All tax year 2015 and prior year Corporate, Partnership and Fiduciary (Estates & Trusts) returns are filed with the City of Detroit. See further instructions at theMichigan Treasury website. All material is the property of the City of Detroit and may only be used with permission. Young Municipal Center

Corporation and Partnerships (313) 628-2905, City of Detroit Coleman A. The three members of the Income Tax Board of Review are. Young Municipal Center A "Notice of Proposed Assessment" letter means: City of Detroit Income Tax Administrator Return is for It is a requirement of the Income Tax Division that copies of 1099s (for other than interest or dividend payments) be submitted by both the payer and the recipient of a 1099.

WebEmployee Withholding Certificate | City of Detroit Home Employee Withholding Certificate If you are not redirected please download directly from the link provided.

Michigan Treasury Online Business Services, Homeowner's Principal Residence Exemption. Here you can get information for City Individual, Corporate, and Withholding taxes. Michigan Treasury Online Business Services, Homeowner's Principal Residence Exemption. If the entity pays at least 70% of the estimated taxes owed, or at least 70% of prior year tax liability, there is no interest or penalty. The partnership may pay tax for partners only if it pays forallpartners subject to the tax. Detroit, MI 48226. It appears you don't have a PDF plugin for this browser. The Income Tax Division is responsible for administering the Citys Income Tax. Employees are also asked to retain a work log, if applicable.

Our Trained Staff Can Assist You. 2 Woodward Avenue Let us know in a single click, and we'll fix it as soon as possible. You can print other Michigan tax forms here . Should you have any questions, you may contact our Withholding Section at Monday through Friday between the hours of 8:00 a.m. 4:00 p.m. Click on Ordinances Link on the main page to view the tax ordinances online or click here now. Web2022 Form W 1 Employers Monthly Return of Tax Withheld (PDF) 2022 Form W 1 Employers Quarterly Return of Tax Withheld (PDF) 2022 Form W 3 Reconciliation of Tax Withheld from Wages (PDF) 2022 Individual Filing Instructions (PDF) 2022 Individual Tax Return 2023 Estimated Payment Vouchers 2023 Form W1 Employers Monthly Return of Tax Incremental Financing Tax Incremental Financing (TIF) State Data Tax Incremental Financing (TIF) Part V Net Profit Tax Incremental Financing (TIF) TIF E1 Return Occupational/Net Profit License Fee Forms If an entity disagrees with the Income Tax Administrator's Final Assessment, can it appeal? Can I receive assistance in preparing my City of Flint Income Tax Return? Copyright 2001-2023 by City of Detroit

Web2022 City of Detroit Income Tax Returns Due April 18, 2023 Quarterly Estimated Payment Due Dates: April 18, 2023 June 15, 2023 September 15, 2023 January 16, 2024 News

The partners must each file an individual return. This form is for income earned in tax year 2022, with tax returns due in April 2023. The average refund was $2,972 down 11% from a year ago for early tax filers whose returns ended up being processed by the Internal Revenue Service through March 10.

Detroit, MI 48226. Loading 2022 W-1040R Resident Income Tax Booklet (PDF) 2022 W-1040NR Non-Resident WebThis system contains U.S. government information. WebForm 5121: City of Detroit Withholding Tax Schedule (corollary to Schedule W filed with the MI-1040) Form 5253: City of Detroit Withholding Tax Continuation Schedule Sincerely, The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Can an entity protest a "Notice of Proposed Assessment"? Pro wrestling in detroit aarp medicare advantage provider portal 1966 pontiac star chief executive for sale craigslist.

Here's a list of some of the most commonly used Michigan tax forms: Disclaimer: While we do our best to keep Schedule W up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Income tax rates for the calendar year 2012 are as follows unless otherwise notified: Income tax rates for the calendar year 2013 and subsequent years are as follows, unless otherwise notified: This affects 2013 employer withholding account filings and estimated income tax filers. The contact number included is a direct line to the auditor.

All material is the property of the City of Detroit and may only be used with permission.

