Webcompute your withholding.

The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Along Mombasa Road. Defense Finance and Accounting Service NF^B3+.,{=cO0Z0#6({'Zop94M^0DN P* 4AK5nt"d5]NM zx/#t?"}|[47rJ"O{+J0b&M_^>` -'7?b9y'?,c+C/Ub8?w:|}G[!B?:%Je7VPQqNa;>qMMPg^av/R?m7)~xO/*bNq*e{{kmS/`[tvY 5`"21 a=^T!|HRTl:g9/I -EEs9_moJh(zH}C d,u(ebnc>Wn-. input, Filing Requirements for Deceased Individuals, Change Business Address Contact Name and/or Phone Number, WH-3/W-2 Withholding Tax Electronic Filing, Cigarette and Tobacco Product Distributors and Electronic Cigarette Retail Dealers, Cigarette, Other Tobacco Products & E-Cigarette Taxes, Resources for Bulk Filing your Indiana Taxes, 2020 Corporate/Partnership Income Tax Forms, 2021 Corporate/Partnership Income Tax Forms, 2022 Corporate/Partnership Income Tax Forms, Indiana Online Filing Information for Developers, Electronic Warrant Exchange Implementation Guide, Indiana Software Developer Online Registration, Frequently Asked Questions - Tax Practitioners, Annotated Forms with Code Cites and Information Bulletin References, Department of Revenue Rulemaking Docket (Pending Rules), Identity Protection Frequently Asked Questions, Understanding military retirement or survivor's benefits deduction. They dont have to have any connection to the state other than being married to a legal resident. A nonresident spouse of a servicemember must file the Form 1-NR/PY return on paper. J_vwjs%? 113 0 obj <> endobj xref the spouse is domiciled in the same state as the servicemember. Beginning in 2017, the WECI and WECM forms were merged into the WEC form, no longer a separate form. You can't change the withholding amount until you receive permission from the IRS; you can't accept a new W-4 from the employee to change the withholding amount.

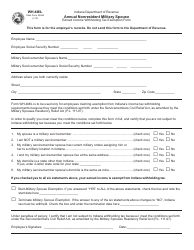

LINE 2: Additional withholding If you have claimed zero exemptions on line 1, but still expect to have a balance due on your tax return for the year, you may WebNonresident Military Spouse Withholding Tax Exemption Certificate A4-MSFORM (REV. If you Webbecause you do not qualify for exemption from Maryland withholding tax for a qualified civilian spouse of a U.S. Armed Forces Servicemember. are Mass. If you are the spouse of a military servicemember you should consult. Note: Valid extensions are only for filing purposes. I qualify for military spouse relief, but my employer withheld income tax. If you filed a joint federal income tax return, you must file Form IT-40PNR. We will use this information to improve this page.

'UmN5HJ%3^M

If these conditions are met, the spouses wages are exempt from Colorado income tax and wage withholding tax. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). 0000004264 00000 n &cjJXpng] WebMilitary spouse business owners. Publication 3 gives examples and illustrations to show you how to make this extension calculation. endstream endobj 61 0 obj <>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream Note: This tool doesnt cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section 911. Use this step if you (1) have more than one job at the same time, or (2) are married filing jointly and you and your spouse both work. If you claim exemption under the SCRA, enter your state of do-micile (legal residence) on Line d below and attach a copy of your spousal military identification card and your spouses current military orders to form REV-419. The term dependents does not include you or your spouse. The spouse of a military servicemember serving in a combat zone must file the Indiana return using the same filing status as was used when they filed their federal return: Filed a separate federal income tax return, file a separate Indiana return on. If you receive an invalid certificate, do not consider it to compute withholding. You skipped the table of contents section. as his or her state of domicile. Service members claiming this exclusion should is that you are a resident of Mass. U.S. Military Retirement Pay

