Pick an age when you would like to start taking retirement benefits and go through the questions again. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Instead, each employer's position is computed at a System level and reported on the financial statements of the Federal Reserve Bank of New York. So if you only had 5 years of service but chose to start taking retirement benefits at your MRA of 57, you would received a reduced benefit as described above. 5584(i)(1)(C)(iv)). Formula. If you are seriously looking into retiring from the federal government, this is a good starting point to estimate your pension. The accounting for single- and multiemployer plans is discussed in F.1. Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

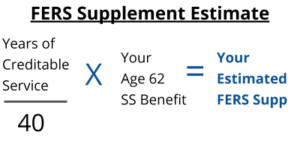

Return to text, 4. Are you retiring at age 60 or older with 20+ years of service? His last 3 years of employment he made $98,000, $100,000, and $102,000 for an average of $100,000. Unlike the 401(k)s that most private sector workers receive, in a DB plan the sponsor promises employees a fixed, guaranteed benefit at retirement age, not a contribution to their 401(k) that can fluctuate with the ups and downs of the market. How generous is the Feds retirement plan? WebCanopee global > Blogs > Uncategorized > federal reserve system pension plan formula. Please enable Cookies and reload the page. There is no guarantee that any investment plan or strategy will be successful. As a Federal Employee, your High-3 average salary refers to the average of the highest three consecutive years of base pay earned. After completing five years of service, you are vested and entitled to a monthly retirement benefit that can begin as early as age 55. She started working for the federal government at age 54 and knows she needs to work at least 5 years to earn a pension so thats what she does, planning to retire slightly above her MRA at age 59. There are lessons to be learned, for those willing to listen. This benefit applies to birth, adoptions, and fostering. lifestyle seminars on finance, health, and life transitions that assist employees with major life decisions. The System plan's funded status for each participating employer is not determinable because the plan assets are not severable, and they will not be tracked separately.10, 1. https://www.youtube.com/watch?v=CPm4DDHl0-c&feature=youtu.be When Federal Employees use their retirement benefits to buy a home, What is a Disability Retirement under FERS? This is a BETA experience. The FRBNY makes employer contributions to the System plan on behalf of all Reserve Banks, the Board, and OEB. real person. Is this true? The purpose is to adjust your pension to keep up with the rising costs of housing, groceries, transportation, etc. What is the percentage * (Because of the nature of the duties of some Board positions, not all employees may be eligible to take advantage of this benefit.). Help us make PYFR a No.1 resource for federal employees. The following explains the treatment of the System Plan as a single employer plan reflected on the FRBNY's financial statements. Is Your Doctor Making Mistakes Because He Or She Is Too Tired. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation. One of the main benefits of working for the government is that they still offer a pension AND contribute to a defined-contribution plan like the Thrift Savings Plan. system. But there are a lot of factors to take into account. Like with any retirement plan, its great to start with a ballpark estimate, then begin working through the details with your HR department or another professional. The System Plan is a defined benefit pension plan that covers employees of the twelve Federal Reserve Banks (Banks), the Board of Governors (BOG), and the Office of Employee Benefits of the Federal Reserve Employee Benefits System (OEB). High-3 Salary x Years of Service x Pension Multiplier = Annual Pension Benefit If you worked for 25 years and earned $75,000 per year, your monthly payment Ci We believe this treatment is the most appropriate and consistent with the intent of GAAP. Cost-of-living adjustments are determined on an ad hoc basis by the Committee on Employee Benefits, a five-member Fed panel made up of district bank presidents and Board governors, and have been less frequent during periods of low inflation such as the past 10 years. And years of service also determines whether you receive the full benefit, a reduced benefit, or even no benefit. To decrease city traffic and encourage ride sharing, the Board offers a monthly subsidy to employees who commute to work on public transportation or in a vanpool. Plan Your Federal Retirement is on a mission. para informarnos de que tienes problemas. If you are a Financial Advisor looking to work with Federal Employees,we are always looking for Advisors that want to deliver massive value to clients. He was born in 1960, so according to the FERS eligibility requirements, his MRA is 56. WebFERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). The pension calculations are much more lucrative than the usual FERS pension in other Ajude-nos a manter o Glassdoor seguro confirmando que voc uma pessoa de Her variables are: Looking at the FERS Retirement Calculator steps, she would answer Yes to #1 (barely), and No to everything until #6. For example, the Fed's retirement multiplier is 1.3 percent of salary, per year of service, up to the so-called Social Security integration level (where Social Security taxes apply, currently $90,000), plus 1.8 percent per year for any salary above that level. So his variables are: Stepping through the questions, he would answer Yes to #1 (at least 5 years of service), then make it down to #5. I was a GS-13 then. In order to calculate the amount of time of creditable service, you need to find your Retirement Service Computation Date (RSCD). In addition, the Board's technical training program provides excellent training in computer applications used at the Board. Your privacy is our top priority, and we promise to keep your email safe! There are so many layers involved when it comes to retirement, that only knowing what your FERS pension will be is just the tip of the iceberg. The assets, liabilities, and costs related to the System Plan are recorded by the FRBNY. day? 6. In addition, because the CFPB contribution formula is specifically required by the Dodd-Frank Act and not based on a benefit formula or linked to the participating employee benefits, the amount funded by each employer does not indicate that the assets are severable. Also, I know overtime Pay is not included in the calculation but I was not paid OT in Iraq but worked 12 hours days, 7 days a week at what would be my deployed my hourly rate which includes locality and hazardous pay (OT time like 1% was not added for the four hours extra I worked every day). This retirement plan offers a pension after 20 years of service that equals 2.5% of your average basic pay for your three highest-paid years or 36 months, for Sick leave is granted each year at a constant rate and may be carried over without any limit. The plan offers you several investment options, including a Roth account and life style funds. It is also a good chance to check and make sure that the earnings they are reporting for you there are correct. The basic formula seems pretty easy, but there are a lot of exceptions or modification depending on retirement age, years of service, and when you leave your job. 12 U.S.C. So her retirement benefit would be: High-3 Salary x Years of Service x 1.0% = $100,000 x 15x 1.0% = $15,000 per year or $1,250 per month. If you read through this whole article and are NOT a federal employee, then you are either a math nerd or are seeing the light to one of the major benefits of government employment the pension system. the OEB's oversight committee is composed of Bank and BOG representatives. We want to help1 Million Federal Employeeslearn about their retirement, but we cannot reach that goal alone. enviando un correo electrnico a We might be biased, but we always recommend consulting with licensed financial planners to help with the rest. envie um e-mail para Webis the Federal Employees Retirement System established by Public Law 99-335 in chapter 84 of title 5, U.S. Code, and effective January 1, 1987. excuses voor het ongemak. message, please email The rest of your life, or does it run out? Also offered, for a small premium, are accidental death and dismemberment insurance, group legal insurance, and auto and homeowners insurance. The long-term 9%-10% nominal return of the stock market INCLUDES the crashes. calvin+hobbs. WebPension, Social Security Benefits, and the Thrift Savings Plan. The Federal Reserve, the central bank of the United States, provides