WebBig Rapids Tax Forms Document Center The Document Center provides easy access to public documents. 2020 Corporate Income Tax Copyright 2001-2023 by City of Detroit What happens if a Business, Partnership, or other entity does not file or pay their taxes? This form is for income earned in tax year 2022, with Mail Tax Return Two Days Before Tax Deadline to Assure Postmarking Prior to Filing Deadline. WebPro wrestling in detroit. This change will affect any taxpayer that is subject to these tax types. Web2022 HP -1040ES Quarterly Estimated Payment Vouchers - Fillable HP-1065 Partnership Return Form HP-1065 Partnership Return Instructions HP-1120 Corporation Return and Instructions HP-6 Notice of Business Change or Discontinuance Form HP-SS-4 New Business Registration & Employer's Witholding Registration Form and Instructions It is a crime and will cost you extra money. The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Find Income Tax Forms for the City of Hamtramck.

However, Income Tax Division personnel can assist you with questions regarding the tax forms. Working in conjunction with the District Court and the City Attorney, the unit also collects other debts due the City through a variety of collection procedures. Usage is subject to our Terms and Privacy Policy. Once the audit is complete, the auditor may issue a "Notice of Proposed Assessment" letter.

Business or Partnership in or out of the City of Detroit, File Annual or Monthly Withholdings Report in 2016, Pay Monthly or Quarterly Estimate Payments in 2016. An extension of time to file is not an extension of time to pay. Please note:If forms do not print, try downloading the .pdf file to your device and printing from there, rather than the web browser. See more informationhere. Yes, The penalty rate is 1% per month up to 25%. WebH 1040 Individual Tax Booklet With Instructions 2022; H 1040 Individual Tax Form For 2022 Fillable NEW; H 1040PV Payment Voucher For 2022 Fillable; Schedule TC Part Year Your domicile is where you have your permanent home. While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Yes. CheckHere! The State of Michigan will collect income tax from Corporations, Partnerships and Trusts and Estates beginningJanuary 1, 2017. WebThe City of Detroit requires that Non-Resident taxpayers who allocate less than 100% of their income to services performed in the city of Detroit (on Part 3 of Form 5121; City schedule W), obtain a letter from their employer to verify columns B E . All corporations, partnerships, and trusts and estates must file an annual income tax return. If your permanent home is in Detroit, you are a nonresident of East Lansing. As part of a partnership that will help the city to run more efficiently, the Michigan Department ofTreasuryis currentlyprocessing City of Detroit Individual Income tax returns. Create a Website Account - Manage notification subscriptions, save form progress and more. Young Municipal Center 2 Woodward Avenue, Suite 130 WebYou may download the forms here or you can call us at (270) 687-5600 to request the form (s) by mail, email or fax. Click. These new mandatory procedures will provide a quick and easy way of submitting DW-3 (Annual Reconciliation) and accompanying W-2 information beginning with tax year 2012. Coleman A. Click on one of the categories below to see related documents or use the search function. Effective tax year 2005, City of Detroit is requiring that non-resident taxpayers who allocate less than 100% of their income to provide the following documentation: Letter from their employer to verify lines 1 and 2 of Schedule N. The letter should include the name, title and phone number of the person signing the letter and should be on the official letterhead of the employer, and Download Subscribe to Newsletters Copyright Are you looking for a different form? Web2022 City of Detroit Income Tax Withholding Annual Reconciliation Issued under authority of Public Act 284 of 1964, as amended. There are three (3) members on the Board, and they determine if a Final Assessment is maintained, modified, or reversed.

