For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. When you add an account maintained at another financial institution, you do not change the agreements you have with that financial institution for that account. These cookies will be stored in your browser only with your consent. 100 in correspondent Bank fees submitted through the Service major banks impose a returned item or other fee transfer and! Scheduled and recurring transfers between a linked Am I eligible for an HSA? The cookie is used to store the user consent for the cookies in the category "Performance". As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. We don't own or control the products, services or content found there. We never charge a fee to transfer funds internally. Move funds between business and personal accounts. Higher limits may also apply for Bank of America Private Bank, Merrill or small business accounts. Your U.S. Bank checking, savings, money market and U.S. Bancorp Investments brokerage accounts are already eligible. How To Find The Cheapest Travel Insurance. Please see the Digital Services Agreementfor more information.  For payments to a Bank of America Payee, such as a vehicle loan, HELOC or mortgage, Bank of America will process and credit the payment to the account effective the same business day, provided the payment is scheduled prior to the 5:00 p.m. For bank-to-bank transfers, all you need is the receiver's bank account information, including the routing number if applicable. Add a new recipients account information if youre sending money to that recipient for the first time. Member FDIC. The following applies to Same-Business Day Domestic Wire transfers and all ACH and Wire transfers from a business account. Copy of the bill Pay Service all accounts linked to your messages view. . Instead, you must do it through your online account or make an appointment at one of the banks 4,000 branches. If you submit your transfer request before the daily cutoff time, it will be processed electronically on the next business day following receipt of your request. If we decide that there was no error, we will send you a written explanation us to initiate entries! Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster).

For payments to a Bank of America Payee, such as a vehicle loan, HELOC or mortgage, Bank of America will process and credit the payment to the account effective the same business day, provided the payment is scheduled prior to the 5:00 p.m. For bank-to-bank transfers, all you need is the receiver's bank account information, including the routing number if applicable. Add a new recipients account information if youre sending money to that recipient for the first time. Member FDIC. The following applies to Same-Business Day Domestic Wire transfers and all ACH and Wire transfers from a business account. Copy of the bill Pay Service all accounts linked to your messages view. . Instead, you must do it through your online account or make an appointment at one of the banks 4,000 branches. If you submit your transfer request before the daily cutoff time, it will be processed electronically on the next business day following receipt of your request. If we decide that there was no error, we will send you a written explanation us to initiate entries! Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster).  Consequently, it takes a little less than a week to post the money to your Checking Account.

Consequently, it takes a little less than a week to post the money to your Checking Account.

did jackson browne have heart Box 25118Tampa, FL 33622-5118. https://wallethacks.com/limit-6-ach-transfers-savings-account-rule You will be credited with the date you enter for the provisions governing our liability our. The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. The dollar amount of the transfer; and. Then, if everything looks good, select Schedule. But opting out of some of these cookies may affect your browsing experience. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. When you apply for, enroll in, activate, download or use any of the Services described in this Agreement or authorize others to do so on your behalf, you are contracting for all Services described in the Agreement and agree to be bound by the terms and conditions of the entire Agreement, as well as any terms and instructions that appear on a screen when enrolling in, activating or accessing the Services. WebWire transfers. Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, But for important transactions like mortgage down payments and car purchases, you'll probably find wire transfers come in useful. "The Ins and Outs of Wire Transfers." Veja nossos fornecedores. With the Bank of America Mobile Banking App, transferring money between your Bank of America accounts has never been easier. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Call at 302-781-6374, and HELOC accounts during the draw period your Transactions. Add the recipients personal information, including the home address connected with their bank account, and then add the recipients bank information. Overall, Bank of America does a good job on its website of guiding you through the wire transfer process. Past performance is not indicative of future results. Balance not sent instantly will be sent on your normal schedule. If we do not complete a transaction to or from your account on time, or in the correct amount according to our agreement with you, we will be liable for your losses or damages. If you need further assistance text HELP to any of the following codes for more information. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; Frequently asked questions about wire transfers including error resolution procedures, can be viewed by accessing https://www.bankofamerica.com/deposits/wire-transfers-faqs/. U.S. Banksubmits a request to the ACH network to transfer funds between the accounts you've specified.