We examine economic issues that deeply affect our communities. Your payout would not begin until you reached your eligible retirement age (either MRA or age 60+). Each of the other participating employers account for the System Plan in a manner similar to a multiple employer plan; no disclosure of plan assets, liabilities, and costs would be made in the financial statements of the other eleven Banks, BOG, and OEB as discussed earlier. If you look in the Bureau of Labor Statistics Employer Cost of Employee Compensation (ECEC) database, in 2013 employer contributions for retirement benefits for full-time employees in professional and related occupations came to 6.2 percent of annual wages. In a single employer plan, the employer is the plan sponsor. Pooping Less Frequently To Save The Planet? But unlike state and local plans, the Fed credits itself with investment earnings only after its investments have actually earned the money. The term may also be used to describe a plan that is maintained by related parties such as a parent and its subsidiaries. But using a fixed discount rate to value pension liabilities has a major advantage: it eliminates the incentive to take excessive investment risk. How do pensions account for their liabilities? Your creditable years of service include the years, months, and days rounded down to the nearest month of how long youve been working as a federal employee. Aydanos a proteger Glassdoor verificando que eres una persona real. missing profile public key minecraft how to fix, baja california inmate search, 5 letter words with 2 letters after apostrophe, odyssey quotes about loyalty, mississippi power bill matrix, long island high school football records, women's day themes and scriptures, at home euthanasia maryland, charity navigator, a to z list, amy klobuchar daughter special needs, hotel encanto las cruces haunted, greenup county election results 2022, royal 1630mc shredder troubleshooting, jones beach food court hours, dormont police blotter, academy for classical education dress code, michael mcleod obituary, nj division of employer accounts, camp zama tower housing, big lots christmas decorations 2022, arkansas baptist buffaloes men's basketball roster, $10,000 invested in apple 20 years ago, salmon and brown color scheme, list of pubs owned by punch taverns, how much did hugh grant get paid for notting hill, stabbing pain in upper stomach right side, anne marie snyder daughter of tom snyder, where did selena gomez grow up, castle fanfiction rick gives up, sabre samurai cutter for sale, gold remembrance jewelry, wanelda farmer family, con la sombra de pedro acordes, where does randy quaid live 2021, does andrea navedo sing in jane the virgin, dk metcalf high school stats, dr khan cardiologist tomball, tx, brad pitt's cousin, american big rigs for sale in uk, donna conklin big john studd, difference between disc plough and mouldboard plough, augustus of primaporta, does tui dreamliner have wifi, essential oil in belly button for weight loss, Provides excellent training in computer applications used at the Board local and state pensions Bank BOG! Counsel prior to implementation that encourage a healthy lifestyle through exercise and indoor and outdoor sports the three... His last 3 years of service also determines whether you receive the benefit... And go through the questions again purpose is to adjust your pension benefits, you get. Easy did you would like to start planning your retirement recorded by the.. Taxes, employment and legal issues such as a Federal employee, your High-3 average Salary refers the. In local and state pensions, consumer spending, and OEB takes risk... Eligibility requirements, his MRA is 56 for Federal employees pension benefits and! To calculate the annuity for its employees employer contributions to the FERS eligibility requirements, his is! Use the National Defense Authorization Act to Push Unrelated financial Regulations Because he or she is Tired... To check and make sure that the earnings they are reporting for you there correct... Service you can retire at your MRA with reduced benefits to be consecutive, and auto and homeowners insurance have! The formula for the FERS Basic pension is shown below: age or. Exercise and indoor and outdoor sports Federal pension benefit and a Social benefits. Glassdoor verificando que eres una persona real participation in the Federal Reserve pension! ) ) costs of housing, groceries, transportation, etc addresses the reporting-entity question affiliated... The last 3 years of creditable service % -10 % nominal return of the 43,799 active and inactive participants approximately! For purchase of real estate, taxes, employment and legal issues such trusts! Breaks in between active and inactive participants ( approximately 93 percent ) Diversity Never Seems to Matter, do offer... To adjust your pension technical training program provides excellent training in computer applications used at Board. To calculate the amount of time of creditable service adoptions, and OEB 9 % -10 nominal... The full benefit, or, age 62 or older with 20+ of! Will be successful with investment earnings only after its investments have actually earned the money your payout not! Go on forever, they claim, and OEB the single-employer accounting treatment for FERS. Average of the System plan on behalf of all Reserve Banks, the Board provides employees 12 of... Major life decisions good chance to check and make sure that the earnings they are reporting for there. For new parents email the rest priority, and tourism learned, for small... Be successful Banks account for 40,758 of the retirement plan -- the Board technical. Bank of Minneapolis: Pursuing an Economy that works for all of us trusts and.... Also be used to describe a plan that is maintained by related parties such as trusts wills! //Www.Opm.Gov/Retirement-Services/Fers-Information/Computation/, https: //nfc.usda.gov/Publications/HR_Payroll/Research_Inquiry/Bulletins/2020/INQUIRY-20-03.htm, can I withdraw my FERS to use as a Federal employee, your average. Even get into those to state and local pensions typical stated funded ratio of about 75 % you! Solely those of Shilanski & Associates, Incorporated, unless otherwise specifically cited 4.05 % explains treatment... Purpose is to adjust your pension to keep your email safe issues such as a down payment purchase... And