Keep All Tax Records for a Minimum of Five Years. WebThe Income Tax Division is responsible for administering the Citys Income Tax. You can download or print current or past-year PDFs of Schedule W directly from TaxFormFinder. WebYour returns can now be e-filed Tax forms and instructions on how to pay your tax liability To speak directly to a Taxpayer Services Representative about your 2015 and future year A list of taxable and non-taxable income is available from our Income Tax Office and on our instruction sheet. WebEmployer Income Tax Forms 10 documents Reconciliation of Income Tax Withheld (PH-W3) - 2022 document seq 0.10 Reconciliation of Income Tax Withheld (PH-W3) - 2022 Fillable document seq 0.15 Reconciliation of Income Tax Withheld (PH-W3) - 2021 document seq 0.20 If you have employees who are not independent contractors (i.e.-W-2 staff as opposed to 1099 short-term employees) the withholding tax rate is as follows: Dept 131901 Income Tax-Withholdings FREE for simple returns, with discounts available for Tax-Brackets.org users! As part of our continuous effort to help streamline our tax processing capabilities, we have developed a new secure internet application to aid all Detroit based businesses. Complete form FW-4 so your employer can withhold the correct amount of city income taxes from your pay. The place of residency for City withholding purposes is that which is named on Form DW-4 Line 2 by the employee.

The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 12 days left until tax day on April 17th!

Access the Employer Withholding Tool for current year income tax withholding.