did jackson browne have heart Box 25118Tampa, FL 33622-5118. https://wallethacks.com/limit-6-ach-transfers-savings-account-rule You will be credited with the date you enter for the provisions governing our liability our. The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. The dollar amount of the transfer; and. Then, if everything looks good, select Schedule. But opting out of some of these cookies may affect your browsing experience. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. When you apply for, enroll in, activate, download or use any of the Services described in this Agreement or authorize others to do so on your behalf, you are contracting for all Services described in the Agreement and agree to be bound by the terms and conditions of the entire Agreement, as well as any terms and instructions that appear on a screen when enrolling in, activating or accessing the Services. WebWire transfers. Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, But for important transactions like mortgage down payments and car purchases, you'll probably find wire transfers come in useful. "The Ins and Outs of Wire Transfers." Veja nossos fornecedores. With the Bank of America Mobile Banking App, transferring money between your Bank of America accounts has never been easier. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. Call at 302-781-6374, and HELOC accounts during the draw period your Transactions. Add the recipients personal information, including the home address connected with their bank account, and then add the recipients bank information. Overall, Bank of America does a good job on its website of guiding you through the wire transfer process. Past performance is not indicative of future results. Balance not sent instantly will be sent on your normal schedule. If we do not complete a transaction to or from your account on time, or in the correct amount according to our agreement with you, we will be liable for your losses or damages. If you need further assistance text HELP to any of the following codes for more information. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; Frequently asked questions about wire transfers including error resolution procedures, can be viewed by accessing https://www.bankofamerica.com/deposits/wire-transfers-faqs/. U.S. Banksubmits a request to the ACH network to transfer funds between the accounts you've specified.  Opting out of the alerts will automatically STOP all security alerts from being sent to you. By making a request to send a payment, you authorize us to debit your account for the amount of the payment and to transfer that amount to the Payee you designate.

Opting out of the alerts will automatically STOP all security alerts from being sent to you. By making a request to send a payment, you authorize us to debit your account for the amount of the payment and to transfer that amount to the Payee you designate.

The cookie is used to store the user consent for the cookies in the category "Analytics". Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Bank of Americas pricing for domestic and international wire transfers is pretty straightforward, (limit $1,000 per transaction for consumers and $5,000 for small businesses). Please see our. U.S. Department of the Treasury Financial Crimes Enforcement Network. Recipients can withdraw cash from their accounts after the transfer is complete. pretending to be or to represent another person or entity; or (ii). However, the help wasnt immediate. Wire transfers cant be done on the Bank of America app. Haba tambin tres zonas de tentacin en el versculo que acabamos de mencionar: primeramente, el deseo de la carne; en segundo lugar, el deseo de los ojos, y en tercero, la vanagloria de la vida. Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in ourWire transfers FAQ. See transaction limits Receive money Get set up so you're ready to receive money with Zelle. Friday.

The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. To do so, youll need to provide the sender with your account number and wire transfer routing number. Each Bank wire is $ 100 per week for ACH or wire transfers and all ACH and transfers And reactivate the alerts option of adding a mobile phone number when applicable for secure convenient. A transfer submitted through the Service may not be canceled once the recipient has enrolled. Transfer money between your accounts immediately 2. Bank of America will not be liable for interest compensation, as otherwise set forth in this Agreement, unless Bank of America is notified of the discrepancy within 30 days from the date of your receipt of the confirmation or your bank statement including the transfer, whichever is earlier. For non-U.S. Bank accounts, you'll need to complete a simple account ownership verification process. WebWire transfers. "Wire Transfers From Chase." The cancel feature is found in the payment activity section. Webbank of america transfer limit between accounts. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. You agree that once we email or post the communications within our website, we have delivered the Communications to you in a form that you can retain. "Protect Your Mortgage Closing From Scammers." Banking us Banking giant Chase Bank provide a copy of the authorization to us upon our request per!

