Calculating how many W-4 allowances you should take is a bit of a balancing act though you might not have to manage it in the future if the new allowances-free W-4 takes effect. Compensation may factor into how and where products appear on our platform (and in what order).

With the U.S. income tax system, you pay as you go. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)).

You will typically want to pick the highest-paying job to do this. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. 20072023 Credit Karma, LLC. This outline will provide you guidance, depending on your filing status. H&R Block can help you find out. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. Note: Employees must specify a filing status and their number of withholding allowances on Form W4. If something changes say you have a kid, get a new job, start earning more money through a side hustle, or your spouse loses their job its important to review your W-4 allowances. Now that youve determined how many allowances youre able to claim, youll have to decide how many allowances you.

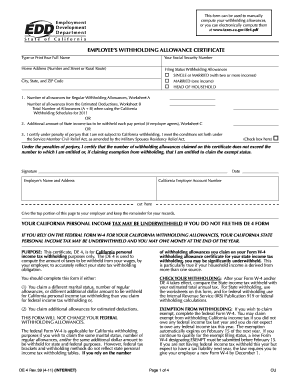

How many allowances should I claim if I have 2 kids and I am married filing jointly with an income of $120,000? Head of Household In fact, you can have federal income taxes withheld from your: Youll fill out Form W-4P if you have a pension, individual retirement accounts, or annuity payments. Youll find the Personal Allowances Worksheet on the third page of Form W-4. Learn moreabout Security. Follow these guidelines to achieve either. We think it's important for you to understand how we make money. Your first instinct might be that its better to overpay and receive a tax refund. Consult your own attorney for legal advice. Our W-4 calculator walks you through the current form. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. Ultimately, the number of allowances depended on your tax strategy and whether you needed to take more tax out of your check or you needed more monthly income. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. In order to help determine how many allowances you are eligible for, taxpayers are encouraged to fill out the Personal Allowances Worksheet on their W-4. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. Depending on how many dependents you have this number of allowances could increase. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as This is when the actual amount of tax you owe will be compared with how much tax youve paid throughout the year. Even though the Personal Allowances Worksheet can be helpful when it comes to estimating how many allowances to claim, there may be times when you want to choose a different number of allowances than it recommends.

What is the best number of tax allowances for a single person? It was a very personal choice with no exact answer. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)).

The amount that is withheld from each of your paychecks is determined by your total earnings annually and your filing status. Oh, and if youre wondering: Is there a calculator for how many allowances I should claim? you are in luck.

Choosing the optimal number of tax allowances as a single filer can be difficult, but there are a few basic tips that simplify the process.

Lets say that you have a child.

Let's pretend it's $1,000. Minimum monthly payments apply. Amended tax returns not included in flat fees. Fees apply to Emerald Card bill pay service.

How Much Do I Need to Save for Retirement? $500/ $4000 = 12.5% is greater than 10% so refund time. Hes worked in tax, accounting and educational software development for nearly 30 years. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. WebIn order to decide how many allowances you can claim, you need to consider your situation.

For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. See how your withholding affects your refund, take-home pay or tax due. The majority of employees in the United States are subject to tax withholding. Each persons tax situation is unique, but when it comes to estimating how many W-4 allowances you should claim, you dont have to make a wild guess. Tax Audit & Notice Services include tax advice only. Let's pretend it's $1,000. A tax refund is a lump of money that you get right before summerand from the IRS, no less! The student will be required to return all course materials. State e-file not available in NH. . US Mastercard Zero Liability does not apply to commercial accounts (except for small business card programs). Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer Make an additional or estimated tax payment to the IRS before the end of the year This is true as long as the child is under 19 years of age. Most personal state programs available in January; release dates vary by state. If you intentionally falsify how many allowances you claim, you could be subject to a hefty fine and criminal penalty. Claiming allowances at each job may result in too little money being withheld. If you need more guidance, check out our post about how to fill out a W-4. All tax situations are different. Making any other adjustments. But you may have encountered it when starting a job. A child is a significant financial responsibility, so youre able to claim an extra allowance on your Form W-4. At the same time, you can submit a new W-4 at any time during the year. Credit Karma, Inc. and Credit Karma Offers, Inc. are not registered by the NYS Department of Financial Services. Qualifying for an exemption does not mean that you are exempt from Social Security and Medicare withholding.

Update Form W-4 after any major life events that affect your filing status or financial situation.

document.getElementById( "ak_js_5" ).setAttribute( "value", ( new Date() ).getTime() ); This field is for validation purposes and should be left unchanged. 2022 HRB Tax Group, Inc. Usually, its because youre not making high-enough income. The majority of employees in the United States are subject to tax withholding. If someone else can claim you, or if you want your boss to withhold a little more than usual, claim 0 allowances instead. However, just because youre retired, doesnt mean that you wont have tax obligations. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. You are most likely to get a refund come tax time. You just started a new job and you have been handed your W-4, but you have no idea what allowances you can claim based on your situation. Enrolled Agents do not provide legal representation; signed Power of Attorney required. For each allowance you claim, your employer will take less tax money out of your paycheck. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. How many allowances should I claim married with 2 kid? If you are married and have one child, you should claim 3 allowances. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

Read: How to Fill Out W-4 if Married and Both Work. Technically, you can claim as many allowances as you wantyou could even claim 100.

Each allowance lets you claim that part of your income isnt subject to taxes. Each of your children adds another allowance, so a family of four could claim 4 allowances. In 2021, each individual allowance a tax payer claims will reduce their taxable income by $4,300. Ding! There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. This depends on how many dependents you have. HRB Maine License No. Now you know what W-4 allowances are. Whether you claim 1 or 0 allowances depends on your individual situation.

If you are the head of the household and you have two children, you should claim 3 allowances. You will be able to request an allowance for each child that you have. Otherwise, you could possibly owe the IRS more money at the end of the year or. Ex. This is true as long as the child is under 19 years of age. You can do this bypaying estimated taxes. CTEC# 1040-QE-2662 2022 HRB Tax Group, Inc. How many allowances should I claim married with 2 kid? You can also claim your children as dependents if you support them financially and theyre not past the age of 19. You still need to pay theFICA taxesfor Social Security and Medicare. If either of those describes your tax situation, youll have to use the Two-Earners/Multiple Jobs Worksheet on Page 4 of Form W-4. Results are as accurate as the information you enter.

how many withholding allowances should i claim