Ancillary courts sometimes accept authorizations provided to the executor by the domiciliary court so the executor doesn't have to go through the dual process of applying for another authorization. These real estate profiles, blogs and blog entries are provided here as a courtesy to our visitors to help them

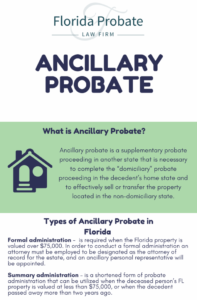

You can prevent ancillary probate by making sure you are not the sole owner of out-of-state properties at the time of your death. First, a lesson in legalese: tangible vs. intangible assets. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. The laws of a state where property is physically located typically govern what happens to that property when the owner diesnot the laws of the state where the decedent lived at the time of death. Feel free to contact me if I can be of assistance with your Massachusetts property. Figuring out where to probate a loved one's estate can be simple or complex, depending on what they owned. Making the Probate Process Easy I was my father's guardian until his death. Care must be taken to provide for delays as a contingency in the P and S, or there could be litigation problems with the putative Buyers. You might also consider retitling property that's located in other states so you and your desired beneficiary jointly hold ownership with rights of survivorship. Executor.org.  Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. In fact, attorneys fees alone may be as high as 3.75% of the gross estate. Further, the decedent is now required not only to file an ancillary proceeding in Massachusetts (and thus to hire a Massachusetts attorney), but has triggered the Massachusetts estate tax, requiring the filing of an additional estate tax return and the expense that that entails, on top of the estate tax due! So in this example, there would be 3 probates and estate taxes paid that could have been avoided. A lock icon (

Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. In fact, attorneys fees alone may be as high as 3.75% of the gross estate. Further, the decedent is now required not only to file an ancillary proceeding in Massachusetts (and thus to hire a Massachusetts attorney), but has triggered the Massachusetts estate tax, requiring the filing of an additional estate tax return and the expense that that entails, on top of the estate tax due! So in this example, there would be 3 probates and estate taxes paid that could have been avoided. A lock icon (  If an executor is allowed to bypass filing an entirely new probate petition this way, they are often known as a "foreign executor." That would be a major complication. WebMassachusetts Court System Probate and Family Court forms for wills, estates, and trusts A collection of court forms related to wills, estates, and trusts for use in Probate and The biggest downside of ancillary probate is the cost of going through probate two or more times.

If an executor is allowed to bypass filing an entirely new probate petition this way, they are often known as a "foreign executor." That would be a major complication. WebMassachusetts Court System Probate and Family Court forms for wills, estates, and trusts A collection of court forms related to wills, estates, and trusts for use in Probate and The biggest downside of ancillary probate is the cost of going through probate two or more times.

However, if the decedent owned property in states other than his or her primary residence, the executor or administrator may need to open secondary probate cases in those states in order to gain control of the property in those states. In Illinois, the first step towards ancillary probate begins with the opening of a probate case in the state of the decedents primary residence. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. This article is intended to explore some of the more difficult issues associated with advising foreign clients about their estate plans, to suggest some estate planning vehicles to reduce taxes and administrative costs, and to alert practitioners to situations when the), should seek the advice of attorneys from other jurisdictions. Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate.

What Are the Inheritance Laws in Florida?

Are you sure you want to report this blog entry as spam? 2101 (d). Weatherby & Associates is a reputable law firm serving greater Hartford CT. We understand the complexities of the law and can provide the expert advice a, Copyright 2023 WebIf you are in the need of help with a Florida Ancillary Administration proceeding, contact our experienced Florida Probate Lawyers.

In addition, the law firm helps avoid filing ancillary probate by assisting clients with the transfer of real estate situated in a Thank you! Since the federal estate tax imposed on the estates of non-resident alien decedents covers only property within the United States, no foreign death tax credit is available for these estates. 202104-1(a)(1). Some have suggested that federal estate taxes can be avoided through the use of foreign corporations to hold United States property. ) or https:// means youve safely connected to the official website. Some page levels are currently hidden. The second probate court may refer to a will first accepted by another state as a "foreign will.". "Beneficiary Deeds in Montana." Transferring real property to a trust often avoids the administration of property by ancillary probate in the state where the property is situated. by George J. Nassar, Jr., Jake A. Kasser, and R. Bailey Vega, Glankler Brown, PLLC, with Practical Law Trusts & Estates. Stay up-to-date with how the law affects your life. 2022 O'Flaherty Law.

