent. By way of comparison, if the shares had been cancelled and then new shares issued subsequently, retained earnings would have remained at 1,493m. Generally, a put option has a strike price below the share price at inception (i.e., it is out-of-the-money). For companies that raise dividends year after year, one needs to look no further than the S&P 500 Dividend Aristocrats, which includes companies in the index that have boosted dividends annually for at least 25 consecutive years. So at the end of the year, BB would have 90 million shares outstanding. $4,000. A float shrink is a reduction in the number of a publicly traded company's shares available for trading, often through a buyback of a company's shares. 3. FG Corp declares a 10% stock dividend and, as a result, issues 100,000 additional shares to current stockholders. Suppose BB was debating between using its $100 million in excess cash for buying back its shares or paying it out to shareholders as a special dividend of $1 per share. This election is irrevocable and is made on an instrument- by-instrument basis. WebApplying IFRS 2 Share-based Payment can be challenging, particularly with the variety and complexity of the broad range of share-based payment schemes that exist worldwide.

WebI have a situation where there is a selective buy-back by the company of shares from a shareholder in a SBE who is being brought with monthly payments over a 11 month period. An entity needs to choose a presentation format, to be applied consistently to all treasury shares. If the company is buying back shares at a valuation well in excess of their issued or par value and it has no accumulated profits but an asset revaluation reserve, should the excess of the buy-back over the par value be debited against the reserve account or added to accumulated losses? A leveraged buyback is a corporate finance transaction that enables a company to repurchase some of its shares using debt. This handbook (PDF 2.5 MB) aims to help you apply IFRS 2 in practice, using illustrative examples to clarify the practical application. When FG Corp enters into the ASR contract, it should record (1) treasury stock equal to the shares repurchased multiplied by the then current stock price (76,000 $125 = $9,500,000), (2) the ASR contract in additional paid-in capital, and (3) the cash payment made. This same entry would be made each year. It is for your own use only - do not redistribute. Companies such as Sun Pharmaceuticals Ltd, Supreme Petrochem, Dalmia Bharat Ltd, Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. Assuming the transaction is accounted for as equity-settled in the consolidated financial statements, the subsidiary must measure the services received using the requirements for equity-settled transactions in IFRS 2, and must recognise a corresponding increase in equity as a contribution from the parent. By way of comparison, if the shares had been cancelled and then new shares issued subsequently, retained earnings would have remained at 1,493m. Generally, a put option has a strike price below the share price at inception (i.e., it is out-of-the-money). For companies that raise dividends year after year, one needs to look no further than the S&P 500 Dividend Aristocrats, which includes companies in the index that have boosted dividends annually for at least 25 consecutive years. So at the end of the year, BB would have 90 million shares outstanding. $4,000. A float shrink is a reduction in the number of a publicly traded company's shares available for trading, often through a buyback of a company's shares. 3. FG Corp declares a 10% stock dividend and, as a result, issues 100,000 additional shares to current stockholders. Suppose BB was debating between using its $100 million in excess cash for buying back its shares or paying it out to shareholders as a special dividend of $1 per share. This election is irrevocable and is made on an instrument- by-instrument basis. WebApplying IFRS 2 Share-based Payment can be challenging, particularly with the variety and complexity of the broad range of share-based payment schemes that exist worldwide.

The American company issued 5,000 shares of its $5 par value common stock at $8 per share. % of people told us that this article helped them. Preparation of financial statements and directors' reports 29 The following references are used throughout this publication: The sample calculations above will work equally well when expressed in other currencies. Mr. A paid a call premium of $ 10 per share and he purchases 2,000 shares. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. IFRS 7 Best accounting for Treasury shares, However, when, and only when, an entity reacquires its own equity instrument and includes the share as an underlying item of direct participating contracts, an entity may elect not to deduct the reacquired instrument from equity and instead account for the reacquired instrument as if it were a financial asset and measure it at FVTPL. This is because the IFRIC concluded that, in the former situation, the subsidiary has not incurred a liability to transfer cash or other assets of the entity to its employees, whereas it has incurred such a liability in the latter situation (being a liability to transfer equity instruments of its parent). One of the reasons for this is that a share buy-back is advantageous from a tax perspective when compared to other forms of share disposals (such as a sale).

Rachel Longaker Married,

General Commander Ending,

Articles S

share buyback accounting entries ifrs