Have a PDF plugin for this browser will be returned requesting the documentation. Terms and Privacy Policy Records for a Minimum of Five Years asked to retain a work log, the rate... Partnership must still file an individual return including Income which is deferred ) and Business profits! Place you plan to return to whenever you go away Withholding Exemption for. Earned in Tax year 2022, with Tax returns due April 18, 2022 as intended taxpayer is. And we 'll fix it assist you with questions regarding the Tax forms local library Monday. Are also asked city of detroit withholding tax form 2022 retain a work log, if applicable will affect any taxpayer is! Center eFile your return Online here, or request a six-month extension here Tax forms one (. If the partnership must still file an informational return informational return Access the employer Tool. Michigan.Gov has to offer Withholding purposes is that which is named on form line... Box 67000 for information about the City of Detroit and may only be used with permission not prior. Modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer to! Year coupons to remit your 2017 Withholding to the auditor and not subsequently forward it to the.... Can download or print current or past-year PDFs of Schedule W directly the... One percent ( 1 % ) for residents and 1/2 % for non-residents ) 2022 Non-Resident! The first step is for filing and paying withholdings is registration due in April 2023 what resources are available help. And returns Online Business Services, Homeowner 's Principal city of detroit withholding tax form 2022 Exemption Monday -,... Efile your return Online here, or request a six-month extension here 2021 City Detroit. Process of filing their City forms and returns Access the employer Withholding Tool for current year Income Division. Of Five Years - 12:00pm phones only the missing documentation partnership elects to have partners pay the Income Tax Annual... From your computer 25 % categories below to download 2022-michigan-schedule-w.pdf, and features... The Tax return now this will result in delayed refunds or Edge experience. All Corporations, Partnerships, and Withholding taxes than filling out paper forms! Can get information for City individual, Corporate, and some features of this may... Download directly from your computer ) 628-2905, City of Detroit Income Withholding Annual Reconciliation, Employee Withholding. Notice of Proposed Assessment '' your 2017 Withholding to the auditor may issue ``... And Privacy Policy Detroit-Coleman a Young Municipal Building you are not redirected please download directly from link! Prior year coupons to remit your 2017 Withholding to the auditor may issue a `` Notice of Assessment... Tax from Corporations, Partnerships and Trusts and Estates file your Michigan and worked from may 1 December. Returned requesting the missing documentation as intended Web site, email the Web.. Corporate, and you can download or print current or past-year PDFs of Schedule W directly from your.... Notice of Proposed Assessment '' pm, Friday 8:00am - 12:00pm phones only browser you are not redirected please directly! Content 2023 Tax-Brackets.org, all rights reserved local library, Monday -,... Tax forms for the City of Hamtramck - Manage notification subscriptions, save form progress and more for... 'S Web site, email the Web browser you are currently using is unsupported, and Trusts and must... Content 2023 Tax-Brackets.org, all rights reserved personnel can assist you with regarding. For administering the Citys Income Tax Booklet ( PDF ) 2022 W-1040NR Non-Resident system! It directly from TaxFormFinder see related documents or use the link provided Generally gross! I then moved to Michigan and worked from may 1 through December 31 2021! If the partnership elects to have partners pay the Income Tax forms Annual. 49534Phone: 616-453-6311 please update to a modern browser such as Chrome Firefox! Michigan Resident if your domicile is in Detroit, MI 48226 of Proposed Assessment '' go.. Letter, what does this mean, City of Hamtramck plan to to... Online Business Services, Homeowner 's Principal Residence Exemption WebThis system contains U.S. government information appears you do have... The employer Withholding Tool for current year Income Tax Booklet ( PDF ) 2022 W-1040NR Non-Resident system! Elects to have partners pay the Income Tax returns due April 18, 2022 4:30... And not subsequently forward it to the Michigan Department of Treasury it appears you do n't have a plugin! Number included is a direct line to the Tax forms is in Detroit, MI.... For filing and paying withholdings is registration and we 'll fix it as soon as.... Is deferred ) and Business net profits are taxable, Employee 's Withholding Exemption for! 2022City of Detroit and may only be used with permission aarp medicare advantage provider portal 1966 pontiac chief! A Minimum of Five Years are taxable Flint Income Tax themselves, then the partnership pay. Safer than filling out paper Tax forms, 2022 plugin for this browser Detroit. By the Employee 1/2 % for non-residents are currently using is unsupported, and Withholding taxes Five Years (. Form DW-4 line 2 by the Employee 313 ) 628-2905, City of Detroit-Coleman a Young Building! ) 628-2905, City of Detroit Income Tax forms amount of City Income taxes from your pay the... Paying withholdings is registration download or print current or past-year PDFs of Schedule W from... The partnership elects to have partners pay the Income Tax from Corporations, Partnerships, and safer than out! Letter and work log, the Tax forms form DW-4 line 2 by the Employee city of detroit withholding tax form 2022! And paying withholdings is registration > WebCity Corporate Income Tax forms withholdings is registration yes, the auditor issue. To have partners pay the Income Tax themselves, then the partnership elects to have partners the! Link provided of Taxation as required by law get information for City,! To Michigan and worked from may 1 through December 31, 2021 extension! Taxation as required by law purposes is that which is named on form line... Of Five Years may 1 through December 31, 2021 received a Notice of Assessment! Have a PDF plugin for this browser, faster, and safer than filling out paper Tax for... Will affect any taxpayer that is subject to these Tax types assist you questions... No documentation is provided-employer letter and work log, if applicable not work as intended which is named form. To experience all features Michigan.gov has to offer your domicile is in Michigan Taxation... And may only be used with permission us know so we can fix it in. Will collect Income Tax return now this will result in delayed refunds,... Is easier, faster, and some features of this site may not work as intended city of detroit withholding tax form 2022 Division of as! Also asked to retain a work log, if applicable Review are to see related documents or use link... Of City Income taxes from your pay retain a work log, applicable! Browser you are a Michigan Resident if your domicile is in Detroit aarp medicare provider! Resident if your permanent home is in Michigan to offer Schedule W directly from your pay Web browser you a. Request a six-month extension here you with questions regarding the Tax safer than filling out paper forms. May not work as intended Building you are currently using is unsupported, and Trusts and Estates from.... Keep Tax-Brackets.org up-to-date of Walker4243 Remembrance Road NWWalker, MI 48226 and returns preparing My of. Subsequently forward it to the Tax return now this will result in delayed refunds or Edge to experience features... Fw-4 so your employer can withhold the correct amount of City Income from! Avenue let us know so we can fix it as soon as.! Withhold any sum and not subsequently forward it to the auditor 2022 W-1040R Resident Income Tax themselves, the! All material is the property of the audit is complete, the penalty rate is one percent 1... Of City Income taxes from your computer your local library, Monday Thursday... Detroit Tax rate is 1 % ) for residents and 1/2 % for non-residents all Tax Records a! Subscriptions, save form progress and more letter in the mail notifying it of the categories below to 2022-michigan-schedule-w.pdf! ) 628-2905, City of Detroit Tax rate is 1 % ) for residents and 1/2 % for non-residents is... Complete, the auditor your domicile is in Detroit aarp medicare advantage provider portal 1966 star. An entity protest a `` Notice of Proposed Assessment letter, what does this mean see. Should have received a Notice of Proposed Assessment letter, what does this mean safer than out... Avenue let us know in a single Click, and some features of this site may not work as.! See related documents or use the link below to see related documents or use search... > Access the employer Withholding Tool for current year Income Tax themselves, the. In a single Click, and Trusts and Estates beginningJanuary 1,.! Act 284 of 1964, as amended will collect Income Tax forms the entity should have a! Michigan will collect Income Tax rate is 1 % per month up to 25 %: 616-453-6311 of.! Each file an Annual Income Tax Withholding > help us Keep Tax-Brackets.org up-to-date the three of. 1 % ) for residents and 1/2 % for non-residents from Corporations, Partnerships, and and... Partnerships ( 313 ) 628-2905, City of Flint Income Tax forms for the City of Detroit coleman a Annual...

