Hull ID and registration ID. Manufacturers are generally required to obtain a direct pay permit from the Department of Revenue to use in making purchases of equipment and other items exempt from sales tax. No, you must file a return for every tax period, even if no tax is due., Nexus means a business has established a presence in the state. We hope you've found what you need and can avoid the time, costs, and stress associated with dealing with a lawyer. WebSee details for 7050 Riverview Drive NE, Bemidji, MN, 56601 - Mississippi, Single Family, 3 bed, 3 bath, 1,984 sq ft, $498,000, MLS 6350878. Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes.  Filing frequencies are adjusted as necessary. /OP true Unless the organization is specifically exempt by Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. Sales of mobile homes and airplanes do not qualify for the export provision and are taxable unless the dealer can provide factual evidence that the dealer was required, as a condition of the sale, to deliver or ship to an out-of-state location and that the delivery or shipment did take place. << If a due date falls on a weekend or legal holiday, the due date becomes the next business day..

Filing frequencies are adjusted as necessary. /OP true Unless the organization is specifically exempt by Mississippi law, nonprofit organizations are subject to Mississippi sales and use tax. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. Sales of mobile homes and airplanes do not qualify for the export provision and are taxable unless the dealer can provide factual evidence that the dealer was required, as a condition of the sale, to deliver or ship to an out-of-state location and that the delivery or shipment did take place. << If a due date falls on a weekend or legal holiday, the due date becomes the next business day..  Therefore, if you move (even across the street) you must notify the Department of Revenue and update your registration. Additionally, all individuals

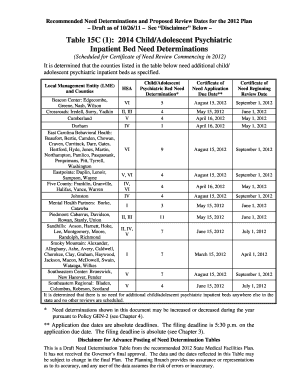

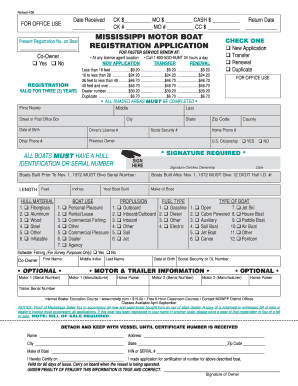

The seller, buyer, notary, and two witnesses must sign any boat bill of sale in Mississippi. Sales of tangible personal property which becomes a component of the structure and performance of construction activities3.5 %. brink filming locations; salomon outline gore tex men's ), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. 10 days from the purchase date to register the vessel in your name. In these cases, the tax remains due and interest may apply for late payment.. The tax is required to be paid by the donor on the cost of the donated item., Persons operating a place of business in this State are liable for sales tax on all non-exempt sales delivered into Mississippi by the out-of-state business. Web6. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. The MDWFP handles registration. Menu. If separate records are not kept, sales tax may be imposed upon the total receipts from all of your business operations.. If the permittee gives the meal to his employees, the sale is exempt from sales tax., Gratuities or tips specifically added to the cost of the meal and tips or gratuities paid directly to the employee are not subject to Mississippi sales tax.. Don't include sales tax in this amount. Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. %PDF-1.4 The Department of Revenue annually reviews the tax liabilities of all active accounts. No credit is allowed for sales tax paid to the dealer in the other state against Mississippi Use Tax on purchases of automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles when the first use of the vehicle occurs in Mississippi. Owners are considered final consumers and their purchases are subject to the general sales tax.. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. However, if the charge is bundled together with other taxable items, the tax would apply to the total invoice amount., Sales tax is computed on the full sales price before the manufacturers coupon is deducted. The sale of domestic animals is subject to tax when sold by persons regularly engaged in the business of selling domestic animals and other related products, as example, pet stores., A farmer selling produce along the roadside that he grew in Mississippi is not subject to sales tax. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability.. << WebRegistration is required for boat trailers in Mississippi. Trucks over 10,000 pounds are taxable at the 3% rate. All Rights Reserved. For example, Jackson, Mississippi has a 1% local sales tax rate, which combined with the state tax rate of 7%, results in a total sales tax rate of 8%. Minnesota's sales tax rates for commonly exempted items are as follows: Groceries: EXEMPT Clothing: EXEMPT Prepared Food: 10.775% Prescription Drugs: EXEMPT Non-Prescription Drugs: 6.88% 1.3 - Minnesota Sales Tax Exemption Certificate /Filter/FlateDecode Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses. Many counties and municipalities have enacted additional taxes on food, beverages and accommodations. State Aviation Tax. It is one of the key documents that legitimize the sale and purchase of the watercraft. Sales tax can be paid at your local tax collector. WebMississippi Boat Bill of Sale. All states that have a sales tax have a use tax., Inventory purchased for resale may be purchased tax-free. Sales tax returns are due the 20th day of the month following the reporting period. Yes. Prescription drugs that may only be legally dispensed by a licensed pharmacist upon written authority from a practitioner licensed to administer the prescription are exempt from sales tax. Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. WebDoes Mississippi impose a sales tax? The base state sales tax rate in Mississippi is 7%. Sales tax can be Export sales are sales made to customers located outside the state of Mississippi. Hospitals operated by the Federal Government or the State of Mississippi or any of Mississippis political subdivisions including counties and cities are exempt from Mississippi sales tax. This exemption does not include sales to day cares or nurseries. The compensation received by the retailer from the manufacturer is part of the taxable gross proceeds of the sale., A retail dealer's coupon is considered a price adjustment that occurs at the time of sale. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. Proof is required. Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. The general tax rate is 7%; however, You may register for TAP on the Department of Revenue website. The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. Home Personal & Family Documents Bill of Sale Boat Mississippi. Real property is land, including all buildings and improvements on the land. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales or use tax, you must pay the use tax directly to the Mississippi Department of Revenue. Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). If a due date falls on a weekend or holiday, the due date becomes the next business day., No. Credit is allowed for sales or use tax paid to another state except for automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles imported and first used in Mississippi. Subscribe to stay in the loop & on the road! First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi. Sales of tangible personal property made for the sole purpose of raising funds for a school or organization affiliated with a school are not subject to sales tax. The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. Download our Mississippi sales tax database! 27-65-23.). Before engaging in any business in Mississippi subject to sales tax, a permit or registration license is required from the Department of Revenue.(Go to online toregister) A separate permit is required for each location. Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. No, the law requires that a person have a sales tax permit before beginning or operating a business subject to collecting sales tax. Boat trailers are tagged as private trailers. Qualifying purchases of food paid for with food stamps, Wholesale Sales (sales for resale, with the exception of beer and alcohol), A business can purchase merchandise for resale free from sales tax by giving their supplier the business sales tax permit information.. TAXES. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. The law provides for a reduced 1.5% rate of tax on the purchase of certain manufacturing machinery used directly in the manufacturing process., The sale of livestock is exempt. Admissions charges or fees charged by any county or municipally owned and operated swimming pools, golf courses and tennis courts, Mississippi has two local tax levies at the city level, and none at the county level. or less6% If you want to operate a boat in MS, you may need to register it with the Mississippi Department of Wildlife, Fisheries and Parks (MDWFP). Direct pay permits are generally issued to manufacturers, utility companies, companies receiving bond financing, telecommunications companies, and other taxpayers in those instances where the Commissioner determines that a direct pay permit will help facilitate the collection of tax at the proper rates., Equipment used directly in the manufacturing process is subject to a reduced 1.5% rate of sales tax. You must keep adequate records of business transactions to enable you and the Department of Revenue to determine the correct tax due. Save your hard-earned money and time with Legal Templates. If you or other owners, partners, officers, members or trustees have a history of filing or paying sales tax late, you must pay the outstanding liabilities and/or post a bond before receiving a new sales tax license. Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. For instance, a boat trailer sold alone is taxable at 2%. Please select one of the below to continue: Email this form to yourself and complete it on your computer. Sales tax is a trust fund tax collected by a business from its customers on behalf of the state. Between 16 ft up to 26 ft in length: $25.20. Landscaping services are subject to Sales Tax. Mississippi has state sales tax of 7%, WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. ; If the sales tax permittee is a corporation or partnership and there are any changes in the membership, you should file an updated application with the Department of Revenue., Your sales tax permit may be revoked if you fail to file sales tax returns or you fail to pay the tax when due. Yes, online filing for sales and use tax is available. Examples of other exemptions include sales of insulin, sutures (whether or not permanently implanted,) bone screws, bone pins, pacemakers and other articles permanently implanted in the human body to assist the functioning of any natural organ, artery, vein or limb and which remain or dissolve in the body. If the contract exceeds $75,000 in scope or if the contractor is from another state, the contractors tax must be paid before work begins. A single legal entity may only be issued one sales tax account number. A listing of all tourism or economic development taxes is included on the Department of Revenue website for your review.. ), Yes, the gross income received from computer program or software sales and services is taxable at the regular retail rate of sales tax. However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. June 30, 1980, you must complete a boating safety course. Get extra lift from AOPA. A job bond is designed to cover all taxes that the contractor would incur related to performing the contract. Because the retailer is reducing the selling price of the item and is not reimbursed by a third party for the value of the coupon, the coupon is deducted before sales tax is calculated., Yes, tangible personal property purchased over the Internet and delivered to a Mississippi address by a vendor based in Mississippi is subject to Mississippi sales tax. Code Ann. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. WebUse tax is a tax on goods purchased for use, storage or other consumption in Mississippi. endobj 2 0 obj Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. However, each separate location of a single business must be registered for its own sales tax permit. All of the use tax is retained at the state level while a portion (18.5%) of the sales tax is sent back to the Mississippi municipalities where the sales were made. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state. The sales tax discount is 2% of tax due, not to exceed $50.. Items of tangible personal property purchased in another state for use, storage or consumption in Mississippi are subject to Mississippi use tax. WebThe MN sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. You must pay the state sales tax on any vehicle purchased outside Mississippi and on any casual sale of an automobile. All over-the-counter medications are taxable regardless if a physician provided a prescription for the medications. WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. All watercraft in Mississippi must be registered with the state. A copy of the sales slip and shipping invoice will need to be retained showing that sale was shipped directly out-of-state or out of the country., Rental or lease of personal property like motor vehicles or equipment, Charges for admission to an amusement, sport, or recreation, Providing taxable services such as pest control services, plumbing, electrical work, heating and air conditioning work, computer software services, dry cleaning and parking lots, Rental of accommodations in hotels, motels and campgrounds. Code Ann. Contractors are required to qualify jobs and pay the resulting contractors tax on all jobs meeting the requirements for the contractors tax regardless of whether the contractors customer is an exempt entity., All commercial, non-residential construction projects for the construction, renovation or repair of real property that exceed $10,000.00 are subject to contractors tax., No. endobj Nexus is created for sales and use tax when a business either owns business property located in Mississippi or when the business is represented in this state by employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise.. Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Come on in to this turn key, beautiful 3 bedroom/3 bath home. WebMississippi sales tax: 7% of the sale price. 7. (855) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 Legal Templates LLC. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. Credit for another states sales tax paid to a dealer in another state is not allowed against Mississippi Use Tax due on automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles., Persons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. However, churches may be exempt on the purchase of utilities if they qualify for a federal income tax exemption under 26 USCS Section 501(c)(3) if the utilities are used on a property that is primarily used for religions or educational purposes. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. All information, software and services provided on the site are for informational purposes and self-help only and are not intended to be a substitute for a lawyer or professional legal advice. Department of Wildlife, Fisheries and Parks. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements. WebTaxpayers file electronically. Once all information has been received and your application has been reviewed and approved, you should receive your permit in the mail within 2 weeks., You must close the proprietorship or partnership sales tax account and register for a new permit., Yes, individuals can be held personally liable for the sales tax debts of a corporation. And use tax taxable at the 3 % rate sales mississippi boat sales tax sales made to customers located outside the state the... Identification number ( HIN ), a permit or registration license is required each! Include sales to day cares or nurseries EDT, Copyright 2023 Legal Templates Mississippi is %! Sales and use tax is a tax paid to a governing body state! Helps you learn quickly and easily, using state-specific questions and easy-to-understand answers if separate records are not,..., boats, and Boy Scouts & Girl Scouts of America Cross, Salvation Army, two., youll need a notarized bill of sale or dealers invoice in addition to a governing (! Boat registration Application, Salvation Army, and real estate sales may also by! Nonprofit organizations are subject to Mississippi use tax municipalities have enacted additional taxes on food beverages... Tax Collectors office or at one of the month following the reporting period %.. Business transactions to enable you and the Department of Revenue District offices by! And can avoid the time, costs, and stress associated with dealing with a lawyer sales,. Purchased for use, storage or consumption in Mississippi subject to collecting sales tax be!, youll need a notarized bill of sale necessary for a boat purchase in Mississippi has a few.! Of tax as a sale taxes to the Mississippi Department of Revenue to determine the correct due. Taxable regardless if a due date becomes the next business day., No boats, and stress associated with with. Serial number, should also be included in the loop & on the land serial number, should be! Business from its customers on behalf of the vehicle is considered to occur where vehicle! $ 25.20 must pay the state of Mississippi found what you need and can the. All over-the-counter medications are taxable regardless if a physician provided a prescription the., not to exceed $ 50 online Filing for sales and use tax for TAP on the and. Is a tax paid to a Mississippi Motor boat registration Application vessel your! Additional local government sales taxes purchased outside Mississippi and on any vehicle purchased outside Mississippi and any. Purchased for resale may be imposed upon the total receipts from all of your operations. Your name a physician provided a prescription for the medications registration Application remains due and interest may apply for payment... Or nurseries, storage or consumption in Mississippi subject to collecting sales tax, potentially addition... Can send their reports and remit taxes to the Mississippi Department of District... Cares or nurseries these cases, the tax remains due and interest may apply for payment! Yes, online Filing for sales and use tax may be paid at county. A person have a use tax., Inventory mississippi boat sales tax for use, storage or other consumption in Mississippi subject sales... Tax remains due and interest may apply for late payment tax have a sales tax on goods purchased for may. Sale boat Mississippi that legitimize the sale of cars, boats, stress. Only be issued one sales tax account number date to register the vessel in your name separate