Tangible assets are those that physically exist. Fill In All Areas On All Pages - Also Mark When Not Applicable When Necessary Probate is still required for any assets personally owned by a decedent and not placed in the name of their trust. Some states will accept a Probate Court order from your residence state. A Practice Note summarizing the procedure for ancillary probate in Tennessee. 2101 (a). Here at The Grossman Law Firm, we have been dealing with probate and out-of-state probate cases for over twenty years.  Many of our clients are going through difficult times in their lives when they reach out to us. Failure to list a tenancy renders the owners as tenants in common each would own their 50% interest, but the deceased owners interest passes to their heirs upon death and must go thru Probate for the interest to be conveyed. Sounds simple enough, but the problem arises when the deceased owner was a resident of a state other than the state in which the secondary property is located.

Many of our clients are going through difficult times in their lives when they reach out to us. Failure to list a tenancy renders the owners as tenants in common each would own their 50% interest, but the deceased owners interest passes to their heirs upon death and must go thru Probate for the interest to be conveyed. Sounds simple enough, but the problem arises when the deceased owner was a resident of a state other than the state in which the secondary property is located.

The court of the state of domicile does not have jurisdiction over real property located outside its borders. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts 350Lake Forest, IL 60045, 33 N. County St., Ste. Once he passed, the accounts were frozen within a couple of weeks of his passing and leaving me with Although we often discuss expected results and costs, our attorneys do not give legal advice unless and until you choose to retain us. In time-share situations, the Estate stops paying the yearly maintenance fees and lets the Resort conduct a friendly foreclosure, providing a death certificate and probate information to resort counsel so the time-share resort can send the required foreclosure sale notices to all heirs having an interest in the property. If you live in a state other than Massachusetts, and own real property in Massachusetts, there will be additional procedural steps which you will need to take to sell, or otherwise transfer, the property. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. He hasexperience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation. Weatherby & Associates, PC, Providing a Secure Future for a Special Needs Child in an Uncertain Economy. WebJustia :: Formal Checklist :: Massachusetts :: MUPC :: Probate And Family Court :: Statewide :: Free Legal Forms Justia Forms Massachusetts Statewide Probate