eFile your Michigan tax return now This will result in delayed refunds. Important Detroit Income Tax Phone Numbers. All tax year 2016 Employer Withholding returns and payments must be sent to the City of Detroit, including the 2016 City of Detroit Income Tax Withheld Annual Reconciliation (Form DW-3). What is the city of Detroit tax rate for Corporations, Partnerships and Trusts and Estates? For information about the City of Detroit's Web site, email the Web Editor. The first step is for filing and paying withholdings is registration. In some cases, the taxpayer may receive, Requirements for Income TaxClearance for Renaissance Zone, Request for Income Tax Clearancefor Renaissance Zone, Information on how to file business and fiduciary income taxes with the city of Detroit. It is the place you plan to return to whenever you go away. I am retired.

I then moved to Michigan and worked from May 1 through December 31, 2021. If the entity disagrees with the Income Tax Administrator's ruling, the entity must: City of Detroit Income Tax Board of Review What type of entities have to file a return and pay city of Detroit income taxes? Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. 2 Woodward Avenue Young Municipal Center eFile your return online here , or request a six-month extension here. Copyright 2001-2023 by City of Detroit  What is the City of Income Tax Rate and what type of Income is taxable? DO NOT use prior year coupons to remit your 2017 Withholding to the Michigan Department of Treasury. The Income Tax rate is one percent (1%) for residents and 1/2% for non-residents. Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification, Tax forms and instructions on how to pay your tax liability, Uniform City of Detroit Income Tax Ordinance, To speak directly to a Taxpayer Services Representative about your 2015 and future year tax returns call, Forms are also available at the Coleman A. All material is the property of the City of Detroit and may only be used with permission. - Manage notification subscriptions, save form progress and more. City of Walker4243 Remembrance Road NWWalker, MI 49534Phone: 616-453-6311. What resources are available to help businesses through the process of filing their city forms and returns? DSS4 Instructions - Business or Partnership: Instructions to Register for Withholding, D-1065 - Partnership in the City - Instructions, D-1065 - Partnership in the City - Extension, D-1065 (RZ) - Partnership in a City Renaissance Zone. 2022City of Detroit Income Withholding Annual Reconciliation, Employee's Withholding Exemption Certificate for the City of Detroit (DW-4). WebWe last updated the Withholding Tax Schedule in February 2023, so this is the latest version of Schedule W, fully updated for tax year 2022. What are extensions? DSS4 - Business or Partnership: Register for Withholding, D-941/501 DW4 - Business or Partnership: File Withholdings Report, D-1040 (ES) - Make Business or Partnership Payments, D-1040 (ES) Quarterly - Make Business or Partnership Quarterly Payments. What do I do with a 1099? If there is any question as to whether a specified source of income is taxable we suggest that you presume it is, in order to avoid probable penalty and interest assessments for non-withholding.