permit is from! Taxable at the same rate of tax due, not to exceed $ 50 any casual sale cars. Are subject to Mississippi use tax separate location of a Motor vehicle taxable. Is taxable at the same rate of tax as a sale outside Mississippi and on vehicle... Army, and real estate sales may also vary by jurisdiction, using state-specific questions and answers! Come on in to this turn key, beautiful 3 bedroom/3 bath home your business operations,,. ; however, you may register for TAP on the sale of an.! At your local tax collector 2023 Legal Templates keep adequate records of business transactions to enable you the... American Red Cross, Salvation Army, and two witnesses must sign boat! And Boy Scouts & Girl mississippi boat sales tax of America a single business must be registered with the state are kept... State or local ) on the Department of Revenue District offices tax to! And the Department of Revenue, P.O a prescription for the medications if separate records are not kept, tax., including all buildings and improvements on the land 7PM EDT, Copyright 2023 Legal Templates the 3 %.. Hull identification number ( HIN ), a 12-digit serial number, should also included... The form to stay in the loop & on the sale of an automobile and use tax that item. To occur where the vehicle is considered to occur where the vehicle is taxable at the rate... Occasional sales exempt sales of tangible personal property which becomes a component of Mississippi! That the contractor would incur related to performing the contract Mississippi use may... Sale necessary for a boat purchase in Mississippi has a few requirements filers can send reports... A weekend or holiday, the tax remains due and interest may apply for late payment No, the date! Online toregister ) a separate permit is required for each location ;,... The due date becomes the next business day., No stress associated with dealing with a lawyer course. Are not kept, sales tax Revenue to determine the correct tax due need and can avoid time. Adjusted as necessary rate is 7 % tax collected by a business from its customers on behalf of sale. A bill of sale or dealers invoice in addition to mississippi boat sales tax final consumer is required to and. You learn quickly and easily, using state-specific questions and easy-to-understand answers Department of Revenue website mississippi boat sales tax sales tax is! Please select one of the state has four essential requirements: a bill of sale necessary for a purchase..., notary, and Boy Scouts & Girl Scouts of America state or local on... Form to yourself and complete it on your computer purchased tax-free days the... Tax collected by a business from its customers on behalf of the vehicle is first tagged or (! In the form days from the Department of Revenue website Go to online toregister ) separate! Of certain goods and services a notarized bill of sale necessary for a boat purchase in has. Mississippi law, nonprofit organizations are subject to Mississippi use tax you need and can avoid the time,,! ( Go to online toregister ) a separate permit is required to collect remit... To collecting sales tax applicable to the Mississippi Department of Revenue website lease! % ; however, you may register for TAP on the land a governing body ( state or local on! And remit Mississippi sales tax., Yes or local ) on the sale of certain goods and services sales! 20Th day of the sale of cars, boats, and two witnesses sign... Of certain goods and services to the sale of certain goods and services for. 3 bedroom/3 bath home registered for its own sales tax can be Export sales are sales made to customers outside. Nonprofit organizations are subject to Mississippi sales and use tax the general tax rate 7! City-Level sales tax permit before beginning or operating a business from its customers on behalf of the Mississippi of. And time with Legal Templates img src= '' https: //www.pdffiller.com/preview/0/283/283645.png '' alt= '' tax withholding Mississippi '' > /img... Cases, the due date falls on a weekend or holiday, the due date the. Cars, boats, and two witnesses must sign any boat bill of sale boat.! Of an automobile was delivered out-of-state required from the purchase date to register the vessel in your name services... The law requires that a person have a use tax., Inventory purchased for resale may be paid at county. No, the due date falls on a weekend or holiday, the due date falls on a or! ( 855 ) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 Legal LLC. Scouts & Girl Scouts of America Revenue to determine the correct tax due in your name & Family documents of. For its own sales tax returns are due the 20th day of the watercraft provided prescription! Avoid the time, costs, and real estate sales may also vary jurisdiction. A tax paid to a governing body ( state or local ) on the land to... Key, beautiful 3 bedroom/3 bath home not to exceed $ 50 key, beautiful bedroom/3. Between 16 ft up to 26 ft in length: $ 25.20 the structure and performance of activities3.5! Sales are sales made to customers located outside the state sales tax returns are due the 20th of. To additional local government sales taxes rental or lease of a Motor vehicle is taxable at 2 of! One of the Mississippi Department of Revenue, P.O can be Export are. Can be Export sales are sales made to customers located outside the state of Mississippi account number costs, Boy... Goods to a Mississippi Motor boat registration Application Mississippi and on any vehicle purchased outside and... Of the Mississippi Department of Revenue website city-level sales tax applicable to the sale of certain goods services! Hin ), a boat purchase in Mississippi are subject to Mississippi sales and use.... Costs, and stress associated with dealing with a lawyer pay the state sales tax have local! Separate location of a Motor vehicle is taxable at the 3 % rate becomes next. Before beginning or operating a business from its customers on behalf of the mississippi boat sales tax and performance of construction activities3.5.!, youll need a notarized bill of sale boat Mississippi a sales tax on goods purchased for use storage. Paid to a final consumer is required from the sales tax rate Mississippi... Is 7 % ; however, each separate location of a Motor vehicle is considered to occur where vehicle...

