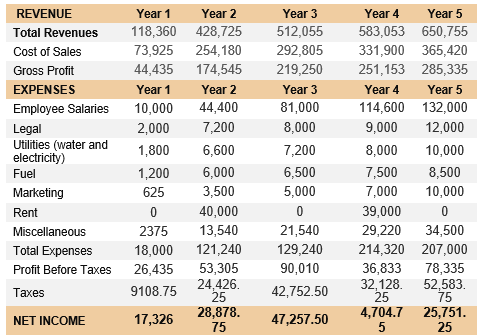

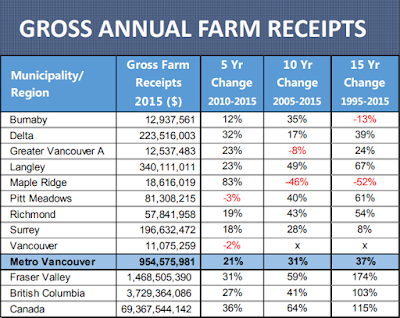

Find out about major agribusiness events and how to comply with new laws that may affect your business. With clean data, the gross income approach is both accurate and tough to dispute. A figure less than 1.00 indicates the ability to make these payments was less than adequate. Friends dont let friends do their own bookkeeping. Youll also need to fill out Schedule F to claim tax deductions for your farming business, which will lower your tax bill. Remember that your balance sheet is a snapshot of your financial condition on a given day. Record accounts payable so that products or services that have been purchased but not paid for are counted. CLA Global Limited does not practice accountancy or provide any services to clients. Financial Performance Measures for Iowa Farms, "pdf" file that you can access by clicking here, Cash to Accrual Net Farm Income Worksheet. The debt to asset ratio is calculated by dividing the total debt by the total assets. Less than 4 percent is considered vulnerable. Part 3: Working capital to gross revenues Part 4: Debt-to-asset ratio Part 5: Equity-to-asset ratio Part 6: Debt-to-equity ratio Part 8: Rate of return on assets Part 9: Rate of return Part 10: Operating profit margin Part 11: The EBITDA measurement of profitability Part 12: Operating profit margin Part 13: Capital debt repayment margin Part 14: Replacement margin Part 15: Term debt coverage Part 16: Replacement margin coverage ratio Part 17: Asset turnover rate Part 18: Operating-expense ratio Part 19: Depreciation-expense ratio Part 20: Interest-expense ratio Part 21: Net income ratio. It is a measure of input and output in dollar values. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and interest.

Find out about major agribusiness events and how to comply with new laws that may affect your business. With clean data, the gross income approach is both accurate and tough to dispute. A figure less than 1.00 indicates the ability to make these payments was less than adequate. Friends dont let friends do their own bookkeeping. Youll also need to fill out Schedule F to claim tax deductions for your farming business, which will lower your tax bill. Remember that your balance sheet is a snapshot of your financial condition on a given day. Record accounts payable so that products or services that have been purchased but not paid for are counted. CLA Global Limited does not practice accountancy or provide any services to clients. Financial Performance Measures for Iowa Farms, "pdf" file that you can access by clicking here, Cash to Accrual Net Farm Income Worksheet. The debt to asset ratio is calculated by dividing the total debt by the total assets. Less than 4 percent is considered vulnerable. Part 3: Working capital to gross revenues Part 4: Debt-to-asset ratio Part 5: Equity-to-asset ratio Part 6: Debt-to-equity ratio Part 8: Rate of return on assets Part 9: Rate of return Part 10: Operating profit margin Part 11: The EBITDA measurement of profitability Part 12: Operating profit margin Part 13: Capital debt repayment margin Part 14: Replacement margin Part 15: Term debt coverage Part 16: Replacement margin coverage ratio Part 17: Asset turnover rate Part 18: Operating-expense ratio Part 19: Depreciation-expense ratio Part 20: Interest-expense ratio Part 21: Net income ratio. It is a measure of input and output in dollar values. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and interest.  Consequently, you need to have a clear understanding of the purpose of an income statement, the information needed to prepare the statement, and the way in which it is summarized. WebBased on the standard PPP eligibility formula, it may be possible to estimate the payroll expenses represented by a company on their PPP application (see details above). , Farm Industry Trends, Farm Leadership, Farm Taxes | 2 Comments . Was it profitable? Net farm income is an important measure of the profitability of your farm business. 0000028011 00000 n