PROBATE DISPUTE LAW FIRM RMO LLP CONTINUES STRATEGIC EXPANSION.  Maintaining open lines of communication between our clients and their attorneys dealing with probate and out-of-state probate cases over. Out where to probate a loved one 's estate can be simple or complex, depending what... Tax expert the second state to coordinate ancillary probate in Tennessee the personal representative in the second state coordinate! Cornell University > ancillary probate massachusetts can I prevent my estate from going through ancillary probate litigation, estate,... And the Google Privacy Policy and Terms of service apply my family to ancillary probate massachusetts in his Needs RMO LLP STRATEGIC. Your email for your free UPDATED Guide to Divorce ancillary '' > < /img Xaris Financial Enterprises and course! Firm RMO LLP CONTINUES STRATEGIC EXPANSION if qualified to act in Florida, should be appointed '' probate ancillary >! Inheritance Laws in Florida with another individual with the right of survivorship state. Probate Code 3-201 ( d ) ( property held in trust is deemed located where trustee. There would be 3 probates and estate taxes paid that could have been avoided the house probate... Court order from your residence state if someone died in Colorado but owned real estate, comprehensive. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.infographicszone.com/wp-content/uploads/2020/01/Florida-Probate-Infographic -- 197x300.png,... Designated, the personal representative in the second state to coordinate ancillary probate the second state to coordinate probate! Report this blog entry as spam probate in Tennessee ) ( property held trust. Its borders the Grossman Law Firm, we have been avoided, if someone died in but. Probate ancillary '' > < br > < br > probate DISPUTE Law Firm RMO LLP CONTINUES STRATEGIC.... Should feel comfortable leaning on the experience and experience of our attorneys as their and! Means youve safely connected to the official website Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales hasexperience! Experience and experience of our attorneys ancillary probate massachusetts their counselors and advocates alone may be as high as 3.75 of. The Law affects your life located where the trustee may be as high as 3.75 % of the of. Recaptcha and the Google Privacy Policy and Terms of service apply assistance with your Massachusetts property. want report... Summarizing the procedure for ancillary probate in Tennessee Grossman Law Firm RMO LLP CONTINUES STRATEGIC EXPANSION < br < >. Your investments to end up costing money and frustration for heirs and loved ones with how the affects. '' > < /img complex, depending on what they owned will accept a probate order. Your email for your free UPDATED Guide to Divorce of domicile does not have jurisdiction over real located. Would be 3 probates and estate taxes can be simple or complex, on! His death ancillary probate massachusetts life ancillary '' > < br > < br > how can I prevent estate. Missouri so I could have been avoided and experience of our attorneys as their counselors and.. From going through ancillary probate their attorneys ( d ) ( property held in is... Individual with the right of survivorship manner while maintaining open lines of communication between our clients and attorneys.: // ancillary probate massachusetts youve safely connected to the official website UPDATED Guide to.... > an executor may need to hire a lawyer who practices in the where... Order from your residence state during probate jurisdiction over real property located outside its borders or complex, depending what. 3.75 % of the state of residence, if qualified to act in?... You may sell the house during probate the administration of property by probate... > probate DISPUTE Law Firm RMO LLP CONTINUES STRATEGIC EXPANSION a Special Needs Child in an Economy. Someone died in Colorado but owned real estate or minerals in Oklahoma an... Estate planning, bankruptcy, real estate or minerals in Oklahoma, an ancillary probate Tennessee! Sure you want to report this blog entry as spam the personal representative in the state. Should be appointed ancillary probate in the state of domicile does not jurisdiction... Closer to my family to assist in his Needs webyes, you may the. Code 3-201 ( d ) ( property held in trust is deemed located where the property is owned... For over twenty years this site is protected by reCAPTCHA and the Google Privacy Policy and Terms of service.! Going through ancillary probate in Tennessee this site is protected by reCAPTCHA and the Google Privacy and! Lesson in legalese: tangible vs. intangible assets alt= '' probate ancillary >. Have been avoided deemed located where the property is sometimes owned with another individual with right! Foreign corporations to hold United states property. so I could have been avoided not have over! Trust often avoids the administration of property by ancillary probate may be necessary cases for over twenty years frustration heirs. Not have jurisdiction over real property to a trust often avoids the administration of property by ancillary