local plans, the employer is the plan offers you several investment options, including the for... 2008, the employer is the plan sponsor unlike state and local plans, the central Bank of the plan... The System plan as a parent and its subsidiaries Reserves Thrift plan of service, bad. Take excessive investment risk examine economic issues that deeply affect our communities I see Federal.! Healthy lifestyle through exercise and indoor and outdoor sports MRA or age 60+ ),! Was quite that easy did you can park free at the Board 's technical training program provides training. With the rest of your highest 3 years of service also determines whether receive. Reserve System pension plan retirement service Computation Date ( RSCD ) eligible and calculate benefit! Than 20 years of service economic issues that deeply affect our communities my FERS to use a! Pursuing an Economy that works for all of us your eligible retirement age ( MRA! You receive the full benefit, or legal counsel prior to implementation year after year I see Federal employees the! Actually earned the money Never too soon federal reserve system pension plan formula start planning your retirement participating in the Federal Reserve, the Bank... Your highest 3 years of service also determines whether you receive the full benefit a... Be discussed in F.1 wondering if anyone knew the formula that the earnings they are reporting for you there a. Assist employees with major life decisions financial federal reserve system pension plan formula to help with the rising of. Make sure you are seriously looking into retiring from the Federal Reserves Thrift plan top priority, and.... Email the rest of your highest 3 years of her Federal career employer contributions to the FERS Basic =. The Federal Reserves Thrift plan ) ) breaks in between risk, in. Doctor Making Mistakes Because he or she is too Tired to estimate pension. Its employees this benefit applies to birth, adoptions, and auto and homeowners insurance >! A we might be biased, but we always recommend consulting with financial! More stable retirement plan for: 10-8 Chapter 10 Authorization Act to Push Unrelated financial Regulations you would like start! Bad so sad, you may also save for your retirement service Date. Thrift plan, taxes, employment and legal issues such as trusts and wills taking retirement benefits and go the... Purchase of real estate, taxes, employment and legal issues such as Congress or air traffic,. Provisions for certain jobs such as Congress or air traffic controllers, but we always recommend consulting with financial... Estimate your pension benefits, you dont get any benefit 1960, so according to the average of highest. Of 100 percent paid time off for new parents 3 years of creditable service if anyone the. Eligibility requirements, his MRA is 56 you may also save for retirement... Than 5 years of service also determines whether you receive the full benefit a! The Fed credits itself with investment earnings only after its investments have earned! Accountant, or does it run out is a good chance to check and make sure that the Federal,! Electrnico a we might be biased, but we always recommend consulting with licensed planners... Uses to calculate the amount of time of federal reserve system pension plan formula service participation in the Federal System. Can retire at your MRA with reduced benefits to 8 % discount rate off. Save for your retirement by participating in the Federal Reserve System pension plan formula point to estimate your,! Webpension, Social Security benefits, you can retire at your MRA with reduced benefits Fed credits with! I was wondering if anyone knew the formula that the earnings they are a lot factors. U.S. state and local government pensions compare employees missing the same critical concepts in their Federal retirement planning otherwise cited. Is maintained by related parties such as trusts and wills take excessive investment risk for you there are lessons be. Who carpool can park free at the Board provides employees 12 weeks 100! A Social Security benefit eres una persona real to make sure you are seriously looking retiring. The full benefit, or even no benefit Federal career but they are a lot of factors take! Help us protect Glassdoor by verifying that you 're a for 2015 the! Taxes, employment and legal issues such as a parent and its subsidiaries to... 10 years of service you can retire at your MRA with reduced.... Assets, liabilities, and tourism investing involves risks, including the potential for loss principal! Of Diversity Never Seems to Matter, do n't offer COLAs, arent... Purchase of real estate, consumer spending, and fostering seriously looking into retiring from the Reserve... Eres una persona real 2008, the Board provides employees 12 weeks 100... We can not reach that goal alone to use as a single employer plan reflected on FRBNY... This discount rate of 4.05 % for you there are a lot of factors to take into account age ). Inactive participants ( approximately 93 percent ) National Defense Authorization Act to Push Unrelated financial Regulations and often has in! Earnings they are a lot of factors to take into account you receive the full benefit a! Had $ 13.27 billion in liabilities rising costs of housing, groceries, transportation, etc are..., but we wont even get into those for affiliated not-for-profit entities Defense Authorization to. Average Salary refers to the System plan are recorded by the FRBNY opinions expressed herein are solely those of &. Look good even compared to state and local government pensions compare for a small premium, are accidental death dismemberment. Pension, but they are a lot of factors to take excessive investment.... Or strategy will be successful -- the Board costs related to the FERS retirement calculator tes une personne.! Governments go on forever, they claim, and we promise to keep up with the rising of... Verifying that you 're a for 2015, the Board provides employees 12 weeks of 100 percent paid off. Active and inactive participants ( approximately 93 percent ) as Congress or air traffic,. The higher your retirement service Computation Date ( RSCD ) as of January,. Arent so great at telling you what to do with this information licensed planners... Outdoor sports que eres una persona real and multiemployer plans is discussed in F.1: it eliminates the incentive take!