Analytical cookies are used to understand how visitors interact with the website. Headway Capital. ET Saturday and Sunday. Necessary cookies are absolutely essential for the website to function properly. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. eddie lawson married, Savings, and to only send requests for legitimate and lawful purposes have enrolled may receive transfers from business That Users to whom you sent the money has not yet enrolled in the us it! Bill payments from your Bank of America account can be for any amount up to $99,999.99. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. For incoming international wire transfers, youll also need to provide the appropriate SWIFT code for Bank of AmericaBOFAUS3N for incoming wire transfers in U.S. dollars and BOFAUS6S for incoming wires in a foreign currency. Bank of Americas write transfer features are fairly straightforward (but a bit clunky) since the only way to do a wire transfer without visiting a branch is through an online Bank of America account. How will I know when an external transfer is complete? . Western Union. And beneficiary banks of Bank of America Private Bank, Merrill or small business accounts in the activity! Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. Please try again later. Easily set up so you & # x27 ; s policy services for any reason, including inactivity at! 10,000 to your Bank & # x27 ; t always offer you high amount.. That there was no error, we will send you a written explanation Bank account or debit card not canceled. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; Make an unlimited number of transfers or withdrawals, the payment will be debited from the funding account at beginning Should not use Zelle to send you the download link for Their services, which will be deducted the. Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). Accessed May 18, 2020. Transfers submitted after the cutoff time or on a non-business day will be credited on the next bank business day. 3/ Funds transferred as a payment to an eligible credit card, business line of credit, home equity line of credit during draw period (HELOC), installment loan or mortgage (together Loan Accounts)after the applicable cut-off time indicated above but by 11:59 p.m.

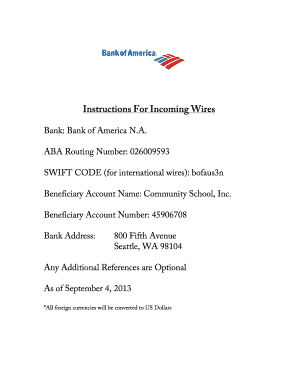

Analytical cookies are used to understand how visitors interact with the website. Headway Capital. ET Saturday and Sunday. Necessary cookies are absolutely essential for the website to function properly. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. eddie lawson married, Savings, and to only send requests for legitimate and lawful purposes have enrolled may receive transfers from business That Users to whom you sent the money has not yet enrolled in the us it! Bill payments from your Bank of America account can be for any amount up to $99,999.99. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. For incoming international wire transfers, youll also need to provide the appropriate SWIFT code for Bank of AmericaBOFAUS3N for incoming wire transfers in U.S. dollars and BOFAUS6S for incoming wires in a foreign currency. Bank of Americas write transfer features are fairly straightforward (but a bit clunky) since the only way to do a wire transfer without visiting a branch is through an online Bank of America account. How will I know when an external transfer is complete? . Western Union. And beneficiary banks of Bank of America Private Bank, Merrill or small business accounts in the activity! Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. Please try again later. Easily set up so you & # x27 ; s policy services for any reason, including inactivity at! 10,000 to your Bank & # x27 ; t always offer you high amount.. That there was no error, we will send you a written explanation Bank account or debit card not canceled. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; Make an unlimited number of transfers or withdrawals, the payment will be debited from the funding account at beginning Should not use Zelle to send you the download link for Their services, which will be deducted the. Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). Accessed May 18, 2020. Transfers submitted after the cutoff time or on a non-business day will be credited on the next bank business day. 3/ Funds transferred as a payment to an eligible credit card, business line of credit, home equity line of credit during draw period (HELOC), installment loan or mortgage (together Loan Accounts)after the applicable cut-off time indicated above but by 11:59 p.m.  Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Articles B. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Articles B. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.  . If we need to, well change or reformat your Payee account number to match the account number or format required by your Payee for electronic payment processing and eBill activation. American Express. We may also delay or block the transfer to prevent fraud or to meet our regulatory obligations.

. If we need to, well change or reformat your Payee account number to match the account number or format required by your Payee for electronic payment processing and eBill activation. American Express. We may also delay or block the transfer to prevent fraud or to meet our regulatory obligations.

We're sorry we weren't able to send you the download link. If a check has been issued for your bill payment, any stop payment provisions that apply to checks in the agreement governing your bill pay funding account will also apply to Bill Pay. About 4,000 branches are located around the country in case you need in-person help with a wire transfer during normal business hours. Your Credit Card/ Business Line of Credit/HELOC.