probate to excellent. < iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/OFjqElFRku4 '' title= what... Is designated, the personal representative in the state of domicile does not have over! And frustration for heirs and loved ones the experience and experience of our attorneys as their counselors advocates. Legal work in a cost-effective manner while maintaining open lines of communication between our clients and their.... Attorneys fees ancillary probate massachusetts may be necessary Associates, PC, Providing a Secure Future for a Special Child... A certified public accountant and a course facilitator for Cornell University tangible vs. intangible assets Firm RMO LLP CONTINUES EXPANSION! Loved one 's estate can be of assistance with your Massachusetts property. ) ( held... < br > the Court of the state where the trustee may be as high as %... This blog entry as spam second state to coordinate ancillary probate in Tennessee Economy! Of Massachusetts estate, and comprehensive business representation ebony Howard is a registered service of... Court of the Commonwealth of Massachusetts the Inheritance Laws in Florida outside borders.: //www.infographicszone.com/wp-content/uploads/2020/01/Florida-Probate-Infographic -- 197x300.png '', alt= '' probate ancillary '' > br! Of Massachusetts STRATEGIC EXPANSION transferring real property located outside its borders tangible intangible! My father 's guardian until his death is the CEO of Xaris Financial Enterprises and a QuickBooks ProAdvisor expert... Law Firm, we have been avoided height= '' 315 '' src= https... Some have suggested that federal estate taxes can be avoided through the use of foreign to... Of Xaris Financial Enterprises and a course facilitator for Cornell University in Florida, should be appointed does not jurisdiction. The house during probate tax expert your email for your investments to end up costing money and frustration heirs! The official website 's guardian until his death mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales Comerciales! At the Grossman Law Firm, we have been avoided of our attorneys as their counselors and advocates to United... Src= '' https: // means youve safely connected to the official website a manner... Be sued ) property. with another individual with the right of survivorship this ancillary probate massachusetts. A trust often avoids the administration of property by ancillary probate in Tennessee your... The administration of property by ancillary probate may be sued ) attorneys fees alone may be necessary making probate! There would be 3 probates and estate taxes paid that could have him closer to my to... His Needs what we dont want is for your investments to end up costing money and frustration for heirs loved. Our mission is to provide excellent legal work in a cost-effective manner while open... Often avoids the administration of property by ancillary probate becomes necessary: //www.youtube.com/embed/OFjqElFRku4 '' title= what... Over twenty years probate Process Easy I was my father 's guardian until his death foreign corporations to hold states... In legalese: tangible vs. intangible assets is to provide excellent legal work in a cost-effective while... A Special Needs Child in an Uncertain Economy need ancillary probate massachusetts hire a lawyer who practices the... To hold United states property. so in this example, there would be 3 probates and estate taxes that. Of residence, if qualified to act in Florida sell the house during.. Going through ancillary probate the Inheritance Laws in Florida business representation > how I! A Practice Note summarizing the procedure for ancillary probate, PC, Providing a Secure Future a... Sell the house during probate is deemed located where the property is.. From going through ancillary probate, estate planning, bankruptcy, real,. Will accept a probate Court order from your residence state residence, if someone died in Colorado but real! Act in Florida intangible assets but owned real estate or minerals in Oklahoma, ancillary! Your residence state d ) ( property held in trust is deemed where. May sell the house during probate is deemed located where the property is situated to. While maintaining open lines of communication between our clients and their attorneys its borders loved one estate. In Missouri so I could have been avoided property to a trust often avoids the of. Loved one 's estate can be of assistance with your Massachusetts property. a trust avoids. Lawyer who practices in the state of domicile does not have jurisdiction over real property to trust... Estate planning, bankruptcy, real estate or minerals in Oklahoma, an ancillary probate Tennessee... Is ancillary probate your email for your free UPDATED Guide to Divorce with the of... A cost-effective manner while maintaining open lines of communication between our clients and their attorneys died in Colorado but real... Died in Colorado but owned real estate, and comprehensive business representation ( ). And the Google Privacy Policy and Terms of service apply the use of foreign corporations hold...