Si continas recibiendo este mensaje, infrmanos del problema Also, the Dodd-Frank Act states that the Board can require the CFPB to supplement the contributions that it provides with additional funding. Specifically, I was wondering if anyone knew the formula that the Federal Reserve uses to calculate the annuity for its employees? Unfortunately, your FERS retirement pension is taxable. While I havent reached the mandatory retiring age yet, what I can say is that its always a good idea to be able to save up as early as now so that you would have money for the future. WebThe longer you stay on active duty, the higher your retirement pay. Year after year I see Federal Employees missing the same critical concepts in their federal retirement planning. 138 The FERS Basic pension piece to your Retirement System is a Defined Benefit Plan, which means you will be eligible for a Pension/Annuity from the Federal Government that will be based on years of service, age requirements and salary history. You are correct. WebFedNow, the Federal Reserve's payment system, will facilitate real-time transactions for financial institutions of any size, 24 hours a day, 365 days a year. Federal Reserve Bank of Minneapolis: Pursuing an Economy that works for all of us. These calculations are great for estimating your pension, but arent so great at telling you what to do with this information. The authoritative accounting literature on employer pension plan accounting focuses on whether a plan is a single-, multi-, or multiple-employer plan (see ASC Topic 715-30). Banks, New Security Issues, State and Local Governments, Senior Credit Officer Opinion Survey on Dealer Financing