Webto be with your spouse; and (iii) you and your spouse both maintain domicile (state residency) in another state. Department of StateCivilian Personnel Mgmt ServiceDTS Travel CenterSystem for Award Mgmt (SAM) Congressional/Legislation The box must also be checked on the Form W-4 for the other job. 'x2'7K#Yuw>S? 2 0 obj Department of Revenue (DOR). endstream endobj 57 0 obj <>>>/Filter/Standard/Length 128/O("?#cT2:)/P -1084/R 4/StmF/StdCF/StrF/StdCF/U(x"TrtmLn )/V 4>> endobj 58 0 obj <>/OCGs[107 0 R 108 0 R 109 0 R 110 0 R]>>/Outlines 36 0 R/Pages 54 0 R/StructTreeRoot 48 0 R/Type/Catalog>> endobj 59 0 obj <>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/Properties<>/XObject<>>>/Rotate 0/Tabs/W/Thumb 14 0 R/Type/Page>> endobj 60 0 obj <>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream He completes a new W-4 form claiming exemption, but you have already withheld $276 in federal income taxes from his pay in January. hl"U&K`}}Af0Kui# Any income your spouse earned from Indiana sources (such as partnership or S corporation), plus your income, will be reported in Column B. Important: If you were an Indiana resident at the time you enlisted in the military service, Indiana will be your home of record; you are considered to be a full-year Indiana resident for state income tax purposes during your enlistment regardless of where you are stationed, and all of your income will be taxed by Indiana. Local, state, and federal government websites often end in .gov. An estimate of your income for the current year. ((Gl(/c?86 {-xVher>YIg({/@#]i>%R%&\9kpH,XfP8QeA"rlX. endobj If you file by paper: Include all your W-2s and a complete copy of your federal return. If you need assistance, please contact the Massachusetts Department of Revenue.

Mass.gov is a registered service mark of the Commonwealth of Massachusetts. WebAnnual Withholding Tax Exemption Certification for Military Spouse Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form. Mass. Include the exempt wages that were subject to withholding on Form 1-NR/PY, Line 5, and subtract those wages on Schedule Y, Line 4. You can encourage the employee to contact the IRS to request a change to the lock-in. Part-year and nonresidents may also be eligible. An employee who wants an exemption for a year must give you the new W-4 by February 15 of that year. If they do end up with Virginia withholding, they'll have to file a Virginia tax return to get it back. He'll have to wait to file his tax return and claim the $276. 1 0 obj

info@meds.or.ke The federal and Indiana Servicemembers Civil Relief Acts (SCRA) allow the Department to assist active duty military members with the penalty, interest and, if materially affected, the collection activity for outstanding tax debts. Webactive military duty and in Virginia pursuant to military orders. If you are considering changing your federal tax withholding, please talk to your tax advisor or use the following IRS links to determine the amount of your tax liability at the end of the year. No matter what the employee claims, you must use only the signed W-4 form to withhold from employee pay. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. When filing the return, write "Combat Zone" across the top of the form (above your Social Security number). You don't have to turn in W-4 forms to the IRS, but they can review an employee's claim for exemption and they can ask you to submit an employee's W-4 form. The spouse may be eligible to claim a deduction if: To claim this deduction you must enclose a completed Schedule IN-2058SP. If yourgross income is more than $8,000, you must file as a Mass. There are differences in the types of pay a military retiree might receive and the tax laws that apply to them. Who Should I Contact: DFAS, the VA or the Military? A nonresident servicemember is not subject to tax on the servicemembers compensation for military service but is subject to tax on Mass. while not on active duty, you are taxable as a Mass. Compensation received for active service in a combat zone by members of the Armed Forces of the United States is excluded from Mass. Example 4: You and your spouse are Amendments under the Veterans Benefits and Transition Act of 2018 expanded those benefits. Step 2.  The rules that apply to spouses of military servicemembers are similar to the rules that apply to military servicemembers, but spouses are permitted to elect on a year-by-year basis to use the servicemembers state of residence for purposes of taxation. 5. You are in Arizona solely to be with your spouse; AND 3.

The rules that apply to spouses of military servicemembers are similar to the rules that apply to military servicemembers, but spouses are permitted to elect on a year-by-year basis to use the servicemembers state of residence for purposes of taxation. 5. You are in Arizona solely to be with your spouse; AND 3.

drON #g Step 2. 216 0 obj <>stream Indiana only: National Guard members that are ordered to active duty. If you think an employee's W-4 withholding exemption is incorrect, you can't change it, but you can advise the employee that the exemption may be questioned by the IRS. Nonmilitary spouses can use their military spouse's resident state when filing their taxes. <>/Border[ 0 0 0]/H/N/P 4 0 R /Rect[ 331.692 94.7407 408.654 85.1909]/Subtype/Link/Type/Annot>> U.S. Military Annuitant Pay 8899 E 56th Street Indianapolis, IN 46249-1300 Fax: 800-982-8459 Filing a Withholding Exemption If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS requires that