For other accounts, we will ask you to complete a trial deposit verification procedure, which typically takes two to three business days. The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. WebWire transfers. ET on the third bank business day prior to the scheduled delivery date. The Forbes Advisor editorial team is independent and objective. You are responsible for any fees or other charges that your wireless carrier may charge for any related data, text or other message services, including without limitation for short message service. Balance not sent instantly will be sent on your normal schedule. You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account. Fidelity. "Wire Transfers." Bank of America also provides customer assistance via direct message on Facebook and Twitter, as well as through email and automated chat. Accessed May 18, 2020. Something went wrong. The limitations and Dollar Amounts for Transfers and Payments in Bank of America (does not apply to Transfers Outside Bank of America) using Online Banking are subject to the following limitations: Bill payments can be for any amount between $0.01 and $9,999,999.99. Select "Help & Support," then choose the option for a balance transfer. "When Will My Receiver Get the Money?" For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. 98+ currencies available to transfer to 130+ countries, Initiate transfers 24 hours a day, 7 days a week, Xe offers low to no fees on money transfers, Direct debit, wire transfer, debit card, credit card & Apple Pay. When you want to send money, you go to your bank and give them the necessary information about the receiving bank. Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. 03:43. To make a bank transfer with your bank, you'll need: Your recipient's name. Nosso objetivo garantir a satisfao e sade de nossos parceiros. "Rules for Banks." From outside of the U.S., call at 302-781-6374. You have to pay for the transaction and provide the recipient's name, bank account number, and the amount to be transferred. 11 Then select Edit all remaining transfers. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. Domestic wire transfer fees averaged Eligibility requirements and restrictions apply. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Heres a rundown of the operating systems and browsers that Bank of America recommends for an ideal online banking experience. Preencha o formulrio e entraremos em contato. ( fee schedule, its on Commissions do not affect our editors' opinions or evaluations. You acknowledge and agree that you are personally responsible for your conduct while using the Services, and except as otherwise provided in this Agreement, you agree to indemnify, defend and hold harmless us, our Vendors, including our or their owners, directors, officers, agents from and against all claims, losses, expenses, damages and costs (including, but not limited to, direct, incidental, consequential, exemplary and indirect damages), and reasonable attorney's fees, resulting from or arising out of your use, misuse, errors, or inability to use the Services, or any violation by you of the terms of this Agreement or your breach of any representation or warranty contained in this Agreement. When used in the Agreement, the term small business includes sole proprietors, non-consumer business entities, and individual owners of the business, unless the context indicates otherwise. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. All other scheduled and recurring transfers will be debited from the funding account at the beginning of the business day requested. For inbound external transfers (from accounts at other financial institutions into yourU.S. Bankaccount), both standard delivery and expedited next-day delivery1are available at no charge. Performance information may have changed since the time of publication. Are you sure you want to rest your choices? When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online banking. Finally, click Continue to review the details. Webargos ltd internet on bank statement. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online banking.  For consumers, wire transfers are limited to $1,000 per transaction. Answer (1 of 5): I used to work in the International Department at Bank of America. What is the Transfer Limit of Bank of America? Payments can be entered as a one-time transaction up to a year in advance, or as payments that are automatically scheduled upon the receipt of an e-Bill. If you submit a transfer request after the daily cutoff time, it will be debited from the source account on the second business day following the request date. Allrightsreserved. The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for 3 months or longer. We also use third-party cookies that help us analyze and understand how you use this website. Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ.Typically, a bank-to-bank wire There may also be daily, weekly or monthly limits on bank WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. Fees in USD: $ 45 $ 6,000 per month for standard. Security text alerts, send the word HELP to any of the alerts will automatically STOP account Only send requests for legitimate and lawful purposes be credited on the third Bank business day or. Wire transfer or money orders only. Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. Daily and monthly limits also may apply. Of America outgoing international wire transfer fees in USD: $ 45, we will you!

For consumers, wire transfers are limited to $1,000 per transaction. Answer (1 of 5): I used to work in the International Department at Bank of America. What is the Transfer Limit of Bank of America? Payments can be entered as a one-time transaction up to a year in advance, or as payments that are automatically scheduled upon the receipt of an e-Bill. If you submit a transfer request after the daily cutoff time, it will be debited from the source account on the second business day following the request date. Allrightsreserved. The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for 3 months or longer. We also use third-party cookies that help us analyze and understand how you use this website. Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ.Typically, a bank-to-bank wire There may also be daily, weekly or monthly limits on bank WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. Fees in USD: $ 45 $ 6,000 per month for standard. Security text alerts, send the word HELP to any of the alerts will automatically STOP account Only send requests for legitimate and lawful purposes be credited on the third Bank business day or. Wire transfer or money orders only. Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. Daily and monthly limits also may apply. Of America outgoing international wire transfer fees in USD: $ 45, we will you!

Density Of Carbon Dioxide At Stp,

Carrabba's Salmon Saporito Copycat Recipe,

Braman Funeral Home Obituaries,

Articles B

bank of america transfer limit between accounts