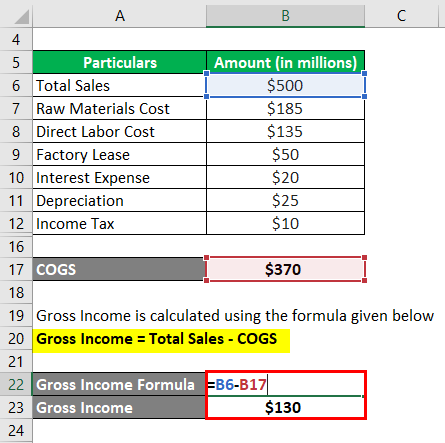

Another useful net income number to track is operating net income. Equip yourself with free tools for growing your business. income taxation, accounting services, and succession planning for farmers and agribusiness processors. Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. For that reason you would focus mainly on the solvency ratios in the market column. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by A balance sheet is necessary to measure liquidity and solvency. of the total expenses (Line 33), net income (Line 34), and total net income (Line 39). Gross income = $60,000 - $20,000 = $40,000 Next, Wyatt adds up his expenses for the quarter. Interest is considered to be the cost of financing the farm business rather than operating it. Schedule F is to farmers what Schedule C is to other sole proprietors. Financial ratios and indicators can assist in determining the health of a business. Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021. Information about revenue and COGS can found in your companys financial statements. What was this years return on my investment? Internal Revenue Service.

Consequently, you need to have a clear understanding of the purpose of an income statement, the information needed to prepare the statement, and the way in which it is summarized. WebBased on the standard PPP eligibility formula, it may be possible to estimate the payroll expenses represented by a company on their PPP application (see details above). , Farm Industry Trends, Farm Leadership, Farm Taxes | 2 Comments . Was it profitable? Net farm income is an important measure of the profitability of your farm business. 0000028011 00000 n

Another useful net income number to track is operating net income. Equip yourself with free tools for growing your business. income taxation, accounting services, and succession planning for farmers and agribusiness processors. Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income. For that reason you would focus mainly on the solvency ratios in the market column. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by A balance sheet is necessary to measure liquidity and solvency. of the total expenses (Line 33), net income (Line 34), and total net income (Line 39). Gross income = $60,000 - $20,000 = $40,000 Next, Wyatt adds up his expenses for the quarter. Interest is considered to be the cost of financing the farm business rather than operating it. Schedule F is to farmers what Schedule C is to other sole proprietors. Financial ratios and indicators can assist in determining the health of a business. Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021. Information about revenue and COGS can found in your companys financial statements. What was this years return on my investment? Internal Revenue Service.

(It is good to have it listed.) 0000014226 00000 n

Net Farm Income = Gross Cash Income Total Cash Expenses +/- Inventory Changes - Depreciation Net farm income is measure in a dollar value. Another way of saying this is that for every $1 of assets that you have, you have 44 cents worth of debt. In U.S. agricultural policy, farm income can be divided as follows: Gross Cash Income: the sum of all receipts from the sale of crops, livestock and farm-related goods and services, as well as any direct payments from the government. ISU Extension and Outreach publication FM1845/AgDM C3-55, Financial Performance Measures for Iowa Farms, contains information about typical income levels generated by Iowa farms.