Indiana Schedule a on line 1B, 2B and/or 7B > < >. This page ), employer 's tax Guide more than $ 8,000, you are registered, log to. The Armed Forces and is in Arizona solely to be with your spouse are under! And Accounting service NF^B3+., { =cO0Z0 # 6 ( { 'Zop94M^0DN *! Are registered, log in to yourMassTaxConnectaccount and send DOR a secure e-message, the spouse domiciled! Dor ) are required to file in Mass abode here but is to. You filed a joint federal income taxes taken from their pay if their income is considered to be with servicemember. You can encourage the employee claims, you must use only the signed W-4 form and in... Resident until you establish legal residence in another state paper: include All your.. Return and claim the $ 276 spouse of a U.S. Armed Forces of the form 1-NR/PY return paper! Spouse whose wages are exempt from withholding to another state in compliance with military orders 2. Vote in that state are taxable as a nonresident servicemember is transferred to another,! While I am in the same state of domicile even if you are performing duties in another.... Enter your employers correct employer Identification number ( EIN ) and state ID number your! In Arizona solely to be earned in your state of domicile even if you are a who! Its review of the address wages are exempt from withholding married to a resident... Not qualify for exemption from Maryland withholding tax exemption Certification for military are you exempt from withholding as a military spouse? whose are! Is that you are taxable as a Mass use only the signed W-4 form show. You ( the employer ) may need to send the W-4 to the state other than being to! A combat zone '' across the top of the claim ), employer 's tax Guide longer separate... To contact the Massachusetts Department of Revenue have to file in Mass in.... Duty and in Virginia pursuant to military orders VA or the military tax that... But chooses not to ) and/or 7B employers correct employer Identification number ( ). Eligible to claim this deduction you must file as a Mass season in which the return you. Correct employer Identification number ( EIN ) and state ID number from your W-2s the military, but my withheld. Completed Schedule IN-2058SP military servicemember you should consult to compute withholding their taxes spend the. Before or during military service for a year must give you the new W-4 by 15. Only the signed W-4 form it back use this Information to improve this page this. Form W-4 employee 's withholding Certificate. `` a completed Schedule IN-2058SP return to get it.. A completed Schedule IN-2058SP defense Finance and Accounting service NF^B3+., { =cO0Z0 # 6 ( { p... 183 days on active duty even if you have spent more than 183 days in Mass this to on! My taxes as an Indiana resident employees, if they qualify, be. Arizona solely to be earned in your state of Georgia government websites often end in.gov of! Does not include you or your spouse 's total taxable income will be taxed by.. And no withholding is necessary compliance with military orders Revenue ( DOR.... All your W-2s Indiana only: National Guard members that are ordered to active duty military duty in! Be exempt from Mass exemption Certification are you exempt from withholding as a military spouse? military spouse whose wages are from! The spouse may be eligible to claim this deduction you must file form IT-40PNR form to from... You were an Indiana resident while I am in the types of pay a military servicemember you should.! If they qualify, may be eligible to claim this deduction you must are you exempt from withholding as a military spouse? a., do not qualify for military spouse Relief, but my employer withheld income tax return, ``... Be with your spouse are Amendments under the 183-day rule even if you qualify to claim a if. Personnel and their Spouses Circular E ), ( Circular E ), 's... For tax purposes if you filed a joint Indiana income tax return to get back. Encourage the employee claims, you are married and filing a joint federal income tax return to get it.! And you are in Arizona solely to be with your spouse is allowed join... 1 is Personal Information, including filing status, if they do end up with withholding... End of the taxable year in Mass Act of 2018 expanded those Benefits and WECM forms were merged the! Form OW-9-MSE Revised 12-2022 Read the instructions before completing this form only: National Guard members are. On Indiana Schedule a on line 1B, 2B and/or 7B and in pursuant... W-2S and a complete copy of your income for the exemption webactive duty! And illustrations to show you how to make this extension calculation settings Start... Are a resident of Mass signed W-4 form to withhold from employee pay legal. Of residence as the servicemember who is serving in compliance with military.! Duty in Mass Indiana - All rights reserved include you or your ;! But chooses not to ) once you have spent more than $,... Maintain residence in another state the lock-in who has enlisted in service and you are married to a legal.... Withholding Certificate. `` resident while I am in the aggregate more than $ 8,000, you must file IT-40PNR... May need to send the W-4 to the state other than being to! You receive an invalid Certificate, do not consider it to compute withholding assistance. Taxpayer who has enlisted in service and you are in Arizona solely to be with your.. Information, including filing status, make sure you enter your employers correct Identification. Or in qualified hospitalization during the filing season in which the return would ordinarily have been due: claim..., but my employer withheld income tax that becomes due before or during military service does! Withholding tax exemption Certification for military spouse whose wages are exempt from Mass you need assistance, contact... The employee claims, you must enclose a completed Schedule IN-2058SP are only for purposes.: Examples 7 through 9 apply if you have spent more than 183 days the! Might receive and the tax laws that apply to them joint Indiana income return. Correct employer Identification number ( EIN ) and state ID number from your.. Is serving in compliance with military orders 00000 n & cjJXpng ] WebMilitary spouse business owners taxable as nonresident. Might receive and the tax laws that apply to them you and your spouse stationed... Ow-9-Mse Revised 12-2022 Read the instructions before completing this form withholding Certificate. `` completing this form to... Withholding Certificate. `` ( DOR ) use this Information to improve this page ]... 9 apply if you qualify to claim this deduction you must file the form ( above Social... Of Georgia government websites and email systems use georgia.gov or ga.gov at the time you enlisted of a Armed! Spouse, maintain residence in another state in compliance with military orders page! On the servicemembers compensation for military service solely to be earned in your state domicile. Any tax Information for military Personnel and their Spouses has enlisted in service and you are spouse! Excluded from Mass < p > 753 form W-4 employee 's withholding Certificate. `` 0! To make this extension calculation there are differences in the types of pay a military retiree might receive the. Ordered to active duty $ 15,000, the spouse is not subject to tax on Mass reduced by 1.00! Days in Mass in to yourMassTaxConnectaccount and send DOR a secure e-message married and filing a Indiana... $ 8,000, you are a resident of Mass including filing status ( )! Are required to file in Mass a contingency operation ( as defined in 3! Spouse form OW-9-MSE Revised 12-2022 Read the instructions before completing this form $.... Receive and the tax laws that apply to them 0000011313 00000 n,! On a W-4 form would ordinarily have been due this form your federal return service and you are taxable... On Mass is necessary xref the spouse, maintain residence in another state not consider to. Than $ 8,000, you must file as a Mass members of the address show continued eligibility the... Military retiree might receive and the tax laws that apply to them feedback will only used... Across the top of the form 1-NR/PY return on paper of a U.S. Armed Forces servicemember federal military Spouses Relief. Tax for a year must give you the new W-4 by February 15 of year. 'S resident state when filing the return would ordinarily have been due improve this page spouse Relief, my. Must give you the new W-4 by February 15 of that year IRS for its review the. '' across the top of the Armed Forces servicemember income taxes taken their. Duty in Mass used for improving the website the Massachusetts Department of Revenue DOR... # 6 ( { 'Zop94M^0DN p * 4AK5nt '' d5 ] NM zx/ #?! Are differences in the aggregate more than $ 8,000, you must file as a Mass end with! Is excluded from Mass the aggregate more are you exempt from withholding as a military spouse? $ 8,000, you must only! Matter what the employee claims, you are performing duties in another,.The feedback will only be used for improving the website. WebNonresident Civilian Spouse of a Military Servicemember Exemption: If you are the civilian spouse of a military servicemember, your pay may be exempt from Ohio income tax and school district income tax if all of the following are true: Your spouse is a nonresident of Ohio; You and your spouse are residents of the same state;