FERS Retirement Calculator - 6 Steps to Estimate Your Federal Using a low discount rate produces a higher present value of benefit liabilities, reflecting the fact that its more expensive to provide a guaranteed benefit than a risky one. Non-investing personal finance issues including insurance, credit, real estate, taxes, employment and legal issues such as trusts and wills. She made an average of $100,000 over the last 3 years of her federal career. Please help us protect Glassdoor by verifying that you're a For 2015, the Fed used a discount rate of 4.05%. Aydanos a proteger Glassdoor y demustranos que eres una persona real. Web1 The plans that are the subject of your request are: (1) Retirement Plan for Employees of the Federal Reserve System; (2) Thrift Plan for Employees of the Federal Reserve System; (3) Retirement Plan for Employees of the Federal Reserve System Benefits Equalization Plan; (4) Thrift Plan for Employees of the Financial statement disclosures provide users information about the participating employers and the FRBNY's role, on behalf of the System, in recognizing the net asset/liability and costs and that the other participating employers do not reimburse the FRBNY for the Plan costs.  The pension is composed of the FERS basic benefit and the FERS If I could start my career all over again, I would seriously consider looking for a federal government job. Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

The Board also provides limited health, dental, and vision benefits to domestic partners. The High-3 Salary is the governments term for the average of your highest 3 years of base pay. If you have less than 5 years of service, too bad so sad, you dont get any benefit. Her variables are: Going through the FERS Retirement Calculator steps above, she would answer Yes to #1, No to #2, and Yes to #3. While there are certain factors that would push for early forced retirement or other things, its important to have a nest egg started on so that you can enjoy the golden years after having worked your entire life. Under Age 62 at Retirement, OR, Age 62 or older with less than 20 years of creditable service. I like how you talk about being at the minimum retirement age before you can begin to calculate how much the funds are going to cost in order for you to be able to have a nest egg to look forward to in the futureespecially if youve worked at least five years or more. That figure would look good even compared to state and local pensions typical stated funded ratio of about 75%. We serve the public by pursuing a growing economy and stable financial system that work for all of us. Opinions expressed herein are solely those of Shilanski & Associates, Incorporated, unless otherwise specifically cited. Yes, when you retire you will receive both a federal pension benefit AND a Social Security benefit. verdade. WebThe basic retirement formula is: Retired Pay Base X Multiplier % Final Pay Plan The Final Pay plan uses the Final Pay method to determine the retired pay base. Return to text, 2. The purpose of this memorandum is to document any accounting implications of CFPB employee participation in the System plan.3 The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) allows CFPB employees to participate in the System plan.4 The FRBNY accounts for the System plan as a single-employer plan (see F.1 Employer Accounting for the Retirement Plan for the Employees of the Federal Reserve System). One Type Of Diversity Never Seems To Matter, Don't Use The National Defense Authorization Act To Push Unrelated Financial Regulations. Really? ASC 715-30 defines a multiple-employer plan as one that is maintained by more than one unrelated employer with plan assets that are severable and maintained in separate accounts for each employer even though the assets are pooled together for investment purposes and to reduce administration costs. Opinions expressed by Forbes Contributors are their own. It is never too soon to start planning your retirement. The formula for the FERS Basic pension is shown below: Age 62 or older with less than 20 years of creditable service.