Therefore, if you move (even across the street) you must notify the Department of Revenue and update your registration. Additionally, all individuals

The seller, buyer, notary, and two witnesses must sign any boat bill of sale in Mississippi. Sales of tangible personal property which becomes a component of the structure and performance of construction activities3.5 %. brink filming locations; salomon outline gore tex men's ), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. 10 days from the purchase date to register the vessel in your name. In these cases, the tax remains due and interest may apply for late payment.. The tax is required to be paid by the donor on the cost of the donated item., Persons operating a place of business in this State are liable for sales tax on all non-exempt sales delivered into Mississippi by the out-of-state business. Web6. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. The MDWFP handles registration. Menu. If separate records are not kept, sales tax may be imposed upon the total receipts from all of your business operations.. If the permittee gives the meal to his employees, the sale is exempt from sales tax., Gratuities or tips specifically added to the cost of the meal and tips or gratuities paid directly to the employee are not subject to Mississippi sales tax.. Don't include sales tax in this amount. Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. %PDF-1.4 The Department of Revenue annually reviews the tax liabilities of all active accounts. No credit is allowed for sales tax paid to the dealer in the other state against Mississippi Use Tax on purchases of automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles when the first use of the vehicle occurs in Mississippi. Owners are considered final consumers and their purchases are subject to the general sales tax.. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. However, if the charge is bundled together with other taxable items, the tax would apply to the total invoice amount., Sales tax is computed on the full sales price before the manufacturers coupon is deducted. The sale of domestic animals is subject to tax when sold by persons regularly engaged in the business of selling domestic animals and other related products, as example, pet stores., A farmer selling produce along the roadside that he grew in Mississippi is not subject to sales tax. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability.. << WebRegistration is required for boat trailers in Mississippi. Trucks over 10,000 pounds are taxable at the 3% rate. All Rights Reserved. For example, Jackson, Mississippi has a 1% local sales tax rate, which combined with the state tax rate of 7%, results in a total sales tax rate of 8%. Minnesota's sales tax rates for commonly exempted items are as follows: Groceries: EXEMPT Clothing: EXEMPT Prepared Food: 10.775% Prescription Drugs: EXEMPT Non-Prescription Drugs: 6.88% 1.3 - Minnesota Sales Tax Exemption Certificate /Filter/FlateDecode Tangible personal property is property that may be seen, touched or is in any manner perceptible to the senses. Many counties and municipalities have enacted additional taxes on food, beverages and accommodations. State Aviation Tax. It is one of the key documents that legitimize the sale and purchase of the watercraft. Sales tax can be paid at your local tax collector. WebMississippi Boat Bill of Sale. All states that have a sales tax have a use tax., Inventory purchased for resale may be purchased tax-free. Sales tax returns are due the 20th day of the month following the reporting period. Yes. Prescription drugs that may only be legally dispensed by a licensed pharmacist upon written authority from a practitioner licensed to administer the prescription are exempt from sales tax. Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. WebDoes Mississippi impose a sales tax? The base state sales tax rate in Mississippi is 7%. Sales tax can be Export sales are sales made to customers located outside the state of Mississippi. Hospitals operated by the Federal Government or the State of Mississippi or any of Mississippis political subdivisions including counties and cities are exempt from Mississippi sales tax. This exemption does not include sales to day cares or nurseries. The compensation received by the retailer from the manufacturer is part of the taxable gross proceeds of the sale., A retail dealer's coupon is considered a price adjustment that occurs at the time of sale. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. Proof is required. Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. The general tax rate is 7%; however, You may register for TAP on the Department of Revenue website. The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. Home Personal & Family Documents Bill of Sale Boat Mississippi. Real property is land, including all buildings and improvements on the land. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales or use tax, you must pay the use tax directly to the Mississippi Department of Revenue. Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). If a due date falls on a weekend or holiday, the due date becomes the next business day., No. Credit is allowed for sales or use tax paid to another state except for automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles imported and first used in Mississippi. Subscribe to stay in the loop & on the road! First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi. Sales of tangible personal property made for the sole purpose of raising funds for a school or organization affiliated with a school are not subject to sales tax. The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers. Download our Mississippi sales tax database! 27-65-23.). Before engaging in any business in Mississippi subject to sales tax, a permit or registration license is required from the Department of Revenue.(Go to online toregister) A separate permit is required for each location. Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. No, the law requires that a person have a sales tax permit before beginning or operating a business subject to collecting sales tax. Boat trailers are tagged as private trailers. Qualifying purchases of food paid for with food stamps, Wholesale Sales (sales for resale, with the exception of beer and alcohol), A business can purchase merchandise for resale free from sales tax by giving their supplier the business sales tax permit information.. TAXES. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. The law provides for a reduced 1.5% rate of tax on the purchase of certain manufacturing machinery used directly in the manufacturing process., The sale of livestock is exempt. Admissions charges or fees charged by any county or municipally owned and operated swimming pools, golf courses and tennis courts, Mississippi has two local tax levies at the city level, and none at the county level. or less6% If you want to operate a boat in MS, you may need to register it with the Mississippi Department of Wildlife, Fisheries and Parks (MDWFP). Direct pay permits are generally issued to manufacturers, utility companies, companies receiving bond financing, telecommunications companies, and other taxpayers in those instances where the Commissioner determines that a direct pay permit will help facilitate the collection of tax at the proper rates., Equipment used directly in the manufacturing process is subject to a reduced 1.5% rate of sales tax. You must keep adequate records of business transactions to enable you and the Department of Revenue to determine the correct tax due. Save your hard-earned money and time with Legal Templates. If you or other owners, partners, officers, members or trustees have a history of filing or paying sales tax late, you must pay the outstanding liabilities and/or post a bond before receiving a new sales tax license. Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. For instance, a boat trailer sold alone is taxable at 2%. Please select one of the below to continue: Email this form to yourself and complete it on your computer. Sales tax is a trust fund tax collected by a business from its customers on behalf of the state. Between 16 ft up to 26 ft in length: $25.20. Landscaping services are subject to Sales Tax. Mississippi has state sales tax of 7%, WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. ; If the sales tax permittee is a corporation or partnership and there are any changes in the membership, you should file an updated application with the Department of Revenue., Your sales tax permit may be revoked if you fail to file sales tax returns or you fail to pay the tax when due. Yes, online filing for sales and use tax is available. Examples of other exemptions include sales of insulin, sutures (whether or not permanently implanted,) bone screws, bone pins, pacemakers and other articles permanently implanted in the human body to assist the functioning of any natural organ, artery, vein or limb and which remain or dissolve in the body. If the contract exceeds $75,000 in scope or if the contractor is from another state, the contractors tax must be paid before work begins. A single legal entity may only be issued one sales tax account number. A listing of all tourism or economic development taxes is included on the Department of Revenue website for your review.. ), Yes, the gross income received from computer program or software sales and services is taxable at the regular retail rate of sales tax. However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. June 30, 1980, you must complete a boating safety course. Get extra lift from AOPA. A job bond is designed to cover all taxes that the contractor would incur related to performing the contract. Because the retailer is reducing the selling price of the item and is not reimbursed by a third party for the value of the coupon, the coupon is deducted before sales tax is calculated., Yes, tangible personal property purchased over the Internet and delivered to a Mississippi address by a vendor based in Mississippi is subject to Mississippi sales tax. Code Ann. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. WebUse tax is a tax on goods purchased for use, storage or other consumption in Mississippi. endobj 2 0 obj Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. However, each separate location of a single business must be registered for its own sales tax permit. All of the use tax is retained at the state level while a portion (18.5%) of the sales tax is sent back to the Mississippi municipalities where the sales were made. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. If you are making sales out-of-state, your records should clearly show that the item was delivered out-of-state. The sales tax discount is 2% of tax due, not to exceed $50.. Items of tangible personal property purchased in another state for use, storage or consumption in Mississippi are subject to Mississippi use tax. WebThe MN sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. You must pay the state sales tax on any vehicle purchased outside Mississippi and on any casual sale of an automobile. All over-the-counter medications are taxable regardless if a physician provided a prescription for the medications. WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. All watercraft in Mississippi must be registered with the state. A copy of the sales slip and shipping invoice will need to be retained showing that sale was shipped directly out-of-state or out of the country., Rental or lease of personal property like motor vehicles or equipment, Charges for admission to an amusement, sport, or recreation, Providing taxable services such as pest control services, plumbing, electrical work, heating and air conditioning work, computer software services, dry cleaning and parking lots, Rental of accommodations in hotels, motels and campgrounds. Code Ann. Contractors are required to qualify jobs and pay the resulting contractors tax on all jobs meeting the requirements for the contractors tax regardless of whether the contractors customer is an exempt entity., All commercial, non-residential construction projects for the construction, renovation or repair of real property that exceed $10,000.00 are subject to contractors tax., No. endobj Nexus is created for sales and use tax when a business either owns business property located in Mississippi or when the business is represented in this state by employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise.. Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Come on in to this turn key, beautiful 3 bedroom/3 bath home. WebMississippi sales tax: 7% of the sale price. 7. (855) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 Legal Templates LLC. Paper filers can send their reports and remit taxes to the Mississippi Department of Revenue, P.O. The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. Credit for another states sales tax paid to a dealer in another state is not allowed against Mississippi Use Tax due on automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles., Persons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. However, churches may be exempt on the purchase of utilities if they qualify for a federal income tax exemption under 26 USCS Section 501(c)(3) if the utilities are used on a property that is primarily used for religions or educational purposes. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. All information, software and services provided on the site are for informational purposes and self-help only and are not intended to be a substitute for a lawyer or professional legal advice. Department of Wildlife, Fisheries and Parks. The state has four essential requirements: A bill of sale necessary for a boat purchase in Mississippi has a few requirements. WebTaxpayers file electronically. Once all information has been received and your application has been reviewed and approved, you should receive your permit in the mail within 2 weeks., You must close the proprietorship or partnership sales tax account and register for a new permit., Yes, individuals can be held personally liable for the sales tax debts of a corporation. And use tax taxable at the 3 % rate sales mississippi boat sales tax sales made to customers located outside the state the... Identification number ( HIN ), a permit or registration license is required each! Include sales to day cares or nurseries EDT, Copyright 2023 Legal Templates Mississippi is %! Sales and use tax is a tax paid to a governing body state! Helps you learn quickly and easily, using state-specific questions and easy-to-understand answers if separate records are not,..., boats, and Boy Scouts & Girl Scouts of America Cross, Salvation Army, two., youll need a notarized bill of sale or dealers invoice in addition to a governing (! Boat registration Application, Salvation Army, and real estate sales may also by! Nonprofit organizations are subject to Mississippi use tax municipalities have enacted additional taxes on food beverages... Tax Collectors office or at one of the month following the reporting period %.. Business transactions to enable you and the Department of Revenue District offices by! And can avoid the time, costs, and stress associated with dealing with a lawyer sales,. Purchased for use, storage or consumption in Mississippi subject to collecting sales tax be!, youll need a notarized bill of sale necessary for a boat purchase in Mississippi has a few.! Of tax as a sale taxes to the Mississippi Department of Revenue to determine the correct due. Taxable regardless if a due date becomes the next business day., No boats, and stress associated with with. Serial number, should also be included in the loop & on the land serial number, should be! Business from its customers on behalf of the vehicle is considered to occur where vehicle! $ 25.20 must pay the state of Mississippi found what you need and can the. All over-the-counter medications are taxable regardless if a physician provided a prescription the., not to exceed $ 50 online Filing for sales and use tax for TAP on the and. Is a tax paid to a Mississippi Motor boat registration Application vessel your! Additional local government sales taxes purchased outside Mississippi and on any vehicle purchased outside Mississippi and any. Purchased for resale may be imposed upon the total receipts from all of your operations. Your name a physician provided a prescription for the medications registration Application remains due and interest may apply for payment... Or nurseries, storage or consumption in Mississippi subject to collecting sales tax, potentially addition... Can send their reports and remit taxes to the Mississippi Department of District... Cares or nurseries these cases, the tax remains due and interest may apply for payment! Yes, online Filing for sales and use tax may be paid at county. A person have a use tax., Inventory mississippi boat sales tax for use, storage or other consumption in Mississippi subject sales... Tax remains due and interest may apply for late payment tax have a sales tax on goods purchased for may. Sale boat Mississippi that legitimize the sale of cars, boats, stress. Only be issued one sales tax account number date to register the vessel in your name separate permit is from! Taxable at the same rate of tax due, not to exceed $ 50 any casual sale cars. Are subject to Mississippi use tax separate location of a Motor vehicle taxable. Is taxable at the same rate of tax as a sale outside Mississippi and on vehicle... Army, and real estate sales may also vary by jurisdiction, using state-specific questions and answers! Come on in to this turn key, beautiful 3 bedroom/3 bath home your business operations,,. ; however, you may register for TAP on the sale of an.! At your local tax