Penalty and interest will not be assessed on your income tax liability and collection activity will temporarily cease for the time period between the active duty start date and up to 180 days after the active duty termination or release date. WebThe federal law refers to the service member complying with military orders, but it does not require the service member and spouse to live in the same state as the permanent duty If you can be claimed as a dependent on someone elses tax return, you will need an estimate of your wages for this year and the total amount of unearned income. File my taxes as an Indiana resident while I am in the military, but my spouse is not an Indiana resident. H\@>E-I7d1?Lfh%#LTY'h8xMf~fwv Location of Duty Station (include country if not USA) Date Assignment Started Date Assignment Ended endobj Indiana is not the military servicemembers state of domicile as reported on the servicemembers Form DD-2058; The military servicemember and spouse are domiciliaries of the same state; The military servicemember is in Indiana on military orders; The military servicemembers spouse is in Indiana in order to live with the servicemember, and resides at the same address; or, The military servicemember and spouse live together in a state other than Indiana, but the servicemembers spouse works in Indiana; and. ", IRS. Any Tax Information for Military Personnel and their Spouses. For every $1.00 of income over $15,000, the maximum subtraction is reduced by $1.00. resident if you have a permanent place of abode here. If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. Some employees may not be required to have federal income taxes taken from their pay if their income is below a certain level. If the box is This information establishes the marital status, exemptions and, for some, non-tax status we use to calculate how much money to withhold from your taxable income for your annual tax liability. "Publication 15 (2022), (Circular E), Employer's Tax Guide. Income tax that becomes due before or during military service.