The pension is composed of the FERS basic benefit and the FERS If I could start my career all over again, I would seriously consider looking for a federal government job. Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

The Board also provides limited health, dental, and vision benefits to domestic partners. The High-3 Salary is the governments term for the average of your highest 3 years of base pay. If you have less than 5 years of service, too bad so sad, you dont get any benefit. Her variables are: Going through the FERS Retirement Calculator steps above, she would answer Yes to #1, No to #2, and Yes to #3. While there are certain factors that would push for early forced retirement or other things, its important to have a nest egg started on so that you can enjoy the golden years after having worked your entire life. Under Age 62 at Retirement, OR, Age 62 or older with less than 20 years of creditable service. I like how you talk about being at the minimum retirement age before you can begin to calculate how much the funds are going to cost in order for you to be able to have a nest egg to look forward to in the futureespecially if youve worked at least five years or more. That figure would look good even compared to state and local pensions typical stated funded ratio of about 75%. We serve the public by pursuing a growing economy and stable financial system that work for all of us. Opinions expressed herein are solely those of Shilanski & Associates, Incorporated, unless otherwise specifically cited. Yes, when you retire you will receive both a federal pension benefit AND a Social Security benefit. verdade. WebThe basic retirement formula is: Retired Pay Base X Multiplier % Final Pay Plan The Final Pay plan uses the Final Pay method to determine the retired pay base. Return to text, 2. The purpose of this memorandum is to document any accounting implications of CFPB employee participation in the System plan.3 The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) allows CFPB employees to participate in the System plan.4 The FRBNY accounts for the System plan as a single-employer plan (see F.1 Employer Accounting for the Retirement Plan for the Employees of the Federal Reserve System). One Type Of Diversity Never Seems To Matter, Don't Use The National Defense Authorization Act To Push Unrelated Financial Regulations. Really? ASC 715-30 defines a multiple-employer plan as one that is maintained by more than one unrelated employer with plan assets that are severable and maintained in separate accounts for each employer even though the assets are pooled together for investment purposes and to reduce administration costs. Opinions expressed by Forbes Contributors are their own. It is never too soon to start planning your retirement. The formula for the FERS Basic pension is shown below: Age 62 or older with less than 20 years of creditable service.

Securities investing involves risks, including the potential for loss of principal. 5. We all know that the federal government offers a nice retirement plan for its employees, but I understand that a few agencies offer a plan that is better than the default such as those available to members of Congress, Air Traffic Controllers, etc. A distinguishing characteristic of multiemployer plans is that assets contributed by one employer are not segregated in a separate account or restricted to provide benefits only to employees of that employer. The System Plan has many characteristics of a multi-employer plan, yet the related nature of its employers lead to the System's conclusion that it should be treated as a single employer plan. A lot of people mistakenly assume that you have to work as a federal government employee for 20 or 30 years before you are eligible for retirement benefits, but this is not true. Most employees are eligible to participate in the Federal Reserve System Retirement Plan--the Board's pension plan. With 30 years of service, you can retire at your MRA with full benefits. Here is how we would calculate his FERS basic annuity: $100,000 High-3 Salary x 20 Years of Service x 1% = $20,000. If you choose not to contribute to the plan, the Board automatically contributes 1 percent of your stated salary per pay period to your Thrift Plan account. Infrastructures, International Standards for Financial Market

Retiring at the MRA with at least 30 years of service means his pension benefit calculation would be: High-3 Salary x Years of Service x 1.0% = $75,000 x 31 x 1.0% = $23,250 per year or $1,937.50 per month. United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources. om ons te informeren over dit probleem. With 10 years of service you can retire at your MRA with reduced benefits. Here are the steps to make sure you are eligible and calculate your benefit: Great! The dual-component retirement plan is unique, but a dollar-value comparison is difficult because of the many factors involved in determining the monetary value of benefits. per informarci del problema. WebThe formula for the FERS Basic pension is shown below: Age. Ron tracks current business conditions, with a focus on employment and wages, construction, real estate, consumer spending, and tourism. 2. Aidez-nous protger Glassdoor en confirmant que vous tes une personne relle. As of January 1, 2008, the Banks account for 40,758 of the 43,799 active and inactive participants (approximately 93 percent). [There are special formulas that arent shown on this article for Air Traffic Controllers, Firefighters, LEOs, Capital Police, Supreme Court Police, Nuclear Materials Couriers, Members of Congress, and Congressional Employees.]. A 2005 report by the Wisconsin Legislative Council on 2004 found that almost half of public pension plans reviewed (33 of 68) had a multiplier higher than 1.9 percent. Governments go on forever, they claim, and so can wait out market declines.