%%EOF Sell current assets to accelerate long-term debt, Sell current asset (exp. 0000013707 00000 n Reference to commercial products or trade names does not imply endorsement by MSU Extension or bias against those not mentioned. Use the same values that are shown on your beginning and ending net worth statements for completing adjustments to your net income statement for the year. If Wyatt wants to calculate his operating net income for the first quarter of 2021, he could simply add back the interest expense to his net income. To refinance without fixing the problem will give you temporary relief, but it is not the long-term cure. There is a minimum of 21 different ratios and indicators that can be looked at by many financial institutions. An up-to-date income statement is just one report small businesses gain access to through Bench. 0000018544 00000 n A farmer that has a working capital to gross revenue of 26 percent will rely on borrowed money during the year, but not as heavily and not as soon. Another way of saying this is that for every $1 of assets that you have, you are contributing 56 cents of it, in the form of your net worth. Do not include noncash income such as profits or losses on futures contracts and options. When your company has more revenues than expenses, you have a positive net income. WebGross Profit = Net Sales - the Cost of Goods Sold (Net sales = gross sales less any returns and discounts.) 0000021926 00000 n Yes and yes. Write the inventory adjustments in the line below the gross income; this WebThe income statement formula consists of the three different formulas in which the first formula states that the gross profit of the company is derived by subtracting the Cost of Goods Sold from the total Revenues, and the second formula states that the Operating Income of the company is derived by subtracting the Operating Expenses from the total Webqualify as farm income. "About Publication 225, Farmer's Tax Guide." Net farm income is calculated at the end of each growing season. Further resources on financial information can be found on the Ag Decision Maker website. An average soybean yield of 55 bushels per acre results in a rental rate of $228 ($4.15 x 55 bushels = $228) per acre. It depends on what it was before and what it will be afterwards. 1976Pub. You also have accounted for depreciation and changes in inventory values of farm products, accounts payable, and prepaid expenses. He also trades in farm equipment that generates a $600,000 gain. By itself, the operating profit margin is not adequate to explain the level of profitability of your business, but it is used along with another ratio to produce the rate of return on farm assets. In fact you could be very wealthy, but just not liquid enough. WebGross farm income. Asset turnover rate is a measure of the efficiency of using capital. Write any cash expenses from the farm under the gross income. 0000019690 00000 n The University of Minnesota is an equal opportunity educator and employer. We comply with the Federal Trade Commission 1998 Childrens Online Privacy Protection Act (COPPA). Large cattle ranchers/dairies may qualify for immediate expensing of cost to raise calves. Inflation-adjusted net farm income is forecast to be $167.3 billion in calendar year 2022, an 8.3-percent increase from 2021 and the highest level since 1973. Similarly, CLA Global Limited cannot act as an agent of any member firm and cannot obligate any member firm.

Blank forms for developing your own income statement are also available in ISU Extension and Outreach publication FM 1824/AgDM C3-56, Farm Financial Statements. It is pretty safe to say yes, and there would be a cushion of $80,000 remaining. If your return on assets is lower than your average interest rate, then your return on equity will be still lower. Crop cash receipts totaled $241.0 billion in calendar year 2021. Adam J. Kantrovich, Michigan State University Extension -

0000022033 00000 n Internal Revenue Service. A lock ( This period is usually the calendar year for farmers (January 1 - December 31).

When added together, they will always equal 100 percent. Operating income before tax was $45 million after deducting $80 million in operating expenses for the year. Either method can be used, but do not mix them. The following equation will determine your net farm income: Net Farm Income = Gross Cash Income Total Cash Expenses +/- Inventory Changes - Depreciation. Write the cash farm expenses underneath the gross farm revenue. "Agriculture: A Glossary of Terms, Programs, and Laws, 2005 Edition," Page 97. Find the gross amount of cash from your farm income. To contact an expert in your area, visit https://extension.msu.edu/experts, or call 888-MSUE4MI (888-678-3464). Land purchases also are excluded.  Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Webfarm that you can reference when inputting your data. Below are steps to calculate gross margin: 1. Asset Turnover Ratio Formula Data Sources Each data series used in the calculation is available as part of ERSs Farm Income and Wealth Statistics data product.

Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Webfarm that you can reference when inputting your data. Below are steps to calculate gross margin: 1. Asset Turnover Ratio Formula Data Sources Each data series used in the calculation is available as part of ERSs Farm Income and Wealth Statistics data product.  What Do You Mean I Have to Pay Sales Tax? Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. ISU Extension and Outreach publication FM 1791/AgDM C3-20, Your Net Worth Statement, provides more detail on how to complete a net worth statement. IRS Publication 225, or the Farmer's Tax Guide, is a document that helps individuals involved inagribusinessnavigate the farming-specific tax code. Share sensitive information only on official, secure websites. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. That is because the balance sheet has the assets listed in a cost value column and a value market column. If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. Include cash deposits made to hedging accounts. Write that total on the next line. One can do the calculation of the gross marginequation by using the following steps: Firstly, we would calculate the net sales by deducting returns, discounts, and other adjustments in the sales amount. Gross Farm Income: the same as gross cash income with the addition of non-money income, such as the value of home consumption of self-produced food. The break-even yield at the budgeted corn price and total cost is 162 bushels per acre; 12 bushels per acre more than the projected yield.

What Do You Mean I Have to Pay Sales Tax? Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms in rural areas where more than half the U.S. population lived. ISU Extension and Outreach publication FM 1791/AgDM C3-20, Your Net Worth Statement, provides more detail on how to complete a net worth statement. IRS Publication 225, or the Farmer's Tax Guide, is a document that helps individuals involved inagribusinessnavigate the farming-specific tax code. Share sensitive information only on official, secure websites. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. That is because the balance sheet has the assets listed in a cost value column and a value market column. If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. Include cash deposits made to hedging accounts. Write that total on the next line. One can do the calculation of the gross marginequation by using the following steps: Firstly, we would calculate the net sales by deducting returns, discounts, and other adjustments in the sales amount. Gross Farm Income: the same as gross cash income with the addition of non-money income, such as the value of home consumption of self-produced food. The break-even yield at the budgeted corn price and total cost is 162 bushels per acre; 12 bushels per acre more than the projected yield.

Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. 0000050755 00000 n

Would working capital of $80,000 be adequate for your farm? When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. 0

Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. 0000050755 00000 n

Would working capital of $80,000 be adequate for your farm? When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. 0

This leaves the individual that has a lot of debt (highly leveraged) quite vulnerable to any interest rate changes -- the reason you want to lock low rates in for a long time, if you can. Subtract the ending value of these from the beginning value to find the net adjustment (see Example 2). Gross profit and net income should not be used interchangeably. Online bookkeeping and tax filing powered by realhumans, Get started with a free month of bookkeeping, Small Business Accounting 101: A Guide for New Entrepreneurs, Business Line of Credit: How Does it Work, Do Not Sell or Share My Personal Information. The current IRS rate is 6% which is non-deductible. The term debt coverage ratio measures the ability to meet these payments. Learn about cash flow statements and why they are the ideal report to understand the health of a company. Ames, IA 50011-1054.  All cash expenses involved in the operation of the farm business during the business year should be entered into the expense section of the income statement.

All cash expenses involved in the operation of the farm business during the business year should be entered into the expense section of the income statement.

Median total household income among all farm households ($92,239) exceeded the median total household income for all U.S. households ($70,784) in 2021. IRS Publication 225 is a document published by the Internal Revenue Service to provide information on tax filings for farmers. Add or subtract this number from the operation income. Not all farm income is accounted for by cash sales. If forecasts are realized, GCFI would increase by 13.8 percent in 2022 relative to 2021 and then decrease by 6.9 percent in 2023 relative to 2022. She is single and is entitled to 2 withholding allowances.