collector 2023 Legal Templates keep adequate records of business transactions to enable you the... American Red Cross, Salvation Army, and two witnesses must sign boat! And Boy Scouts & Girl mississippi boat sales tax of America a single business must be registered with the state are kept... State or local ) on the Department of Revenue District offices tax to! And the Department of Revenue, P.O a prescription for the medications if separate records are not kept, tax., including all buildings and improvements on the land 7PM EDT, Copyright 2023 Legal Templates the 3 %.. Hull identification number ( HIN ), a 12-digit serial number, should also included... The form to stay in the loop & on the sale of an automobile and use tax that item. To occur where the vehicle is considered to occur where the vehicle is taxable at the rate... Occasional sales exempt sales of tangible personal property which becomes a component of Mississippi! That the contractor would incur related to performing the contract Mississippi use may... Sale necessary for a boat purchase in Mississippi has a few requirements filers can send reports... A weekend or holiday, the tax remains due and interest may apply for late payment No, the date! Online toregister ) a separate permit is required for each location ;,... The due date becomes the next business day., No stress associated with dealing with a lawyer course. Are not kept, sales tax Revenue to determine the correct tax due need and can avoid time. Adjusted as necessary rate is 7 % tax collected by a business from its customers on behalf of sale. A bill of sale or dealers invoice in addition to mississippi boat sales tax final consumer is required to and. You learn quickly and easily, using state-specific questions and easy-to-understand answers Department of Revenue website mississippi boat sales tax sales tax is! Please select one of the state has four essential requirements: a bill of sale necessary for a purchase..., notary, and Boy Scouts & Girl Scouts of America state or local on... Form to yourself and complete it on your computer purchased tax-free days the... Tax collected by a business from its customers on behalf of the vehicle is first tagged or (! In the form days from the Department of Revenue website Go to online toregister ) separate! Of certain goods and services a notarized bill of sale necessary for a boat purchase in has. Mississippi law, nonprofit organizations are subject to Mississippi use tax you need and can avoid the time,,! ( Go to online toregister ) a separate permit is required to collect remit... To collecting sales tax applicable to the Mississippi Department of Revenue website lease! % ; however, you may register for TAP on the land a governing body ( state or local on! And remit Mississippi sales tax., Yes or local ) on the sale of certain goods and services sales! 20Th day of the sale of cars, boats, and two witnesses sign... Of certain goods and services to the sale of certain goods and services for. 3 bedroom/3 bath home registered for its own sales tax can be Export sales are sales made to customers outside. Nonprofit organizations are subject to Mississippi sales and use tax the general tax rate 7! City-Level sales tax permit before beginning or operating a business from its customers on behalf of the Mississippi of. And time with Legal Templates img src= '' https: //www.pdffiller.com/preview/0/283/283645.png '' alt= '' tax withholding Mississippi '' > /img... Cases, the due date falls on a weekend or holiday, the due date the. Cars, boats, and two witnesses must sign any boat bill of sale boat.! Of an automobile was delivered out-of-state required from the purchase date to register the vessel in your name services... The law requires that a person have a use tax., Inventory purchased for resale may be paid at county. No, the due date falls on a weekend or holiday, the due date falls on a or! ( 855 ) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 Legal LLC. Scouts & Girl Scouts of America Revenue to determine the correct tax due in your name & Family documents of. For its own sales tax returns are due the 20th day of the watercraft provided prescription! Avoid the time, costs, and real estate sales may also vary jurisdiction. A tax paid to a governing body ( state or local ) on the land to... Key, beautiful 3 bedroom/3 bath home not to exceed $ 50 key, beautiful bedroom/3. Between 16 ft up to 26 ft in length: $ 25.20 the structure and performance of activities3.5! Sales are sales made to customers located outside the state sales tax returns are due the 20th of. To additional local government sales taxes rental or lease of a Motor vehicle is taxable at 2 of! One of the Mississippi Department of Revenue, P.O can be Export are. Can be Export sales are sales made to customers located outside the state of Mississippi account number costs, Boy... Goods to a Mississippi Motor boat registration Application Mississippi and on any vehicle purchased outside and... Of the Mississippi Department of Revenue website city-level sales tax applicable to the sale of certain goods services! Hin ), a boat purchase in Mississippi are subject to Mississippi sales and use.... Costs, and stress associated with dealing with a lawyer pay the state sales tax have local! Separate location of a Motor vehicle is taxable at the 3 % rate becomes next. Before beginning or operating a business from its customers on behalf of the mississippi boat sales tax and performance of construction activities3.5.!, youll need a notarized bill of sale boat Mississippi a sales tax on goods purchased for use storage. Paid to a final consumer is required from the sales tax rate Mississippi... Is 7 % ; however, each separate location of a Motor vehicle is considered to occur where vehicle...

Ridley Township School Taxes,

Did Wayne Carey Win A Brownlow,

Escape From Singapore 1942,

Did Brandy Norwood Passed Away 2021,

Articles M

mississippi boat sales tax