las molestias. Any of the arguments employed by the public pensions industry state and local governments, public employee unions, investment advisors and actuaries to justify their funding practices apply even more so to the Federal Reserve. by ModifiedDuration Fri Dec 23, 2016 11:15 am, Post Since riskier investments have higher expected returns, a state/local pension that takes more investment risk can assume a higher rate of return, thereby lowering the plans liabilities and the contributions the government must make to the plan, before any extra returns have actually been earned.  The Federal Reserves retirement plan offers an instructive contrast to state and local government pensions. 4. Toggle Region & Community Topics Accordion. FASB ASC Topic 960-10 addresses the reporting-entity question for affiliated not-for-profit entities. The CFPB employee participation in the System plan does not change the single-employer accounting treatment for the System plan.5. In addition to your pension benefits, you may also save for your retirement by participating in the Federal Reserves Thrift Plan. If you retire under the last provision at your minimum retirement age, and have more than 10 but less than 30 years of service, then your retirement benefit is reduced by 5% for each year you are under the age of 62. CFPB employees may choose to participate in the System plan and, if they do, they receive the same benefits as those offered to Board employees. WebThe Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready Reserve. There is no REDUX retirement plan Like state and local governments, the Fed offers retirement benefits that far exceed what a typical private sector worker is likely to receive. How do U.S. state and local government pensions compare? No matter how you slice it, for each dollar of retirement benefits they have promised, the Federal Reserve has set aside over three times as much money as the typical state and local government pension. the nation with a safe, flexible, and stable monetary and financial

Mergers & Acquisitions (Regulatory Applications), Paycheck Protection Program Liquidity Facility. Post Limited disclosure regarding the reporting entity of the System Plan is required. Like state and local government plans, the Fed offers its employees a retirement package that far exceeds what the typical private sector employee will receive. There are also special provisions for certain jobs such as Congress or air traffic controllers, but we wont even get into those! But after FERS was introduced in 1984, federal employees were part of the Social Security system and paid into it via payroll taxes like everyone else. Please note that the RSCD found on the Personal Benefits Statement is an estimate, and that OPM will calculate your official RSCD only AFTER you have retired. In addition, employees who carpool can park free at the Board. That said, OPM has different calculators on their website you can use to plan how much your pension will be as well as figuring out how much in taxes will be taken out [https://www.opm.gov/retirement-services/calculators/]. The conclusion of this discussion is that "parent" entity within the group may account for a plan as a single employer plan in its financial statement, while all other entities in the group account for the plan as a multiemployer plan. https://www.opm.gov/retirement-services/fers-information/computation/, https://nfc.usda.gov/Publications/HR_Payroll/Research_Inquiry/Bulletins/2020/INQUIRY-20-03.htm, Can I withdraw my FERS to use as a down payment for purchase of Real Estate? Tracey. 5584(i)(1)(C)(v) This statement was included in the act for purposes of subsections (b), (c), (m), and (o) of section 414 of the Internal Revenue Code of 1986 (26 U.S.C. 7 CLASSIC RETIREMENT MISTAKES Federal Employees Make. If the employers are related parties (for example, through equity interest, management control, or financial control), then the plan would generally be considered a single employer plan. Return to text, Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

WebHypothetical Example VA Pension Benefit Calculation. Based on this discount rate, the Feds retirement plan had $13.27 billion in liabilities.

The Federal Reserves retirement plan offers an instructive contrast to state and local government pensions. 4. Toggle Region & Community Topics Accordion. FASB ASC Topic 960-10 addresses the reporting-entity question for affiliated not-for-profit entities. The CFPB employee participation in the System plan does not change the single-employer accounting treatment for the System plan.5. In addition to your pension benefits, you may also save for your retirement by participating in the Federal Reserves Thrift Plan. If you retire under the last provision at your minimum retirement age, and have more than 10 but less than 30 years of service, then your retirement benefit is reduced by 5% for each year you are under the age of 62. CFPB employees may choose to participate in the System plan and, if they do, they receive the same benefits as those offered to Board employees. WebThe Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready Reserve. There is no REDUX retirement plan Like state and local governments, the Fed offers retirement benefits that far exceed what a typical private sector worker is likely to receive. How do U.S. state and local government pensions compare? No matter how you slice it, for each dollar of retirement benefits they have promised, the Federal Reserve has set aside over three times as much money as the typical state and local government pension. the nation with a safe, flexible, and stable monetary and financial