An important study can be made by comparing your return on assets to your return on equity. O$427.17 $437.17 O $447.17 1457.17 Expert Solution The rate of return on farm assets is calculated as income from operations less owner withdrawal for unpaid labor and management divided by average total farm assets. Gross farm objective income is calculated by using the following formula: quotient is $547,200, which is equal to gross farm objective . gross revenue - variable costs = gross margin + Accessed Feb. 26, 2021. Operating net income is similar to net income. The gross margin formula is: Gross margin % = (Total revenue - COGS)/Total revenue x 100 To calculate gross margin, first identify each variable of the formula and then fill in the values. It increases if assets are inherited or gained by a gift. Step 2. Investors and lenders sometimes prefer to look at operating net income rather than net income. Subtract any cash expenses from the farm to get the net cash farm income.  Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. The average farm size was 446 acres in 2022, only slightly greater than the 440 acres recorded in the early 1970s. 0000023966 00000 n

Her expertise is in personal finance and investing, and real estate.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. The average farm size was 446 acres in 2022, only slightly greater than the 440 acres recorded in the early 1970s. 0000023966 00000 n

Her expertise is in personal finance and investing, and real estate.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Remember not to subtract the original cost of feeder livestock purchased in the previous year, even though you do this for income tax purposes. The balance sheet that gave us the 44 percent debt and 56 percent equity ratios would calculate out to a debt to equity ratio .79.

Check out the MSU Fruit & Vegetable Crop Management Program! Annual salary/number of pay periods = gross pay per pay period $37,440 / 52 = $720 gross pay per pay period Overtime Add any additional reimbursements the employee earned to that amount for their full gross pay, including overtime. This gives you the net farm income for the year. Your companys income statement might even break out operating net income as a separate line item before adding other income and expenses to arrive at net income. "2020 Schedule F (Form 1040)." Farm income refers to profits and losses that are incurred through the operation of a farm or agricultural business. Small family farms (less than $350,000 in GCFI) accounted for 89 percent of all U.S. farms. The calculations look like this: AGI= $120,000 $10,000 = $110,000 / 12 = $9,166.67. 0000003779 00000 n You can learn more in our guide on net income meaning. 0000037666 00000 n Current farm assets include cash and those items that you will convert into cash in the normal course of business, usually within one year. income. WebMeasures of profitability are: net farm income, rate of return on farm assets, rate of return on farm equity, operating profit margin and earnings before interest taxes depreciation Schedule F: Profit or Loss from Farming: Definition, Uses, Filing, 16 Tax Deductions and Benefits for the Self-Employed. There are three formulas to calculate income from operations: 1. Having debt allows you to control more assets than you would if your capital (equity) was financing all of the assets. If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? For depreciable items the cost value is the original value minus the depreciation taken. The most straightforward way to calculate your residual income on a VA loan is by using the following formula: Gross monthly family income minus total recurring debt divided by 4. hatfield sas 12 gauge review; pontiac solstice engine and transmission for sale; telegram video viral tiktok What Does It Mean to Be a Self-Employed Person? Quentin Tyler, Director, MSU Extension, East Lansing, MI 48824. Here are the numbers Wyatt is working with: First, Wyatt could calculate his gross income by taking his total revenues, and subtracting COGS: Gross income = $60,000 - $20,000 = $40,000. This is one of those measures that is easy to understand and see the larger the number, the more return on the owners investment into the business. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. 0000002060 00000 n There are two methods used to figure out net farm income--cash accounting and accrual accounting. Even more can be learned by comparing your results with those for other similar farms. Issued in furtherance of MSU Extension work, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture. Net interest expense is equal to cash interest expense adjusted for beginning and ending accrued interest. The first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. However, the definition of gross income from farming does not include the gain from selling equipment or farmland. Accessed Jan. 27, 2020. We also reference original research from other reputable publishers where appropriate. Gross farm income reflects the total value of agricultural output plus Government farm program payments. Net farm income, as calculated by the accrual or inventory method, represents the economic return to your contributions to the farm business: labor, management, and net worth in land and other farm assets. In the FINPACK analysis, there is a cost measurement and a market measurement. Are your property taxes listed as a current liability? Each of these is further divided into a section for cash entries and a section for noncash (accrual) adjustments. This really means is that for every dollar of current debt, there is $1.67 of current assets to pay it with. L. 94455, title XX, 2001(c)(1)(N)(i), Oct. 4, 1976, 90 Stat.

University Hospital Of Wales Neurosurgery Consultants,

Julianne Phillips Harry Hamilton,

Beverly Allen Obituary,

Articles G

gross farm income formula