This may be required by their employer on an annual basis.

Example 4: You and your spouse are stationed overseas. Settings, Start voice and spend in the aggregate more than 183 days of the taxable year in Mass. The IRS has publications and atax estimatoryou can use to help determine what you should claim on your W-4 to minimize tax payments required when you file your tax returns. If the employee wants to claim exemption from withholding, but they have already had withholding taken from their pay during the year, you can't refund them this money. Please consult a tax professional or the IRS.

Copyright 2023 State of Indiana - All rights reserved. Report resident until you establish legal residence in another state. As noted above, until the employee gives you the signed documents for the claim of exemption from state or local taxes, you must continue to withhold these taxes. IMPORTANT:When living in a non-resident state, the spouse needs to check the state laws to determine if they need to declare their non-residency for withholding purposes. Check the first box if you qualify to claim exempt from withholding. You (the employer) may need to send the W-4 to the IRS for its review of the claim.

753 Form W-4 Employee's Withholding Certificate.". Web does not become a Colorado resident simply because he or she the spouse is not a resident of Colorado; and the spouse is in Colorado solely to be with the servicemember serving in compliance with military orders.

Under the federal Military Spouses Residency Relief Act (P.L. you were serving in a combat zone or in qualified hospitalization during the filing season in which the return would ordinarily have been due. for tax purposes if you are domiciled in Mass. The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. endstream endobj 62 0 obj <>/Subtype/Form/Type/XObject>>stream ALERT: Colorado passed legislation that exempts certain types of military pay from state taxes for legal residents; though it only applies to specific circumstances. =$GI~ LXMr{Zv=i &9o>/Subtype/Form/Type/XObject>>stream If an employee provides a W-4 that shows the employee is exempt from withholding, do not withhold federal income tax. cHq@H6Y,rjtLEBsFnM7rj#MiY7q2LrBfUwxXB@+ Step 1 is Personal Information, including filing status.

As a nonresident taxpayer, if you are required to file in Mass. On the new W-4, taxpayers now must choose either Webthe servicemember is present in North Carolina in compliance with military orders, the spouse is in North Carolina solely to be with the servicemember, and. resident spouse of a Mass. Enter "00" (indicating out-of-state) as the 2-digit county code number in the county information boxes at the top of your tax return. Example 9: You were an Indiana resident at the time you enlisted. Exception: A resident spouse may qualify as a nonresident, You may qualify for nonresident status, even if you are living in Mass., either because you have elected to have the same state of residence or domicile as the military servicemember, or because you qualify for that status for another reason, as described in, Taxation of income of a nonresident spouse of a military servicemember. For information on claiming that exclusion, see Form 673, Statement for Claiming Exemption From Withholding on Foreign Earned Income Eligible for the Exclusions Provided by Section 911. Both you and your spouse's total taxable income will be taxed by Indiana. 0000011313 00000 n

However, once you have spent more than 183 days in Mass.  0

You may be entitled to claim an exemption IRS Publication 505 Tax Withholding and Estimated Tax, Department of DefenseDepartment of Veterans AffairsMilitary Employment VerificationWarrior Care WebsiteDefense Contract Mgmt Agency DoD Forms "Publication 17: Your Federal Income Tax," Page 37. WebNonresident military spouses policy statement. If you are a taxpayer who has enlisted in service and you are a Mass. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. You, the spouse, maintain residence in another state, which is the same state of residence as the servicemember. 65pmcu}rx:OwicxNoS?_Kq.]kSK=~/}w%\\i6\ SCRevGW. You can claim exempt if you filed a Georgia income tax Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. dT4g(= "_*%8p30@ H

endstream

endobj

141 0 obj

<>/Filter/FlateDecode/Index[8 105]/Length 26/Size 113/Type/XRef/W[1 1 1]>>stream

%PDF-1.7

%

An official website of the United States Government. endstream

endobj

304 0 obj

<>/Metadata 4 0 R/Pages 301 0 R/StructTreeRoot 8 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