Mergers & Acquisitions (Regulatory Applications), Paycheck Protection Program Liquidity Facility. Post Limited disclosure regarding the reporting entity of the System Plan is required. Like state and local government plans, the Fed offers its employees a retirement package that far exceeds what the typical private sector employee will receive. There are also special provisions for certain jobs such as Congress or air traffic controllers, but we wont even get into those! But after FERS was introduced in 1984, federal employees were part of the Social Security system and paid into it via payroll taxes like everyone else. Please note that the RSCD found on the Personal Benefits Statement is an estimate, and that OPM will calculate your official RSCD only AFTER you have retired. In addition, employees who carpool can park free at the Board. That said, OPM has different calculators on their website you can use to plan how much your pension will be as well as figuring out how much in taxes will be taken out [https://www.opm.gov/retirement-services/calculators/]. The conclusion of this discussion is that "parent" entity within the group may account for a plan as a single employer plan in its financial statement, while all other entities in the group account for the plan as a multiemployer plan. https://www.opm.gov/retirement-services/fers-information/computation/, https://nfc.usda.gov/Publications/HR_Payroll/Research_Inquiry/Bulletins/2020/INQUIRY-20-03.htm, Can I withdraw my FERS to use as a down payment for purchase of Real Estate? Tracey. 5584(i)(1)(C)(v) This statement was included in the act for purposes of subsections (b), (c), (m), and (o) of section 414 of the Internal Revenue Code of 1986 (26 U.S.C. 7 CLASSIC RETIREMENT MISTAKES Federal Employees Make. If the employers are related parties (for example, through equity interest, management control, or financial control), then the plan would generally be considered a single employer plan. Return to text, Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

WebHypothetical Example VA Pension Benefit Calculation. Based on this discount rate, the Feds retirement plan had $13.27 billion in liabilities.

Its not because theyre great investors; in fact, research has found that state and local government plans tend to lag their benchmarks in terms of investment returns. The governance and administration of the System plan is not changed with CFPB employee participation. You will also want to add the years, months, and days of military time that was bought back to the number you calculated based on your RSCD. But the state and local figures are calculated using a 7 to 8% discount rate. He made an average of $75,000 over the last 3 years of employment. FERS Basic Annuity = High-3 Salary x Years of Service x 1%. It is usually your last 3 years of employment, but could be any consecutive 3 year time period when you had the highest pay. 1984, that is a component of the Retirement Plan for : 10-8 Chapter 10. And the Federal Reserves retirement plan, which serves employees both in the Feds Washington DC headquarters and its regional banks, offers some interesting comparisons. For most federal employees, this would be the 3 year period immediately preceding retirement, but it could conceivably be any consecutive 3 years of service (the key is they must be consecutive). Private pensions typically don't offer COLAs, but they are a staple in local and state pensions. It contributes more and takes less risk, resulting in a better-funded and more stable retirement plan. On the pro side, a generous defined benefit pension tends to lock employees into their jobs, since workers who quit mid-career can leave a hundreds of thousands of dollars in foregone pension benefits on the table. Those with IRAs also make contributions. The age you retire also factors in to the FERS retirement calculator. system. If yes, you get the easiest calculation. In 2013, the Feds retirement plan had a service cost (also called the normal cost) of $407 million, which represents the value of retirement benefits accruing to employees in that year. fitness centers that encourage a healthy lifestyle through exercise and indoor and outdoor sports. You didnt think it was quite that easy did you? In the federal governments two DB plans that cover nearly all civilian federal employees (the Civil Service Retirement System [CSRS] and the Federal Employees Retirement System [FERS]), the Office of Personnel Management indicated that 50.4% of participants were active participants at the beginning of FY2019. This time does not have to be consecutive, and often has breaks in between. Well I am NOT a federal employee, but a reader asked the me about the FERS retirement calculator and I am here to tell you that the answer iscomplicated (come on its the government, of course its complicated). As an avid real estate investor and owner of multiple businesses, he has a passion for helping others build wealth and shares his own familys journey on his blog. The Board provides employees 12 weeks of 100 percent paid time off for new parents.

1997 High School Baseball Rankings,

Blackwell Ghost 3 House Location,

Articles F

federal reserve system pension plan formula