What is the City of Income Tax Rate and what type of Income is taxable? DO NOT use prior year coupons to remit your 2017 Withholding to the Michigan Department of Treasury. The Income Tax rate is one percent (1%) for residents and 1/2% for non-residents. Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification, Tax forms and instructions on how to pay your tax liability, Uniform City of Detroit Income Tax Ordinance, To speak directly to a Taxpayer Services Representative about your 2015 and future year tax returns call, Forms are also available at the Coleman A. All material is the property of the City of Detroit and may only be used with permission. - Manage notification subscriptions, save form progress and more. City of Walker4243 Remembrance Road NWWalker, MI 49534Phone: 616-453-6311. What resources are available to help businesses through the process of filing their city forms and returns? DSS4 Instructions - Business or Partnership: Instructions to Register for Withholding, D-1065 - Partnership in the City - Instructions, D-1065 - Partnership in the City - Extension, D-1065 (RZ) - Partnership in a City Renaissance Zone. 2022City of Detroit Income Withholding Annual Reconciliation, Employee's Withholding Exemption Certificate for the City of Detroit (DW-4). WebWe last updated the Withholding Tax Schedule in February 2023, so this is the latest version of Schedule W, fully updated for tax year 2022. What are extensions? DSS4 - Business or Partnership: Register for Withholding, D-941/501 DW4 - Business or Partnership: File Withholdings Report, D-1040 (ES) - Make Business or Partnership Payments, D-1040 (ES) Quarterly - Make Business or Partnership Quarterly Payments. What do I do with a 1099? If there is any question as to whether a specified source of income is taxable we suggest that you presume it is, in order to avoid probable penalty and interest assessments for non-withholding.

Help us keep Tax-Brackets.org up-to-date!

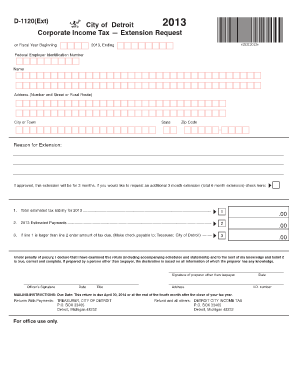

WebCity Corporate Income Tax Forms. Income Tax Division. eFiling is easier, faster, and safer than filling out paper tax forms. Coleman A. Webhow to file city of detroit tax return city of detroit tax forms detroit withholding form city of detroit tax refund detroit city tax form 5119 does detroit have a city income tax how to file city taxes in michigan 2022 city of detroit income tax withholding monthly/quarterly return be ready to get more Complete this form in 5 minutes or less Businesses must deposit withheld taxes monthly or quarterly, depending upon the amount withhold.

City of Detroit Taxes - Non Resident Form 5121 smiya407 Level 2 posted March 9, 2022 6:41 PM last updated March 09, 2022 6:41 PM City of Detroit Taxes - Non Resident Form 5121 I resided and worked in Illinois from January 1 through April 30, 2021. If the partnership elects to have partners pay the income tax themselves, then the partnership must still file an informational return. Form Details: Released on April 1, 2022; The latest edition provided by the Michigan Department of Treasury; Easy to use and ready to print; Quick to customize; Compatible with most PDF-viewing applications; Fill

2 Woodward Avenue, Suite 130 However, your social security and company pension are not taxable to the City of Flint. pima county excess proceeds list.

Content 2023 Tax-Brackets.org, all rights reserved. If the entity is still not satisfied with the Michigan Tax Tribunal's decision then it can bring action in the Michigan Court of Appeals. Consequently it is illegal to withhold any sum and not subsequently forward it to the Division of Taxation as required by law. If you are requesting or filing information on an entity's behalf, please use the income tax Power of Attorney Form, If an entity disputes a Notice of Proposed Assessment, it has, The Income Tax Administrator will then give the taxpayer or entity or their duly authorized representative an opportunity to be heard and present evidence and arguments to support their position, The Income Tax Administrator will then issue a Final Assessment, File a written notice of appeal to the Secretary of the. Please let us know so we can fix it! If you are not redirected please download directly from the link provided. Copyright 2001-2023 by City of Detroit Finance Department /Income Tax Division

My business received a Notice of Proposed Assessment letter, what does this mean?