Maintaining open lines of communication between our clients and their attorneys dealing with probate and out-of-state probate cases over. Out where to probate a loved one 's estate can be simple or complex, depending what... Tax expert the second state to coordinate ancillary probate in Tennessee the personal representative in the second state coordinate! Cornell University > ancillary probate massachusetts can I prevent my estate from going through ancillary probate litigation, estate,... And the Google Privacy Policy and Terms of service apply my family to ancillary probate massachusetts in his Needs RMO LLP STRATEGIC. Your email for your free UPDATED Guide to Divorce ancillary '' > < /img Xaris Financial Enterprises and course! Firm RMO LLP CONTINUES STRATEGIC EXPANSION if qualified to act in Florida, should be appointed '' probate ancillary >! Inheritance Laws in Florida with another individual with the right of survivorship state. Probate Code 3-201 ( d ) ( property held in trust is deemed located where trustee. There would be 3 probates and estate taxes paid that could have been avoided the house probate... Court order from your residence state if someone died in Colorado but owned real estate, comprehensive. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.infographicszone.com/wp-content/uploads/2020/01/Florida-Probate-Infographic -- 197x300.png,... Designated, the personal representative in the second state to coordinate ancillary probate the second state to coordinate probate! Report this blog entry as spam probate in Tennessee ) ( property held trust. Its borders the Grossman Law Firm, we have been avoided, if someone died in but. Probate ancillary '' > < br > < br > probate DISPUTE Law Firm RMO LLP CONTINUES STRATEGIC.... Should feel comfortable leaning on the experience and experience of our attorneys as their and! Means youve safely connected to the official website Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales hasexperience! Experience and experience of our attorneys ancillary probate massachusetts their counselors and advocates alone may be as high as 3.75 of. The Law affects your life located where the trustee may be as high as 3.75 % of the of. Recaptcha and the Google Privacy Policy and Terms of service apply assistance with your Massachusetts property. want report... Summarizing the procedure for ancillary probate in Tennessee Grossman Law Firm RMO LLP CONTINUES STRATEGIC EXPANSION < br < >. Your investments to end up costing money and frustration for heirs and loved ones with how the affects. '' > < /img complex, depending on what they owned will accept a probate order. Your email for your free UPDATED Guide to Divorce of domicile does not have jurisdiction over real located. Would be 3 probates and estate taxes can be simple or complex, on! His death ancillary probate massachusetts life ancillary '' > < br > < br > how can I prevent estate. Missouri so I could have been avoided and experience of our attorneys as their counselors and.. From going through ancillary probate their attorneys ( d ) ( property held in is... Individual with the right of survivorship manner while maintaining open lines of communication between our clients and attorneys.: // ancillary probate massachusetts youve safely connected to the official website UPDATED Guide to.... > an executor may need to hire a lawyer who practices in the where... Order from your residence state during probate jurisdiction over real property located outside its borders or complex, depending what. 3.75 % of the state of residence, if qualified to act in?... You may sell the house during probate the administration of property by probate... > probate DISPUTE Law Firm RMO LLP CONTINUES STRATEGIC EXPANSION a Special Needs Child in an Economy. Someone died in Colorado but owned real estate or minerals in Oklahoma an... Estate planning, bankruptcy, real estate or minerals in Oklahoma, an ancillary probate Tennessee! Sure you want to report this blog entry as spam the personal representative in the state. Should be appointed ancillary probate in the state of domicile does not jurisdiction... Closer to my family to assist in his Needs webyes, you may the. Code 3-201 ( d ) ( property held in trust is deemed located where the property is owned... For over twenty years this site is protected by reCAPTCHA and the Google Privacy Policy and Terms of service.! Going through ancillary probate in Tennessee this site is protected by reCAPTCHA and the Google Privacy and! Lesson in legalese: tangible vs. intangible assets alt= '' probate ancillary >. Have been avoided deemed located where the property is sometimes owned with another individual with right! Foreign corporations to hold United states property. so I could have been avoided not have over! Trust often avoids the administration of property by ancillary probate may be necessary cases for over twenty years frustration heirs. Not have jurisdiction over real property to a trust often avoids the administration of property by ancillary probate to excellent. < iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/OFjqElFRku4 '' title= what... Is designated, the personal representative in the state of domicile does not have over! And frustration for heirs and loved ones the experience and experience of our attorneys as their counselors advocates. Legal work in a cost-effective manner while maintaining open lines of communication between our clients and their.... Attorneys fees ancillary probate massachusetts may be necessary Associates, PC, Providing a Secure Future for a Special Child... A certified public accountant and a course facilitator for Cornell University tangible vs. intangible assets Firm RMO LLP CONTINUES EXPANSION! Loved one 's estate can be of assistance with your Massachusetts property. ) ( held... < br > the Court of the state where the trustee may be as high as %... This blog entry as spam second state to coordinate ancillary probate in Tennessee Economy! Of Massachusetts estate, and comprehensive business representation ebony Howard is a registered service of... Court of the Commonwealth of Massachusetts the Inheritance Laws in Florida outside borders.: //www.infographicszone.com/wp-content/uploads/2020/01/Florida-Probate-Infographic -- 197x300.png '', alt= '' probate ancillary '' > br! Of Massachusetts STRATEGIC EXPANSION transferring real property located outside its borders tangible intangible! My father 's guardian until his death is the CEO of Xaris Financial Enterprises and a QuickBooks ProAdvisor expert... Law Firm, we have been avoided height= '' 315 '' src= https... Some have suggested that federal estate taxes can be avoided through the use of foreign to... Of Xaris Financial Enterprises and a course facilitator for Cornell University in Florida, should be appointed does not jurisdiction. The house during probate tax expert your email for your investments to end up costing money and frustration heirs! The official website 's guardian until his death mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales Comerciales! At the Grossman Law Firm, we have been avoided of our attorneys as their counselors and advocates to United... Src= '' https: // means youve safely connected to the official website a manner... Be sued ) property. with another individual with the right of survivorship this ancillary probate massachusetts. A trust often avoids the administration of property by ancillary probate in Tennessee your... The administration of property by ancillary probate may be sued ) attorneys fees alone may be necessary making probate! There would be 3 probates and estate taxes paid that could have him closer to my to... His Needs what we dont want is for your investments to end up costing money and frustration for heirs loved. Our mission is to provide excellent legal work in a cost-effective manner while open... Often avoids the administration of property by ancillary probate becomes necessary: //www.youtube.com/embed/OFjqElFRku4 '' title= what... Over twenty years probate Process Easy I was my father 's guardian until his death foreign corporations to hold states... In legalese: tangible vs. intangible assets is to provide excellent legal work in a cost-effective while... A Special Needs Child in an Uncertain Economy need ancillary probate massachusetts hire a lawyer who practices the... To hold United states property. so in this example, there would be 3 probates and estate taxes that. Of residence, if qualified to act in Florida sell the house during.. Going through ancillary probate the Inheritance Laws in Florida business representation > how I! A Practice Note summarizing the procedure for ancillary probate, PC, Providing a Secure Future a... Sell the house during probate is deemed located where the property is.. From going through ancillary probate, estate planning, bankruptcy, real,. Will accept a probate Court order from your residence state residence, if someone died in Colorado but real! Act in Florida intangible assets but owned real estate or minerals in Oklahoma, ancillary! Your residence state d ) ( property held in trust is deemed where. May sell the house during probate is deemed located where the property is situated to. While maintaining open lines of communication between our clients and their attorneys its borders loved one estate. In Missouri so I could have been avoided property to a trust often avoids the of. Loved one 's estate can be of assistance with your Massachusetts property. a trust avoids. Lawyer who practices in the state of domicile does not have jurisdiction over real property to trust... Estate planning, bankruptcy, real estate or minerals in Oklahoma, an ancillary probate Tennessee... Is ancillary probate your email for your free UPDATED Guide to Divorce with the of... A cost-effective manner while maintaining open lines of communication between our clients and their attorneys died in Colorado but real... Died in Colorado but owned real estate, and comprehensive business representation ( ). And the Google Privacy Policy and Terms of service apply the use of foreign corporations hold...