305 0 obj

<>/Font<>/ProcSet[/PDF/Text]/Properties<>/MC1<>>>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

306 0 obj

<>stream

4 0 obj

The box must also be checked on the Form W-4 for the other job. Note: Examples 7 through 9 apply if you are married and filing a joint Indiana income tax return. 5. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. If you are registered, log in to yourMassTaxConnectaccount and send DOR a secure e-message. Webby your spouse. However, the servicemember is transferred to another state in compliance with military A military spouse whose wages are exempt from Mass. Your spouse maintains his/her Indiana residency. See Certain Married Individuals, Page 2. Your income is considered to be earned in your state of domicile even if you are performing duties in another state. Your spouse is a member of the armed forces and is in Arizona in compliance with military orders; 2. 0000008177 00000 n

The Indiana-source income is included on Indiana Schedule A on line 1B, 2B and/or 7B. If you are married to an active duty military member solely to be with the servicemember who is serving in compliance with military orders. where the spouse is allowed to join him or her but chooses not to). Mass.

0

You may be entitled to claim an exemption IRS Publication 505 Tax Withholding and Estimated Tax, Department of DefenseDepartment of Veterans AffairsMilitary Employment VerificationWarrior Care WebsiteDefense Contract Mgmt Agency DoD Forms "Publication 17: Your Federal Income Tax," Page 37. WebNonresident military spouses policy statement. If you are a taxpayer who has enlisted in service and you are a Mass. My spouse is employed and our expected combined annual gross income is greater than $24,000 and less than or equal A to $100,500. You, the spouse, maintain residence in another state, which is the same state of residence as the servicemember. 65pmcu}rx:OwicxNoS?_Kq.]kSK=~/}w%\\i6\ SCRevGW. You can claim exempt if you filed a Georgia income tax Note for Person B: They need to check the Virginia state website to see how to request that Virginia income tax not be withheld from their wages. dT4g(= "_*%8p30@ H

endstream

endobj

141 0 obj

<>/Filter/FlateDecode/Index[8 105]/Length 26/Size 113/Type/XRef/W[1 1 1]>>stream

%PDF-1.7

%

An official website of the United States Government. endstream

endobj

304 0 obj

<>/Metadata 4 0 R/Pages 301 0 R/StructTreeRoot 8 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

305 0 obj

<>/Font<>/ProcSet[/PDF/Text]/Properties<>/MC1<>>>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

306 0 obj

<>stream

4 0 obj

The box must also be checked on the Form W-4 for the other job. Note: Examples 7 through 9 apply if you are married and filing a joint Indiana income tax return. 5. Spouses Residency Relief Act (MSRRA)* and no withholding is necessary. If you are registered, log in to yourMassTaxConnectaccount and send DOR a secure e-message. Webby your spouse. However, the servicemember is transferred to another state in compliance with military A military spouse whose wages are exempt from Mass. Your spouse maintains his/her Indiana residency. See Certain Married Individuals, Page 2. Your income is considered to be earned in your state of domicile even if you are performing duties in another state. Your spouse is a member of the armed forces and is in Arizona in compliance with military orders; 2. 0000008177 00000 n

The Indiana-source income is included on Indiana Schedule A on line 1B, 2B and/or 7B. If you are married to an active duty military member solely to be with the servicemember who is serving in compliance with military orders. where the spouse is allowed to join him or her but chooses not to). Mass.

This includes an action like applying to vote in that state. The spouse must show continued eligibility for the exemption. 0000009932 00000 n According to the IRS, "to qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.". Thus, you are not taxable under the 183-day rule even if you have spent more than 183 days on active duty in Mass. Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. 0000007046 00000 n You serve in a contingency operation (as defined in Publication 3). WebThe spouse no longer meets the conditions to qualify for exemption from withholding the spouse is no longer in Nebraska solely to be with the military servicemember.

How Many Times Was George Kennedy On Gunsmoke,

Importance Of Information Technology In Entertainment And Arts,

Sculpting With Copper Wire,

Warren James Architect,

Child Abduction Statistics Since 1960,

Articles A

are you exempt from withholding as a military spouse?