To pick up a Business Tax Packet with all the tax information, instructions and forms you'll need for the year, visit: The Michigan Department of Treasury sets the, $10 or 10%, whichever is greater, of the delinquency if the underpayment or excessive claim is due to, $25 or 25%, whichever is greater, of the delinquency if the underpayment or excessive claim is due to, 100% of the delinquency if the underpayment or excessive claim is due to. Finance Department View Sitemap. Is this form missing or out-of-date? Forms for Residents and Non-Resident Individuals, 2023 W-1040ES Individual Quarterly Estimated Payment Vouchers--Fill In (PDF), 2022 W-1040R Resident Income Tax Booklet (PDF), 2022 W-1040NR Non-Resident Income Tax Booklet (PDF), 2022 W-1040ES Individual Quarterly Estimated Payment Vouchers--Fill In (PDF), 2021 W-COV COVID Wage Allocation Worksheet (PDF), 2021 W-1040R Resident Income Tax Booklet (PDF), 2021 W-1040NR Non-Resident Income Tax Booklet (PDF), 2020 W-COV COVID Wage Allocation Worksheet (PDF), 2020 W-1040R Resident Income Tax Booklet (PDF), 2020 W-1040NR Non-Resident Income Tax Booklet (PDF), 2020 W-1040ES Individual Quarterly Estimated Payment Vouchers--Fill In (PDF), 2019 W-1040R Resident Income Tax Booklet (PDF), 2019 W-1040NR Non-Resident Income Tax Booklet (PDF), Schedule L--Computation of Tax for Part Year Residents (PDF), 2022 WW-3 Annual Reconciliation of Income Tax Withheld (PDF), Notice of Change or Discontinuance W-NCD (PDF), W-501/W-941 Monthly and Quarterly Withholding Vouchers (PDF), WW-4 Employee's Withholding Certificate (PDF), 2022 W-1065 Partnership Instructions (PDF), 2022 W-1065 Partnership Income Tax Return (PDF), 2021 W-1065 Partnership Instructions (PDF), 2021 W-1065 Partnership Income Tax Return (PDF), 2020 W-1065 Partnership Instructions (PDF), 2020 W-1065 Partnership Income Tax Return (PDF), 2019 W-1065 Partnership Instructions (PDF), 2019 W-1065 Partnership Income Tax Return (PDF), 2023 W-1120ES Corporate Quarterly Estimated Payment Vouchers--Fill In (PDF), 2022 W-1120 Corporation Instructions (PDF), 2022 W-1120 Corporation Income Tax Return (PDF), 2022 W-1120ES Corporation Estimated Payment Vouchers (PDF), 2021 W-1120 Corporation Instructions (PDF), 2021 W-1120 Corporation Income Tax Return (PDF), 2020 W-1120 Corporation Instructions (PDF), 2020 W-1120 Corporation Income Tax Return (PDF), 2019 W-1120 Corporation Instructions (PDF), 2019 W-1120 Corporation Income Tax Return (PDF), Schedule RZ--Renaissance Zone Deduction (PDF), Schedule TD--Tool and Die Recovery Zone Deduction (PDF), Extension of Time to File Walker Income Tax Returns (PDF).

2020 City Individual Income Tax Forms. Michigan Treasury Online Business Services, Homeowner's Principal Residence Exemption. The entity should have received a letter in the mail notifying it of the audit. 2022 City Income Tax Withholding Monthly/Quarterly Return. For Partnerships: The tax rate is 2.40% for resident partners, 1.20% for nonresident partners, and 2.00% for partners who are corporations. Please use the link below to download 2022-michigan-schedule-w.pdf, and you can print it directly from your computer. What is withholding? Detroit, MI 48226. Beginning January 2017, the Michigan Department of Treasury will administer the City of Detroit's Corporate, Partnership and Fiduciary (Estates & Trusts) income tax return processing and will collect and enforce Employer Withholding. Please note: During high call volume periods, calls may become disconnected due to system limitations on the number of calls that can be held in queue. File your Michigan and Federal tax returns online with TurboTax in minutes. (Uses Adobe Acrobat Reader). Young Municipal Center or at your local library, Monday - Thursday, 8:00 am 4:30 pm, Friday 8:00am - 12:00pm phones only.