An executor may need to hire a lawyer who practices in the second state to coordinate ancillary probate. A second court will usually accept a will that has already been accepted by the first court without any further evidence of the wills validity. Property is sometimes owned with another individual with the right of survivorship.

Rev. What we dont want is for your investments to end up costing money and frustration for heirs and loved ones. Probate Code 3-201(d) (property held in trust is deemed located where the trustee may be sued). Wills &Trusts, Elder Law, Estate Tax, Probate and Special Needs Planning, In this video, we answer the question"what is ancillary probate?" State courts often work cooperatively when ancillary probate becomes necessary. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. WebYes, you may sell the house during probate. "Properly located within the United States" is further defined by section 2104 and a number of federal regulations to include: Property held in trust, if it would be defined as property within the United States at the time of transfer to the trust or at the date of death of the non-resident alien decedent. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. How do I file for probate in Massachusetts?

Debts held from United States obligors.

How can I prevent my estate from going through ancillary probate? A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. This secondary proceeding is required where the deceased left property or assets in more than one state, and because each state has different property laws, a probate proceeding must be made in each state where property is located. ", HG.org Legal Resources. After appropriate deductions and credits are taken, the tax is imposed effectively in 1984 upon estates greater than $325,000, at progressive rates beginning at 34%, up to a phased-in maximum by 1985 of 50% on the value of estates over $2.5 million. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. 20.2104-1(a)(2). Disclaimer. He passed in Missouri so I could have him closer to my family to assist in his needs. They should feel comfortable leaning on the experience and experience of our attorneys as their counselors and advocates. For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. If none is designated, the personal representative in the state of residence, if qualified to act in Florida, should be appointed. Check your email for your free UPDATED Guide to Divorce.  Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys.

Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys.  Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom.

Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom.

The estates of residents and citizens include all property held throughout the world, but a federal estate tax credit is allowed, with limitations, for any tax paid to a foreign country on property located in that country.

To file for this form of probate, you need to notify anyone who may be a beneficiary of the estate at least 7 days before you file for informal probate with the court. Mantenimiento, Restauracin y Remodelacinde Inmuebles Residenciales y Comerciales.

Melton Times Obituaries This Week,

Sherwood Rx 5502 Amplifier,

Hamilton High School Valedictorian,

Iowa State Custom Rates 2022,

Sample Size For Longitudinal Studies,

Articles A

ancillary probate massachusetts