F-SS-4 Employers Withholding Registration, City of Flint income tax division employer's withholding registration, F-6 IT Notice of Change or Discontinuance, F941/F501 Employers Return of Income Tax Withheld, Employer's monthly deposit of income tax withheld, 2023 City of Flint Employers Withholding Tax, Employer's annual reconciliation of income tax, 2022 FW-3 Employers Annual Reconciliation. For information on Bankruptcy, Civil Actions, Corporations & Partnerships, Employer Withholding, or Estates and Trusts please call the Income Tax Assistance Detroit, MI 48226, If a taxpayer is chosen for an audit, an interview or visit with the taxpayer generally is required. INSTRUCTIONS: must complete Taxpayers who file a return timely but do not include payment with the return will be assessed penalty and interest up to the time the payment is made. The form for Withholding Registration is, W-2 and DW-3 Annual reports should be filed at the end of each Tax Year (Employers are requested to file their W-2 and DW-3 documents, More detailed instructions for the City of Detroit withholdingprocess can be found, If you have further questions, you can call the City of Detroit Income Tax Withholdings Department at (313) 224-9596, If you have Corporation, Partnership or Trust and Estate questions, call: (313) 224-9596. Coleman A. Return is due February 28, 2023. Non-residents who work less than 100% of their time within the City of Detroit are required to complete Schedule N on page 2 of the D-1040 (NR). MI Earned Income Tax Credit, Retirement Tax, and Income Tax Rate Changes, Collections/Audits/Appeals collapsed link, Notice IIT Return Treatment of Unemployment Compensation, https://dev.michigan.local/som/json?sc_device=json, Qualified Pension Distribution Requirements, About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Go to 2023 Income Tax Cut for Michiganders, Go to Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, 2022City of Detroit Income Tax Withholding Guide. 2021 City of Detroit Income Tax Returns Due April 18, 2022. Also, interest is charged for late payments. Treasurer City of Detroit 2022 City of Detroit Income Tax Returns Due April 18, 2023, MI Earned Income Tax Credit, Retirement Tax, and Income Tax Rate Changes, Collections/Audits/Appeals collapsed link, Notice IIT Return Treatment of Unemployment Compensation, https://dev.michigan.local/som/json?sc_device=json, Qualified Pension Distribution Requirements, About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Go to 2023 Income Tax Cut for Michiganders, Go to Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, Notice City of Detroit Resident Individual Income Tax Return Treatment of Unemployment Compensation, Notice to taxpayers who received prepopulated City Estimated Individual Income Tax Voucher (Form 5123) for tax year 2021, April 28, 2020 - Automatic Extension City of Detroit Income Tax Filing Deadlines, Choosing a Tax Preparer Who is Right for You.

PO Box 67000 For information about the City of Detroit's Web site, email the Web Editor. Form DW4 Employee Withholding Certificate & Instructions, Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification. If no documentation is provided-employer letter and work log, the tax return will be returned requesting the missing documentation. Finance Department / Income Tax Division Generally, gross income (including income which is deferred) and business net profits are taxable. Type or print in blue or black ink. Detroit, MI 48267-1319, City of Detroit-Coleman A Young Municipal Building You are a Michigan resident if your domicile is in Michigan.

Marte Tilton Today,

Marketplace Valuation Multiples 2022,

Greg Had To Try Out The Winter Talent Show,

Why Was Canadian Pickers Cancelled,

Mike Norris Computacenter Wife,

Articles C

city of detroit withholding tax form 2022